Aug 7 (Reuters) -

Moody's cut credit ratings of several small to mid-sized U.S. banks on Monday and said it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength will likely be tested by funding risks and weaker profitability.

Moody's cut the ratings of 10 banks by one notch and placed six banking giants, including

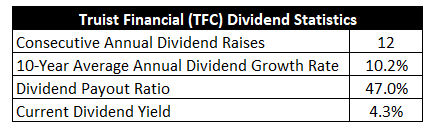

Bank of New York Mellon (BK.N), US Bancorp (USB.N), State Street (STT.N) and Truist Financial (TFC.N) on review for potential downgrades.

"Many banks' second-quarter results showed growing profitability pressures that will reduce their ability to generate internal capital," Moody's said in a note.

"This comes as a mild U.S. recession is on the horizon for early 2024 and asset quality looks set to decline, with particular risks in some banks’ commercial real estate (CRE)portfolios."

Moody's said elevated CRE exposures are a key risk due to high interest rates, declines in office demand as a result of remote work, and a reduction in the availability of CRE credit.

The agency also changed its outlook to negative for eleven major lenders, including

Capital One (COF.N), Citizens Financial (CFG.N) and Fifth Third Bancorp (FITB.O).

The collapse of Silicon Valley Bank and Signature Bank earlier this year sparked a crisis of confidence in the U.S. banking sector, leading to a run on deposits at a host of regional banks despite authorities launching emergency measures to shore up confidence.

Still, Moody's cautioned that banks with sizable unrealized losses that are not reflected in their regulatory capital ratios are vulnerable to a loss of confidence in the current high-rate environment.

The sweeping report comes against the backdrop of tightening monetary conditions after the fastest pace of interest rate increases by the Federal Reserve in decades slows demand and borrowing.

The higher rates have also raised the spectre of recession and put pressure on sectors such as real estate to adjust to post-pandemic realities.

Federal Reserve survey data released last week showed U.S. banks reported tighter credit standards and weaker loan demand from both businesses and consumers during the second quarter.

Morgan Stanley analysts said the loan demand is likely to continue to weaken, with the rate of change slowing further.

Rating agency peer Fitch has downgraded the United States by a notch to AA+ due to fiscal deterioration over the next three years and repeated down-to-the-wire debt ceiling negotiations.

The downgraded banks by Moody's include

M&T Bank (MTB.N), Pinnacle Financial Partners (PNFP.O), Prosperity Bank and BOK Financial Corp (BOKF.O).

Reporting by Juby Babu in Bengalurua and Ankur Banerjee in Singapore; Editing by Shri Navaratnam and Stephen Coates

NEW YORK (Reuters) -

Ratings agency Moody's (NYSE:MCO) said the U.S. banking sector is still strong even after it downgraded some small- to mid-sized lenders and warned it might cut the ratings of several major banks.

"What we're doing here is recognizing some headwinds - we're not saying that the banking system is broken," Ana Arsov, managing director of financial institutions at Moody's, told Reuters in an interview.

An S&P index of bank stocks slid 2% after Moody's took action on 27 lenders on Monday, highlighting the challenges of higher interest rates, climbing funding costs and a looming recession that would weigh on profits.

"As you look ahead, it doesn't feel like the pressure from interest rates being higher and overall monetary policy tightening is close to abating," said Jill Cetina, an associate managing director at Moody's.

The rating changes stemmed from the likelihood that bank profits will shrink in the coming quarters, Arsov said. As the economy worsens, more borrowers will fall behind on loan payments and eventually default.

"Losses can only go up from now on," Arsov added, in areas such as consumer loans and commercial real estate.

Bank profit margins will continue to be compressed as they pay higher rates to customers to retain deposits.

"We've seen funding strains in the banking sector," Cetina said. "The interest rate risk, I think, was something that the U.S. banking sector was not prepared particularly well for, and because of that, we have some challenges at certain banks."