Honeywell Rebounds on Analyst Upgrades, Enthusiasm for CEO Adamczyk

https://www.thestreet.com/investing/hon ... o-14825093

Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell Slides By With Q4 Earnings

When Honeywell International Inc. (NYSE: HON) reported its most recent quarterly results before the markets opened on Friday, the company posted $1.91 in earnings per share (EPS) and $9.73 billion in revenue. The consensus estimates had called for $1.89 in EPS and $9.7 billion in revenue, and the fourth quarter of last year reportedly had $1.85 in EPS and $10.84 billion in revenue.

During this past quarter, sales were down 10% on a reported basis and up 6% on an organic basis. The difference between reported and organic sales primarily relates to the spin-offs of the former Transportation Systems business (formerly in Aerospace) and the former Homes and ADI Global Distribution business (formerly in Honeywell Building Technologies), partially offset by the favorable impact of foreign currency translation.

In terms of its segments, Honeywell reported as follows:

Aerospace net sales decreased 12% year over year to $3.43 billion, an increase of 10% organically.

Honeywell Building Technologies net sales decreased 31% to $1.80 billion, an increase of 1% organically.

Performance Materials and Technologies net sales decreased 2% at $2.80 billion, flat organically.

Safety and Productivity Solutions net sales increased 15% to $1.70 billion, an increase of 15% organically.

Looking ahead to the 2019 full year, Honeywell expects to see EPS in the range of $7.80 to $8.10 and sales of $36.0 billion to $36.9 billion. Consensus estimates are calling for $7.88 in EPS and $37.05 billion in revenue.

https://247wallst.com/investing/2019/02 ... -earnings/

When Honeywell International Inc. (NYSE: HON) reported its most recent quarterly results before the markets opened on Friday, the company posted $1.91 in earnings per share (EPS) and $9.73 billion in revenue. The consensus estimates had called for $1.89 in EPS and $9.7 billion in revenue, and the fourth quarter of last year reportedly had $1.85 in EPS and $10.84 billion in revenue.

During this past quarter, sales were down 10% on a reported basis and up 6% on an organic basis. The difference between reported and organic sales primarily relates to the spin-offs of the former Transportation Systems business (formerly in Aerospace) and the former Homes and ADI Global Distribution business (formerly in Honeywell Building Technologies), partially offset by the favorable impact of foreign currency translation.

In terms of its segments, Honeywell reported as follows:

Aerospace net sales decreased 12% year over year to $3.43 billion, an increase of 10% organically.

Honeywell Building Technologies net sales decreased 31% to $1.80 billion, an increase of 1% organically.

Performance Materials and Technologies net sales decreased 2% at $2.80 billion, flat organically.

Safety and Productivity Solutions net sales increased 15% to $1.70 billion, an increase of 15% organically.

Looking ahead to the 2019 full year, Honeywell expects to see EPS in the range of $7.80 to $8.10 and sales of $36.0 billion to $36.9 billion. Consensus estimates are calling for $7.88 in EPS and $37.05 billion in revenue.

https://247wallst.com/investing/2019/02 ... -earnings/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell (HON - Get Report) posted stronger-than-expected first quarter earnings, and boosted its full year outlook, thanks to a solid performance from its aerospace division.

Honeywell said earnings for the three months ending in March came in at $1.92 per share, up 4.3% from the same period last year and ahead of the Street consensus forecast of $1.83 per share. Group revenues, Honeywell said, fell 15% from last year to $8.884 billion, but were paced by a 10% increase in organic sales from the group's aerospace division to $3.34 billion.

Looking into 2019, Honeywell said it sees full-year revenues in the region of $36.5 billion to $37.2 billion, a $300 million improvement from the prior forecast, with an organic growth rate of between 3% and 6%, up from a previous estimate of between 2% and 5%. Segment margins are also seen rising between 1.1% and 1.4% this year, Honeywell said, while earnings are expected to be in the range of $7.90 to $8.15 per share, a 15 cent bump at the higher end of the prior forecast.

https://www.thestreet.com/investing/ear ... e-14931005

Honeywell said earnings for the three months ending in March came in at $1.92 per share, up 4.3% from the same period last year and ahead of the Street consensus forecast of $1.83 per share. Group revenues, Honeywell said, fell 15% from last year to $8.884 billion, but were paced by a 10% increase in organic sales from the group's aerospace division to $3.34 billion.

