Tyson Foods raises prices, scrambles to keep up with inflation

(Reuters) -Tyson Foods Inc cannot increase prices for chicken and prepared foods fast enough to keep pace with rising costs for raw materials like grain, Chief Executive Donnie King said on Monday, after the company reported higher-than-expected quarterly earnings.

The meat company lifted its 2021 revenue forecast due to strong beef demand as sales of steaks and burgers from U.S. restaurants and hotels recovered following the easing of COVID-19 restrictions. U.S. beef exports are also robust.

But costs are also increasing, a potential drag on future earnings.

Tyson has increased prices for restaurant customers to offset inflation and plans to raise retail prices on Sept. 5, King said on a conference call with analysts. More increases are planned, he said.

"Costs are hitting us faster than we can get pricing at this point," King said.

Branded and value-added products are particularly affected by inflation, which reached 14% in the quarter ended on July 3, he said.

"We've seen unprecedented and accelerating inflation, and we're trying to catch up with that," King told reporters.

Tyson increased its average price for pork by 39.3% in the last quarter, while it raised beef and chicken prices 11.6% and 15.6% respectively. Sales volumes also increased.

Total quarterly sales climbed to $12.48 billion from $10.02 billion a year earlier, topping analysts' estimates for $11.49 billion.

Net income attributable to Tyson increased to $2.05 per share from $1.44 a year earlier. On an adjusted basis, Tyson earned $2.70 per share, crushing estimates of $1.62, according to IBES data from Refinitiv.

The Jimmy Dean hotdogs maker said it expects total sales of about $46 billion to $47 billion for fiscal 2021, compared with an earlier forecast of $44 billion to $46 billion.

The company, which is mandating COVID-19 vaccinations for U.S. employees, said rising coronavirus cases have made it harder to find workers.

"We were on a good trajectory and then the Delta variant showed up," King said.

https://www.investing.com/news/stock-ma ... nd-2584022

---

Tyson stock rises after earnings beat

By MarketWatch - 4 hours ago

Tyson Foods Inc. stock rose 2.3% in Monday premarket trading after the meat manufacturer reported fiscal third quarter earnings and sales that beat expectations.

https://www.investing.com/news/stock-ma ... st-2584222

Latest Release

Aug 09, 2021

EPS / Forecast

2.7 / 1.6

Revenue / Forecast

12.48B / 11.49B

Tyson Foods NYSE: TSN przemysł mięsny

Re: Tyson Foods NYSE: TSN przemysł mięsny

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Tyson Foods NYSE: TSN przemysł mięsny

Latest Release

Feb 07, 2022

EPS / Forecast

2.87! / 1.94

Revenue / Forecast

12.93B! / 12.16B

Feb 07, 2022

EPS / Forecast

2.87! / 1.94

Revenue / Forecast

12.93B! / 12.16B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Latest Release

May 09, 2022

EPS / Forecast

2.29! / 1.86

Revenue / Forecast

13.12B / 12.84B

May 09, 2022

EPS / Forecast

2.29! / 1.86

Revenue / Forecast

13.12B / 12.84B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Tyson Foods Downgraded at Argus on Inflationary and FX Headwinds

Shares of Tyson Foods (NYSE:TSN) were downgraded to Hold from Buy at Argus on Tuesday.

The firm told investors in a note that Tyson is facing inflationary strengthening dollar headwinds.

"We expect inflation and a strong dollar to be headwinds for Tyson. In order to stretch their food dollars, U.S. customers have been purchasing less costly generic products rather than Tyson's relatively expensive goods. Internationally, a strong dollar and an increase in hog prices are likely to cause pork volumes to drop," wrote Argus.

Argus feels Tyson shares are "fairly valued at current prices above $75."

"They are trading at 9.5-times our revised FY23 EPS estimate, below the average multiple of 16.4 for large-cap food processors and toward the middle of their three-year historical range of 6-13. We believe that the current valuation adequately reflects prospects for slowing sales in Tyson's retail business," they said. "Should hog prices ease or export volumes improve more than we anticipate, we would consider an upgrade."