Looking into 2019, Honeywell said it sees full-year revenues in the region of $36.5 billion to $37.2 billion, a $300 million improvement from the prior forecast, with an organic growth rate of between 3% and 6%, up from a previous estimate of between 2% and 5%. Segment margins are also seen rising between 1.1% and 1.4% this year, Honeywell said, while earnings are expected to be in the range of $7.90 to $8.15 per share, a 15 cent bump at the higher end of the prior forecast.

https://www.thestreet.com/investing/ear ... e-14931005

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

When Honeywell International Inc. (NYSE: HON) reported its most recent quarterly results before the markets opened on Friday, the company posted $2.06 in earnings per share (EPS) and $9.50 billion in revenue. The consensus estimates had called for $2.04 in EPS and $9.61 billion in revenue, and the fourth quarter of last year reportedly had $1.91 in EPS and $9.73 billion in revenue.

During the fourth quarter, sales were down 2% on a reported basis and up 2% on an organic basis. The difference between reported and organic sales primarily relates to the spin-off of the former Homes and ADI Global Distribution business (formerly in Honeywell Building Technologies).

In terms of its segments, Honeywell reported as follows:

Aerospace net sales increased 7% organically year over year to $3.66 billion.

Honeywell Building Technologies net sales decreased 19% to $1.46 billion, an increase of 1% organically.

Performance Materials and Technologies net sales increased 2% organically to $2.86 billion.

Safety and Productivity Solutions net sales decreased 11% organically to $1.52 billion.

Looking ahead to the 2020 full year, Honeywell expects to see EPS in the range of $8.60 to $9.00 and sales of $36.7 billion to $37.8 billion. Consensus estimates are calling for $8.14 in EPS and $36.82 billion in revenue.

https://247wallst.com/industrials/2020/ ... ings-beat/

During the fourth quarter, sales were down 2% on a reported basis and up 2% on an organic basis. The difference between reported and organic sales primarily relates to the spin-off of the former Homes and ADI Global Distribution business (formerly in Honeywell Building Technologies).

In terms of its segments, Honeywell reported as follows:

Aerospace net sales increased 7% organically year over year to $3.66 billion.

Honeywell Building Technologies net sales decreased 19% to $1.46 billion, an increase of 1% organically.

Performance Materials and Technologies net sales increased 2% organically to $2.86 billion.

Safety and Productivity Solutions net sales decreased 11% organically to $1.52 billion.

Looking ahead to the 2020 full year, Honeywell expects to see EPS in the range of $8.60 to $9.00 and sales of $36.7 billion to $37.8 billion. Consensus estimates are calling for $8.14 in EPS and $36.82 billion in revenue.

https://247wallst.com/industrials/2020/ ... ings-beat/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

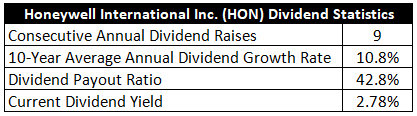

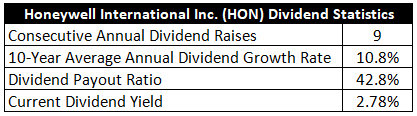

Undervalued Dividend Growth Stock of the Week: Honeywell International Inc. (HON)

https://dailytradealert.com/2020/03/29/ ... -week-249/

https://dailytradealert.com/2020/03/29/ ... -week-249/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell Beats Q2 Earnings Forecast, Aerospace Sales Slump

Honeywell said sales from its key aerospace division are likely to fall 25% this quarter, following a 27.5% slump over the three months ending in June, amid weakening demand for commercial aircraft around the world.

Honeywell Inc. (HON) - Get Report posted stronger-than-expected second quarter earnings Friday but noted a significant slump in aerospace sales linked to Boeing's 737 MAX delays and weak demand for commercial aircraft.

Honeywell said adjusted earnings for the three months ending in June were pegged at $1.26 per share, down 40% from the same period last year but 5 cents ahead of the Street consensus forecast. Group revenues, Honeywell said, fell 19.1% to $7.477 billion, just ahead of analysts' estimates.