Over the longer term, Argus sees "strong prospects" for Tyson as demand for protein continues to grow and the company invests in new products, e-commerce upgrades, and capacity expansion.

Shares of Tyson Foods (NYSE:TSN) were downgraded to Hold from Buy at Argus on Tuesday.

The firm told investors in a note that Tyson is facing inflationary strengthening dollar headwinds.

"We expect inflation and a strong dollar to be headwinds for Tyson. In order to stretch their food dollars, U.S. customers have been purchasing less costly generic products rather than Tyson's relatively expensive goods. Internationally, a strong dollar and an increase in hog prices are likely to cause pork volumes to drop," wrote Argus.

Argus feels Tyson shares are "fairly valued at current prices above $75."

"They are trading at 9.5-times our revised FY23 EPS estimate, below the average multiple of 16.4 for large-cap food processors and toward the middle of their three-year historical range of 6-13. We believe that the current valuation adequately reflects prospects for slowing sales in Tyson's retail business," they said. "Should hog prices ease or export volumes improve more than we anticipate, we would consider an upgrade."

Over the longer term, Argus sees "strong prospects" for Tyson as demand for protein continues to grow and the company invests in new products, e-commerce upgrades, and capacity expansion.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

CHICAGO (Reuters) - Tyson Foods Inc (NYSE:TSN) is joining other corporate heavyweights in moving jobs out of Illinois.

The biggest U.S. meat company by sales said on Wednesday it will relocate all corporate employees from offices in Chicago and suburban Downers Grove, along with those in Dakota Dunes, South Dakota, to its headquarters in Springdale, Arkansas.

It is the latest shakeup for Tyson, which has about 1,000 corporate employees in the Chicago-area and South Dakota offices. Overall the meat company has about 120,000 U.S. employees, with about 114,000 of those working in production plants.

Tyson will begin a "phased relocation" of the corporate employees early next year, according to a statement. It said the move will "foster closer collaboration, enhance team member agility and enable faster decision making."

Members of the Tyson family, which founded Tyson Foods, and several top executives have long been based in Arkansas.

A company spokesperson said no layoffs are associated with the relocations. It was not known how many office workers would make the move.

Representatives for Chicago's mayor and Illinois's governor did not immediately respond to requests for comment.

Tyson's decision deals another blow to Chicago's business community after hedge fund Citadel said in June it was moving its global headquarters from the city to Miami. Boeing (NYSE:BA) also said this year it would move its headquarters to Arlington, Virginia, from Chicago, and Caterpillar (NYSE:CAT) announced plans to relocate to Texas from a Chicago suburb.

Kellogg (NYSE:K), however, based the corporate headquarters for its largest business, snacks, in Chicago after announcing a split into three independent companies this summer.

Tyson gained its Chicago office when it acquired Hillshire Brands in 2014 and then ran its prepared foods business there.

Last week, Tyson said Noelle O'Mara, who was group president of prepared foods, left the job and would be replaced by Stewart Glendinning, who was chief financial officer. John R. Tyson, the son of the chairman of the company's board of directors, took over as finance chief this week.

The biggest U.S. meat company by sales said on Wednesday it will relocate all corporate employees from offices in Chicago and suburban Downers Grove, along with those in Dakota Dunes, South Dakota, to its headquarters in Springdale, Arkansas.

It is the latest shakeup for Tyson, which has about 1,000 corporate employees in the Chicago-area and South Dakota offices. Overall the meat company has about 120,000 U.S. employees, with about 114,000 of those working in production plants.

Tyson will begin a "phased relocation" of the corporate employees early next year, according to a statement. It said the move will "foster closer collaboration, enhance team member agility and enable faster decision making."

Members of the Tyson family, which founded Tyson Foods, and several top executives have long been based in Arkansas.

A company spokesperson said no layoffs are associated with the relocations. It was not known how many office workers would make the move.

Representatives for Chicago's mayor and Illinois's governor did not immediately respond to requests for comment.

Tyson's decision deals another blow to Chicago's business community after hedge fund Citadel said in June it was moving its global headquarters from the city to Miami. Boeing (NYSE:BA) also said this year it would move its headquarters to Arlington, Virginia, from Chicago, and Caterpillar (NYSE:CAT) announced plans to relocate to Texas from a Chicago suburb.

Kellogg (NYSE:K), however, based the corporate headquarters for its largest business, snacks, in Chicago after announcing a split into three independent companies this summer.

Tyson gained its Chicago office when it acquired Hillshire Brands in 2014 and then ran its prepared foods business there.

Last week, Tyson said Noelle O'Mara, who was group president of prepared foods, left the job and would be replaced by Stewart Glendinning, who was chief financial officer. John R. Tyson, the son of the chairman of the company's board of directors, took over as finance chief this week.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

CHICAGO (Reuters) -Tyson Foods Chief Financial Officer John R. Tyson, 32, was arrested for criminal trespassing and public intoxication  in Fayetteville, Arkansas, on Sunday, according to a police report.

in Fayetteville, Arkansas, on Sunday, according to a police report.

A college-aged female was alarmed to have found Tyson, who she did not know, asleep in her bed upon returning home, according to the Fayetteville police report.

The $24 billion company named John R. Tyson, great-grandson of its founder, CFO in September. Shares of the largest U.S. meat company by sales were down 1.3% on Monday.

The police report cited "Tyson's unlawful presence in a house, where he was not invited, paired with the odor of intoxicants, and his general demeanor when confronted by uniformed officers."

The company said in a statement it was aware of the incident and called it a personal matter. John R. Tyson, who was previously the company's chief sustainability officer, could not immediately be reached for comment.

The Tyson family has voting power over about 71% of the company's outstanding stock, according to regulatory filings. Tyson Foods (NYSE:TSN) reports quarterly earnings on Nov. 14.

John R. Tyson was booked at the Washington County detention center and released Sunday evening. He is summoned to court on Dec. 1, according to the police report.

A college-aged female was alarmed to have found Tyson, who she did not know, asleep in her bed upon returning home, according to the Fayetteville police report.

The $24 billion company named John R. Tyson, great-grandson of its founder, CFO in September. Shares of the largest U.S. meat company by sales were down 1.3% on Monday.

The police report cited "Tyson's unlawful presence in a house, where he was not invited, paired with the odor of intoxicants, and his general demeanor when confronted by uniformed officers."

The company said in a statement it was aware of the incident and called it a personal matter. John R. Tyson, who was previously the company's chief sustainability officer, could not immediately be reached for comment.

The Tyson family has voting power over about 71% of the company's outstanding stock, according to regulatory filings. Tyson Foods (NYSE:TSN) reports quarterly earnings on Nov. 14.

John R. Tyson was booked at the Washington County detention center and released Sunday evening. He is summoned to court on Dec. 1, according to the police report.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

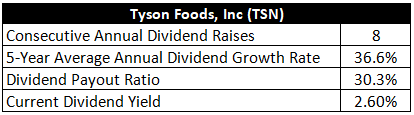

Undervalued Dividend Growth Stock of the Week: Tyson Foods (TSN)Undervalued Dividend Growth Stock of the Week: Tyson Foods, Inc. (TSN)

June 14, 2020

https://dailytradealert.com/2020/06/14/ ... s-inc-tsn/

by Jason Fieber, Mr. Free at 33 • December 25, 2022

https://dailytradealert.com/2022/12/25/ ... foods-tsn/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Shares of Tyson Foods Inc (NYSE:TSN) fell 4.9% after chicken and meat producer fell short of quarterly expectations on slowing demand and a decline in chicken prices.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Goldman Sachs downgraded Tyson Foods (NYSE:TSN) to a Neutral rating (From BUY) and cut the price target on the stock to $66.00 (from $91.00) following the food company’s 1Q23 earnings report. The results revealed a sharp deterioration in profitability across the organization, most notably in Chicken, undermining confidence that the cumulative effect of recent operational and strategic changes could sustainably improve margins and earnings for the company.