Aerospace sales slumped 27.5% to $2.54 billion, Honeywell said, due to lower commercial aircraft demand amid the peak of travel restrictions during the coronavirus pandemic and the broader impact of the delayed return to service of Boeing Co.'s (BA) - Get Report 737 MAX. The group added that third quarter Aerospace sales are likely to fall by 25% when compared to last year.

"The second quarter was a challenging one, but we executed on the three things that will enable us to weather this downturn: aggressively managing cost, driving sales growth where demand is strong, and investing in exciting new technologies that, through careful attention to customer and end-user needs, will help keep people safe when they get back to the workplace, back to play, back to travel, and back to life," said CEO Darius Adamczyk.

"Our focus on sales, cost, and optimizing working capital, combined with our diverse portfolio and strong balance sheet, will enable Honeywell to adapt to and execute through the downturn. I am confident we will emerge well-positioned for the economic recovery to come,

Honeywell shares were marked 0.15% lower in pre-market trading immediately following the earnings release to indicate an opening bell price of $153.50 each, a move that would extend the stock's year-to-date decline to around 13.3%.

https://www.thestreet.com/investing/hon ... ales-slump

Honeywell said sales from its key aerospace division are likely to fall 25% this quarter, following a 27.5% slump over the three months ending in June, amid weakening demand for commercial aircraft around the world.

Honeywell Inc. (HON) - Get Report posted stronger-than-expected second quarter earnings Friday but noted a significant slump in aerospace sales linked to Boeing's 737 MAX delays and weak demand for commercial aircraft.

Honeywell said adjusted earnings for the three months ending in June were pegged at $1.26 per share, down 40% from the same period last year but 5 cents ahead of the Street consensus forecast. Group revenues, Honeywell said, fell 19.1% to $7.477 billion, just ahead of analysts' estimates.

Aerospace sales slumped 27.5% to $2.54 billion, Honeywell said, due to lower commercial aircraft demand amid the peak of travel restrictions during the coronavirus pandemic and the broader impact of the delayed return to service of Boeing Co.'s (BA) - Get Report 737 MAX. The group added that third quarter Aerospace sales are likely to fall by 25% when compared to last year.

"The second quarter was a challenging one, but we executed on the three things that will enable us to weather this downturn: aggressively managing cost, driving sales growth where demand is strong, and investing in exciting new technologies that, through careful attention to customer and end-user needs, will help keep people safe when they get back to the workplace, back to play, back to travel, and back to life," said CEO Darius Adamczyk.

"Our focus on sales, cost, and optimizing working capital, combined with our diverse portfolio and strong balance sheet, will enable Honeywell to adapt to and execute through the downturn. I am confident we will emerge well-positioned for the economic recovery to come,

Honeywell shares were marked 0.15% lower in pre-market trading immediately following the earnings release to indicate an opening bell price of $153.50 each, a move that would extend the stock's year-to-date decline to around 13.3%.

https://www.thestreet.com/investing/hon ... ales-slump

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Morning Bell With Jim Cramer: When to Buy Honeywell Shares

https://www.thestreet.com/video/jim-cra ... t-august-6

https://www.thestreet.com/video/jim-cra ... t-august-6

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell Beats on Strong Automation and PPE Sales

M. COREY GOLDMANJAN 29, 20211:29

Honeywell (HON) - Get Report on Friday posted fourth-quarter adjusted earnings and sales that beat analysts’ forecasts amid double-digit growth in warehouse automation and PPE products and services sales.

Honeywell posted net income of $1.36 billion, or $1.94 a share, vs. $1.59 billion, or $2.16 a share, in the comparable year-ago period. On an adjusted basis, the company earned $2.07 a share, above the $2 a share expected by analysts polled by FactSet.

Sales came in at $8.9 billion, down 6% from $9.5 billion a year ago though above analysts’ forecasts of $8.4 billion. Aerospace sales, which includes parts for commercial airplanes, fell 19% year-over-year, driven by lower demand for commercial aircraft fueled by reduced flight hours and lower volumes among carriers due to the pandemic and drop-off in travel.

That was offset, however, by a 27% gain in “safety and productivity solutions” sales, driven by double-digit sales in its defense and space, warehouse automation and personal protective equipment lines of business. Backlog remained at a record high, Honeywell said.

Honeywell ended 2020 with $15.2 billion of cash and short-term investments on hand.