TSN reported adjusted FY1Q23 EPS of $0.85, well below the consensus estimate of $1.31. Weakness in the quarter was largely driven by underperformance in Chicken, where an expected contraction in competing protein availability and a subsequent demand increase in Retail failed to materialize, resulting in operating inefficiencies as inventories were liquidated to lower-value markets.

Goldman Sachs analysts wrote in a note, “In Chicken, we recognize higher feed costs and low commodity poultry prices are real market headwinds at the moment, but we had anticipated (consistent with initial management guidance in November) that these could be offset by improved live production/fixed cost absorption, automation investments, further processed mix, and cost-based price models over time. TSN management attributed the shortfall to higher aggregate domestic protein availability and specific surpluses of TSN retail tray pack production that needed to be diverted to more commoditized channels at significantly less favorable realized values. Importantly, however, TSN’s own significant increase in internal production (harvest volume +15% vs. segment sales volume +2.5%) represented a disproportionate share of industry growth. With increases in TSN’s internal harvest set to remain well above industry average this year, the importance of TSN accurately forecasting demand by channel to avoid similar short-term mix pressures moving forward only grows, in our view, and with it, execution risk.”

Shares of TSN are down 0.46% in premarket trading on Tuesday.

https://www.investing.com/news/stock-ma ... SI-2997081

TSN reported adjusted FY1Q23 EPS of $0.85, well below the consensus estimate of $1.31. Weakness in the quarter was largely driven by underperformance in Chicken, where an expected contraction in competing protein availability and a subsequent demand increase in Retail failed to materialize, resulting in operating inefficiencies as inventories were liquidated to lower-value markets.

Goldman Sachs analysts wrote in a note, “In Chicken, we recognize higher feed costs and low commodity poultry prices are real market headwinds at the moment, but we had anticipated (consistent with initial management guidance in November) that these could be offset by improved live production/fixed cost absorption, automation investments, further processed mix, and cost-based price models over time. TSN management attributed the shortfall to higher aggregate domestic protein availability and specific surpluses of TSN retail tray pack production that needed to be diverted to more commoditized channels at significantly less favorable realized values. Importantly, however, TSN’s own significant increase in internal production (harvest volume +15% vs. segment sales volume +2.5%) represented a disproportionate share of industry growth. With increases in TSN’s internal harvest set to remain well above industry average this year, the importance of TSN accurately forecasting demand by channel to avoid similar short-term mix pressures moving forward only grows, in our view, and with it, execution risk.”

Shares of TSN are down 0.46% in premarket trading on Tuesday.

https://www.investing.com/news/stock-ma ... SI-2997081

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

The Dirt-Cheap Stock of the Week

https://www.youtube.com/watch?v=7xl4Sr9b6Wk

https://www.youtube.com/watch?v=7xl4Sr9b6Wk

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Tyson Foods to shut two US chicken plants with nearly 1,700 workers

CHICAGO (Reuters) -Tyson Foods Inc will close two U.S. chicken plants with almost 1,700 employees on May 12, the company said on Tuesday.

The closures show the biggest U.S. meat company by sales is still trying to figure out how to improve its chicken business that has struggled for years.

Tyson will shut a plant in Glen Allen, Virginia, with 692 employees and a plant in Van Buren, Arkansas, with 969 employees, according to a statement.

Chicken demand will shift to other plants as part of a strategy to utilize the full capacity at each of its facilities, the company said.

"The current scale and inability to economically improve operations has led to the difficult decision to close the facilities," Tyson said.

Arkansas-based Tyson said last year it could not fulfill all its orders for chicken due to limited supplies and labor, and planned to boost production. The company previously bought chicken from other producers to meet demand.

Tyson wrongly predicted last year that demand for chicken would be strong at supermarkets in November and December, Chief Executive Donnie King said on a quarterly earnings call last month. In January, the company replaced the president of its poultry business.

Shuttering plants is difficult but justified as Tyson seeks to improve performance, said Arun Sundaram, senior equity analyst at CFRA Research. He said he was not surprised by the decision and expects Tyson may implement further restructuring.

"There's been a lot of investor pressure to management about improving the chicken margins," Sundaram said.

Tyson shares were slightly lower in afternoon trading.

Overall sales missed analyst estimates for the quarter ending Dec. 31, when total operating margins dropped to 3.5% from 11.3% a year earlier. The company at the time said the current quarter would be weaker than the end of 2022.

"They're desperate," said Magaly Licolli, director of Venceremos, an organization that advocates for poultry workers in Arkansas. "They're trying to save money and cutting workers and making other workers do more."

Tyson had about 124,000 U.S. employees as of Oct. 1, including 118,000 workers at non-corporate sites like meat plants, regulatory filings show. In October, the company said it would relocate all corporate employees to its headquarters in Springdale, Arkansas.

The United Food and Commercial Workers Local 400 union, which represents employees at Tyson's plant in Virginia, slammed the decision to close the facility.

"These men and women risked their lives and the safety of their families to keep this plant operational during the pandemic, and this is the thanks they get?" said Mark Federici, UFCW Local 400 president.

Tyson said workers losing their jobs could apply for positions at other company facilities.

CHICAGO (Reuters) -Tyson Foods Inc will close two U.S. chicken plants with almost 1,700 employees on May 12, the company said on Tuesday.

The closures show the biggest U.S. meat company by sales is still trying to figure out how to improve its chicken business that has struggled for years.

Tyson will shut a plant in Glen Allen, Virginia, with 692 employees and a plant in Van Buren, Arkansas, with 969 employees, according to a statement.

Chicken demand will shift to other plants as part of a strategy to utilize the full capacity at each of its facilities, the company said.

"The current scale and inability to economically improve operations has led to the difficult decision to close the facilities," Tyson said.

Arkansas-based Tyson said last year it could not fulfill all its orders for chicken due to limited supplies and labor, and planned to boost production. The company previously bought chicken from other producers to meet demand.

Tyson wrongly predicted last year that demand for chicken would be strong at supermarkets in November and December, Chief Executive Donnie King said on a quarterly earnings call last month. In January, the company replaced the president of its poultry business.

Shuttering plants is difficult but justified as Tyson seeks to improve performance, said Arun Sundaram, senior equity analyst at CFRA Research. He said he was not surprised by the decision and expects Tyson may implement further restructuring.

"There's been a lot of investor pressure to management about improving the chicken margins," Sundaram said.

Tyson shares were slightly lower in afternoon trading.

Overall sales missed analyst estimates for the quarter ending Dec. 31, when total operating margins dropped to 3.5% from 11.3% a year earlier. The company at the time said the current quarter would be weaker than the end of 2022.

"They're desperate," said Magaly Licolli, director of Venceremos, an organization that advocates for poultry workers in Arkansas. "They're trying to save money and cutting workers and making other workers do more."

Tyson had about 124,000 U.S. employees as of Oct. 1, including 118,000 workers at non-corporate sites like meat plants, regulatory filings show. In October, the company said it would relocate all corporate employees to its headquarters in Springdale, Arkansas.

The United Food and Commercial Workers Local 400 union, which represents employees at Tyson's plant in Virginia, slammed the decision to close the facility.

"These men and women risked their lives and the safety of their families to keep this plant operational during the pandemic, and this is the thanks they get?" said Mark Federici, UFCW Local 400 president.

Tyson said workers losing their jobs could apply for positions at other company facilities.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

U.S. Tyson Foods workers strike at Arkansas chicken plant set to close

CHICAGO (Reuters) -About 150 employees of a Tyson Foods Inc (NYSE:TSN) chicken plant in Arkansas went on strike on Monday for better treatment before the company shuts the facility, an organizer said.

Tyson plans to close the plant in Van Buren, Arkansas, on May 12, eliminating jobs for 969 non-union employees, as it seeks to improve performance in its chicken business.

Employees refused to work in part because Tyson said they would not receive full payouts for vacation time they accrued, said Magaly Licolli, director of Venceremos, an organization that advocates for poultry workers in Arkansas. She said the strike may continue on Tuesday and Wednesday.

Tyson told Reuters later on Monday it already had a policy in place to give full payouts to employees with unused vacation or holiday time. The company said it will also pay a bonus of $1,000 to workers who stay in their jobs until the plant closes.