For 2021, the company expects adjusted per-share earnings of between $7.60 and $8 on sales of between $33.4 billion and $34.4 billion.

https://www.thestreet.com/video/honeywe ... pace-sales

M. COREY GOLDMANJAN 29, 20211:29

Honeywell (HON) - Get Report on Friday posted fourth-quarter adjusted earnings and sales that beat analysts’ forecasts amid double-digit growth in warehouse automation and PPE products and services sales.

Honeywell posted net income of $1.36 billion, or $1.94 a share, vs. $1.59 billion, or $2.16 a share, in the comparable year-ago period. On an adjusted basis, the company earned $2.07 a share, above the $2 a share expected by analysts polled by FactSet.

Sales came in at $8.9 billion, down 6% from $9.5 billion a year ago though above analysts’ forecasts of $8.4 billion. Aerospace sales, which includes parts for commercial airplanes, fell 19% year-over-year, driven by lower demand for commercial aircraft fueled by reduced flight hours and lower volumes among carriers due to the pandemic and drop-off in travel.

That was offset, however, by a 27% gain in “safety and productivity solutions” sales, driven by double-digit sales in its defense and space, warehouse automation and personal protective equipment lines of business. Backlog remained at a record high, Honeywell said.

Honeywell ended 2020 with $15.2 billion of cash and short-term investments on hand.

For 2021, the company expects adjusted per-share earnings of between $7.60 and $8 on sales of between $33.4 billion and $34.4 billion.

https://www.thestreet.com/video/honeywe ... pace-sales

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Amerykański potentat segmentu przemysłowego, konglomerat Honeywell zwiększa swoją obecność w Polsce. W kwietniu otworzy nowy zakład w Chorzowie.

https://www.pb.pl/honeywell-otworzy-zak ... ie-1109952

https://www.pb.pl/honeywell-otworzy-zak ... ie-1109952

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell Beats Earnings Forecast, Lifts 2021 Outlook As Aerospace Rebounds

https://www.thestreet.com/investing/hon ... ce-rebound

https://www.thestreet.com/investing/hon ... ce-rebound

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell had beat expectations on Friday with second quarter EPS of $2.02 on revenue of $8.81B, compared to forecast for EPS of $1.94 on revenue of $8.64

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell vs. 3M: Which Industrial Stock is a Better Investment?

oneywell International Inc. (HON - Get Rating) and 3M Company (MMM - Get Rating) are two well-known companies in the industrial space. HON operates as a diversified technology and manufacturing company worldwide. The company operates through four segments — Aerospace; Honeywell Building Technologies; Performance Materials and Technologies; and Safety and Productivity Solutions. MMM develops, manufactures, and markets various products worldwide.

The company also operates through four business segments — Safety and Industrial; Transportation and Electronics; Health Care; and Consumer. It offers its products through e-commerce platforms and traditional wholesalers, retailers, jobbers, distributors, dealers, and directly to users.

The industrial sector has been recovering with the reopening of economic activities as there has been solid progress on the vaccination front. Rising demand for advanced equipment, machinery, and supplies should drive the sector’s growth. So, both HON and MMM should benefit. In terms of the past year’s performance, HON is a winner with a 34.9% gain versus MMM’s 13.4% return. But which of these stocks is a better pick now? Let’s find out.

Latest Developments

On September 27, 2021, HON acquired Performix Inc., a manufacturing execution system (MES) software provider for the pharmaceutical manufacturing and biotech industries. Adding Performix’s industry-leading manufacturing execution system software will further enhance HON’s ability to deliver a leading integrated software platform to pharmaceutical and biotech manufacturers that assures faster compliance, improved reliability, and better production throughput at the highest levels of quality.

On September 27, 2021, MMM’s Scotch-Brite Brand and Phylagen, a biotech company specializing in optimizing indoor microbial life, launched Scotch-Brite Clean Scan, the world’s first consumer home cleaning efficacy test. Clean Scan checks for microbial levels in the home’s common areas, providing lab-analyzed and personalized reports to help people better understand the cleanliness of their homes. Both companies expect to witness high demand for this test kit in the upcoming months.