Some employees quit after Tyson announced the plant would close, leaving more work for fewer employees, Licolli said. Employees who previously suffered injuries on the job worry they will struggle to find work elsewhere, she said.

Among those protesting was Maritza Sandoval, 52, who said she suffered elbow and knee injuries from working at the plant for more than 14 years.

"We are being treated really bad," Sandoval said.

Tyson has offered to transfer plant workers to another facility in Texas, with compensation for relocating, but many do not want to uproot their lives or their families, Licolli said.

Tyson said in an email that it is offering employees relocation support to work at other facilities in Arkansas as well.

The company has also received pushback over a plan to shut a chicken plant in Glen Allen, Virginia, with 692 employees and said it will shift demand to other facilities from the plants it is closing.

Last month, Tyson said the closures were part of a strategy to operate its remaining plants at full capacity.

https://www.investing.com/news/stock-ma ... se-3051849

CHICAGO (Reuters) -About 150 employees of a Tyson Foods Inc (NYSE:TSN) chicken plant in Arkansas went on strike on Monday for better treatment before the company shuts the facility, an organizer said.

Tyson plans to close the plant in Van Buren, Arkansas, on May 12, eliminating jobs for 969 non-union employees, as it seeks to improve performance in its chicken business.

Employees refused to work in part because Tyson said they would not receive full payouts for vacation time they accrued, said Magaly Licolli, director of Venceremos, an organization that advocates for poultry workers in Arkansas. She said the strike may continue on Tuesday and Wednesday.

Tyson told Reuters later on Monday it already had a policy in place to give full payouts to employees with unused vacation or holiday time. The company said it will also pay a bonus of $1,000 to workers who stay in their jobs until the plant closes.

Some employees quit after Tyson announced the plant would close, leaving more work for fewer employees, Licolli said. Employees who previously suffered injuries on the job worry they will struggle to find work elsewhere, she said.

Among those protesting was Maritza Sandoval, 52, who said she suffered elbow and knee injuries from working at the plant for more than 14 years.

"We are being treated really bad," Sandoval said.

Tyson has offered to transfer plant workers to another facility in Texas, with compensation for relocating, but many do not want to uproot their lives or their families, Licolli said.

Tyson said in an email that it is offering employees relocation support to work at other facilities in Arkansas as well.

The company has also received pushback over a plan to shut a chicken plant in Glen Allen, Virginia, with 692 employees and said it will shift demand to other facilities from the plants it is closing.

Last month, Tyson said the closures were part of a strategy to operate its remaining plants at full capacity.

https://www.investing.com/news/stock-ma ... se-3051849

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Latest Release

May 08, 2023

EPS / Forecast

-0.04 / 0.8

Revenue / Forecast

13.13B / 13.59B

Tyson Foods cuts 2023 sales forecast as demand slows

(Reuters) -Tyson Foods Inc trimmed its full-year revenue forecast on Monday, in a sign that price hikes and stubbornly high inflation are discouraging consumers from spending on its products.

Shares of the Jimmy Dean sausages maker fell 5% in premarket trading, as the company also missed second-quarter revenue estimates.

U.S. meatpackers have bumped up prices of their products to safeguard margins from spiraling costs of animal feed, labor, freight and commodity prices, aggravated due to lingering drought situation and supply chain issues.

That, coupled with mounting recessionary fears in the United States, has forced budget-conscious consumers to opt for more affordable and cheaper alternatives over pricier meat.

Tyson now expects fiscal 2023 sales between $53 billion and $54 billion, compared with its previous forecast of $55 billion to $57 billion.

The Springdale, Arkansas-based meatpacker's net sales were $13.13 billion in the quarter ended April 1, compared with analysts' average estimate of $13.62 billion, according to Refinitiv data.

May 08, 2023

EPS / Forecast

-0.04 / 0.8

Revenue / Forecast

13.13B / 13.59B

Tyson Foods cuts 2023 sales forecast as demand slows

(Reuters) -Tyson Foods Inc trimmed its full-year revenue forecast on Monday, in a sign that price hikes and stubbornly high inflation are discouraging consumers from spending on its products.

Shares of the Jimmy Dean sausages maker fell 5% in premarket trading, as the company also missed second-quarter revenue estimates.

U.S. meatpackers have bumped up prices of their products to safeguard margins from spiraling costs of animal feed, labor, freight and commodity prices, aggravated due to lingering drought situation and supply chain issues.

That, coupled with mounting recessionary fears in the United States, has forced budget-conscious consumers to opt for more affordable and cheaper alternatives over pricier meat.

Tyson now expects fiscal 2023 sales between $53 billion and $54 billion, compared with its previous forecast of $55 billion to $57 billion.

The Springdale, Arkansas-based meatpacker's net sales were $13.13 billion in the quarter ended April 1, compared with analysts' average estimate of $13.62 billion, according to Refinitiv data.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

CHICAGO (Reuters) - Tyson Foods Inc (NYSE:TSN) plans to resume slaughtering pigs in mid-May at a Madison, Nebraska, pork plant damaged by fire two weeks ago, the meatpacker said on Tuesday.

The extended halt to slaughtering comes as weak consumer demand for pork and low prices are squeezing margins for meatpackers and hurting hog farmers.

Tyson is continuing to divert hogs to other pork plants that would normally be slaughtered in Madison since the April 23 fire, spokesperson Liz Croston said. The Madison plant is doing limited "further processing" work, she said, after hogs are slaughtered elsewhere.

The company previously said it was repairing the plant and expected it to resume production the second week of May.

Tyson's pork business lost $31 million in the quarter that ended on April 1, compared to a profit of $59 million a year earlier. Average sales prices for the company's pork tumbled by 10.3% in the quarter due to reduced global demand, while sales volumes edged up because more hogs were available for slaughtering, Tyson said in an earnings report on Monday.

The meatpacker lowered its forecast for its pork unit's adjusted operating margins to a loss of 2% to breaking even for fiscal year 2023. In February, the company projected full-year margins would be 0% to 2%.

On Tuesday, the amount of money meatpackers earn buying hogs and converting them into meat was about $5.05 per hog, compared to $7.70 per hog on Monday, analysts at HedgersEdge.com said.

U.S. meatpackers slaughtered an estimated 451,000 hogs on Tuesday, down from 470,000 hogs a week ago and 478,000 hogs a year ago, the U.S. Department of Agriculture said.

The extended halt to slaughtering comes as weak consumer demand for pork and low prices are squeezing margins for meatpackers and hurting hog farmers.

Tyson is continuing to divert hogs to other pork plants that would normally be slaughtered in Madison since the April 23 fire, spokesperson Liz Croston said. The Madison plant is doing limited "further processing" work, she said, after hogs are slaughtered elsewhere.

The company previously said it was repairing the plant and expected it to resume production the second week of May.

Tyson's pork business lost $31 million in the quarter that ended on April 1, compared to a profit of $59 million a year earlier. Average sales prices for the company's pork tumbled by 10.3% in the quarter due to reduced global demand, while sales volumes edged up because more hogs were available for slaughtering, Tyson said in an earnings report on Monday.

The meatpacker lowered its forecast for its pork unit's adjusted operating margins to a loss of 2% to breaking even for fiscal year 2023. In February, the company projected full-year margins would be 0% to 2%.

On Tuesday, the amount of money meatpackers earn buying hogs and converting them into meat was about $5.05 per hog, compared to $7.70 per hog on Monday, analysts at HedgersEdge.com said.

U.S. meatpackers slaughtered an estimated 451,000 hogs on Tuesday, down from 470,000 hogs a week ago and 478,000 hogs a year ago, the U.S. Department of Agriculture said.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Tyson Foods NYSE: TSN przemysł mięsny

Tyson Foods poniósł w ostatnim kwartale zaskakującą stratę, co doprowadziło do 15% spadku cen akcji i obniżenia rocznej prognozy przychodów. Spółka oczekiwała rocznych przychodów na poziomie od 53 do 54 mld USD

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 10 gości