Recent Financial Results

HON’s net sales for its fiscal second quarter that ended June 30, 2021, increased 17.8% year-over-year to $8.81 billion. The company’s total segment profit came in at $1.79 billion, indicating a 29.5% improvement year-over-year. Its operating income came in at $1.60 billion, up 57% from the prior-year period. HON’s adjusted net income came in at $1.42 billion for the quarter, representing a 58.8% year-over-year improvement. Its adjusted EPS increased 60.3% year-over-year to $2.02. As of June 30, 2021, the company had $11.43 billion in cash and cash equivalents.

For its fiscal second quarter that ended June 30, 2021, MMM’s net sales increased 24.7% year-over-year to $8.95 billion. The company’s adjusted operating income came in at $1.97 billion for the quarter, representing a 40% rise from the prior-year period. MMM’s adjusted net income came in at $1.52 billion, up 45.4% from the year-ago period. Its adjusted EPS increased 43.1% year-over-year to $2.59. The company had $4.70 billion in cash and cash equivalents as of June 30, 2021.

Past and Expected Financial Performance

HON’s net income and EPS have grown at CAGRs of 48% and 51.9% over the past three years, respectively. The company’s total assets have grown at a 2.2% CAGR over the past three years.

HON’s EPS is expected to grow 28.8% year-over-year in the current quarter ending September 30, 2021, 14.1% in the current year, and 13.6% next year. Its revenue is expected to grow 13.7% year-over-year in the current quarter and 7.8% in the current year. Analysts expect the stock’s EPS to grow at a 12.7% rate per annum over the next five years.

In comparison, MMM’s net income and EPS have grown at CAGRs of 10.3% and 11.8%, respectively, over the past three years. The company’s total assets have increased at a CAGR of 9.5% over the past three years.

Analysts expect MMM’s EPS to decline 2.8% year-over-year in the current quarter ending September 30, 2021, and increase 14.2% in the current year and 7.1% next year. Its revenue is expected to improve 4.9% year-over-year in the current quarter, 9.5% in the current year, and 3.5% next year. The stock’s EPS is expected to grow at an 8.9% rate per annum over the next five years.

Valuation

In terms of non-GAAP forward PEG, HON is currently trading at 2.44x, 1.7% higher than MMM’s 2.40x.

In terms of forward EV/Sales, HON’s 4.6x compares with MMM’s 3.36x.

Profitability

MMM’s trailing-12-month revenue is significantly higher than what HON generates. MMM is also profitable, with a 29% EBITDA margin versus HON’s 24.6%.

Also, MMM’s ROE, ROA, and ROTC values of 46.6%, 10.9%, and 15.4% compare favorably with HON’s 27.6%, 7.1%, and 11%, respectively.

POWR Ratings

While MMM has an overall grade of C, which translates into a Neutral rating in our proprietary POWR Ratings system, HON has an overall grade of B, equating to Buy rating. The POWR Ratings are calculated considering 118 different factors, each weighted to an optimal degree.

Both MMM and HON have a C grade for Value, consistent with their slightly higher-than-industry valuation ratios. MMM’s 2.40x non-GAAP forward PEG is 52.1% higher than the 1.58x industry average. HON has a non-GAAP forward PEG of 2.44x, 54.5% higher than the industry average of 1.58x.

HON has a B grade for Sentiment, which is consistent with favorable analyst estimates. Analysts expect HON’s EPS to grow 29% year-over-year in the current quarter ending September 30, 2021, to $2.01. However, MMM’s D grade for Sentiment is in sync with analysts’ relatively lower estimates. Its EPS is expected to come in at $2.36 for the current quarter ending September 30, 2021, representing a 2.8% year-over-year decline.

Of the 83 stocks in the A-rated Industrial – Machinery industry, MMM is ranked #57. On the other hand, HON is ranked #13 out of 45 stocks in the A-rated Industrial – Manufacturing industry.

Beyond what we’ve stated above, our POWR Ratings system has also graded HON and MMM for Growth, Stability, Momentum, and Quality.

Get all of MMM’s grades here. Also, click here to see additional grades for HON.

The Winner

With ongoing solid demand, as rising investments drive the industrial sector’s growth, HON and MMM should benefit. However, we think better earnings growth prospects make HON a better buy here.

Our research shows that the odds of success increase if one bets on stocks with an Overall POWR Rating of Buy or Strong Buy. Click here to access the top-rated stocks in the Industrial – Machinery industry, and here for those in the Industrial – Manufacturing industry.

https://stocknews.com/news/hon-mmm-hone ... nvestment/

oneywell International Inc. (HON - Get Rating) and 3M Company (MMM - Get Rating) are two well-known companies in the industrial space. HON operates as a diversified technology and manufacturing company worldwide. The company operates through four segments — Aerospace; Honeywell Building Technologies; Performance Materials and Technologies; and Safety and Productivity Solutions. MMM develops, manufactures, and markets various products worldwide.

The company also operates through four business segments — Safety and Industrial; Transportation and Electronics; Health Care; and Consumer. It offers its products through e-commerce platforms and traditional wholesalers, retailers, jobbers, distributors, dealers, and directly to users.

The industrial sector has been recovering with the reopening of economic activities as there has been solid progress on the vaccination front. Rising demand for advanced equipment, machinery, and supplies should drive the sector’s growth. So, both HON and MMM should benefit. In terms of the past year’s performance, HON is a winner with a 34.9% gain versus MMM’s 13.4% return. But which of these stocks is a better pick now? Let’s find out.

Latest Developments

On September 27, 2021, HON acquired Performix Inc., a manufacturing execution system (MES) software provider for the pharmaceutical manufacturing and biotech industries. Adding Performix’s industry-leading manufacturing execution system software will further enhance HON’s ability to deliver a leading integrated software platform to pharmaceutical and biotech manufacturers that assures faster compliance, improved reliability, and better production throughput at the highest levels of quality.

On September 27, 2021, MMM’s Scotch-Brite Brand and Phylagen, a biotech company specializing in optimizing indoor microbial life, launched Scotch-Brite Clean Scan, the world’s first consumer home cleaning efficacy test. Clean Scan checks for microbial levels in the home’s common areas, providing lab-analyzed and personalized reports to help people better understand the cleanliness of their homes. Both companies expect to witness high demand for this test kit in the upcoming months.

Recent Financial Results

HON’s net sales for its fiscal second quarter that ended June 30, 2021, increased 17.8% year-over-year to $8.81 billion. The company’s total segment profit came in at $1.79 billion, indicating a 29.5% improvement year-over-year. Its operating income came in at $1.60 billion, up 57% from the prior-year period. HON’s adjusted net income came in at $1.42 billion for the quarter, representing a 58.8% year-over-year improvement. Its adjusted EPS increased 60.3% year-over-year to $2.02. As of June 30, 2021, the company had $11.43 billion in cash and cash equivalents.

For its fiscal second quarter that ended June 30, 2021, MMM’s net sales increased 24.7% year-over-year to $8.95 billion. The company’s adjusted operating income came in at $1.97 billion for the quarter, representing a 40% rise from the prior-year period. MMM’s adjusted net income came in at $1.52 billion, up 45.4% from the year-ago period. Its adjusted EPS increased 43.1% year-over-year to $2.59. The company had $4.70 billion in cash and cash equivalents as of June 30, 2021.

Past and Expected Financial Performance

HON’s net income and EPS have grown at CAGRs of 48% and 51.9% over the past three years, respectively. The company’s total assets have grown at a 2.2% CAGR over the past three years.

HON’s EPS is expected to grow 28.8% year-over-year in the current quarter ending September 30, 2021, 14.1% in the current year, and 13.6% next year. Its revenue is expected to grow 13.7% year-over-year in the current quarter and 7.8% in the current year. Analysts expect the stock’s EPS to grow at a 12.7% rate per annum over the next five years.

In comparison, MMM’s net income and EPS have grown at CAGRs of 10.3% and 11.8%, respectively, over the past three years. The company’s total assets have increased at a CAGR of 9.5% over the past three years.

Analysts expect MMM’s EPS to decline 2.8% year-over-year in the current quarter ending September 30, 2021, and increase 14.2% in the current year and 7.1% next year. Its revenue is expected to improve 4.9% year-over-year in the current quarter, 9.5% in the current year, and 3.5% next year. The stock’s EPS is expected to grow at an 8.9% rate per annum over the next five years.

Valuation

In terms of non-GAAP forward PEG, HON is currently trading at 2.44x, 1.7% higher than MMM’s 2.40x.

In terms of forward EV/Sales, HON’s 4.6x compares with MMM’s 3.36x.

Profitability

MMM’s trailing-12-month revenue is significantly higher than what HON generates. MMM is also profitable, with a 29% EBITDA margin versus HON’s 24.6%.

Also, MMM’s ROE, ROA, and ROTC values of 46.6%, 10.9%, and 15.4% compare favorably with HON’s 27.6%, 7.1%, and 11%, respectively.

POWR Ratings

While MMM has an overall grade of C, which translates into a Neutral rating in our proprietary POWR Ratings system, HON has an overall grade of B, equating to Buy rating. The POWR Ratings are calculated considering 118 different factors, each weighted to an optimal degree.

Both MMM and HON have a C grade for Value, consistent with their slightly higher-than-industry valuation ratios. MMM’s 2.40x non-GAAP forward PEG is 52.1% higher than the 1.58x industry average. HON has a non-GAAP forward PEG of 2.44x, 54.5% higher than the industry average of 1.58x.

HON has a B grade for Sentiment, which is consistent with favorable analyst estimates. Analysts expect HON’s EPS to grow 29% year-over-year in the current quarter ending September 30, 2021, to $2.01. However, MMM’s D grade for Sentiment is in sync with analysts’ relatively lower estimates. Its EPS is expected to come in at $2.36 for the current quarter ending September 30, 2021, representing a 2.8% year-over-year decline.

Of the 83 stocks in the A-rated Industrial – Machinery industry, MMM is ranked #57. On the other hand, HON is ranked #13 out of 45 stocks in the A-rated Industrial – Manufacturing industry.

Beyond what we’ve stated above, our POWR Ratings system has also graded HON and MMM for Growth, Stability, Momentum, and Quality.

Get all of MMM’s grades here. Also, click here to see additional grades for HON.

The Winner

With ongoing solid demand, as rising investments drive the industrial sector’s growth, HON and MMM should benefit. However, we think better earnings growth prospects make HON a better buy here.

Our research shows that the odds of success increase if one bets on stocks with an Overall POWR Rating of Buy or Strong Buy. Click here to access the top-rated stocks in the Industrial – Machinery industry, and here for those in the Industrial – Manufacturing industry.

https://stocknews.com/news/hon-mmm-hone ... nvestment/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

#Honeywell hikes dividend by 5.4 percent. $HON

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Investing.com - Honeywell (NASDAQ:HON) reported on Thursday second quarter earnings that beat analysts' forecasts and revenue that topped expectations.

Honeywell announced earnings per share of $2.1 on revenue of $8.95B. Analysts polled by Investing.com anticipated EPS of $2.03 on revenue of $8.68B.

Honeywell shares are up 19% from the beginning of the year, still down 22.44% from its 52 week high of $236.79 set on August 2, 2021. They are outperforming the S&P 500 which is down 15.58% from the start of the year.

Honeywell follows other major Industrials sector earnings this month

Honeywell's report follows an earnings beat by United Parcel Service on Tuesday, who reported EPS of $3.29 on revenue of $24.77B, compared to forecasts EPS of $3.16 on revenue of $24.65B.

Union Pacific had beat expectations on July 21 with second quarter EPS of $2.93 on revenue of $6.27B, compared to forecast for EPS of $2.84 on revenue of $6.12B.

Honeywell announced earnings per share of $2.1 on revenue of $8.95B. Analysts polled by Investing.com anticipated EPS of $2.03 on revenue of $8.68B.

Honeywell shares are up 19% from the beginning of the year, still down 22.44% from its 52 week high of $236.79 set on August 2, 2021. They are outperforming the S&P 500 which is down 15.58% from the start of the year.

Honeywell follows other major Industrials sector earnings this month

Honeywell's report follows an earnings beat by United Parcel Service on Tuesday, who reported EPS of $3.29 on revenue of $24.77B, compared to forecasts EPS of $3.16 on revenue of $24.65B.

Union Pacific had beat expectations on July 21 with second quarter EPS of $2.93 on revenue of $6.27B, compared to forecast for EPS of $2.84 on revenue of $6.12B.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Honeywell NYSE: HON automatyka, systemy alarmowe i ppoż

Honeywell (NASDAQ:HON) declared a quarterly dividend of $1.03 per share, or $4.12 annualized. This is a 5.1% increase from the prior dividend of $0.98. The dividend will be payable on December 2, 2022, to stockholders of record on November 11, 2022, with an ex-dividend date of November 9, 2022. The annual yield on the dividend is 2.4 percent

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 91 gości