Philip Morris is a Quality Dividend Stock to Buy Now

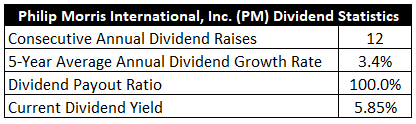

Philip Morris International (PM), a leading tobacco company, has a reputation for paying healthy dividends. And strong growth in its primary IQOS smoke-free products business, along with its continued advancement in research and technology to strengthen its operations, should position the company well to maintain or raise its dividends. As such, we think the stock is a solid pick for investors looking for a steady stream of income. Read on.Incorporated in 1987, Philip Morris International Inc. (NYSE:PM) manufactures and sells nicotine-based products, related accessories and devices, and IQOS smoke-free products. PM’s shares have advanced 33.4% over the past year and 20.2% so far this year. The company delivered strong top and bottom-line results in its last reported quarter, driven by higher heated tobacco unit shipment volume in East Asia and Australia and favorable pricing. Since its market debut in 2008, PM has raised its annual dividend every year, amounting to a 160.9% total increase, or an 8.3% CAGR.

Tobacco companies benefit significantly from the highly addictive nature of their products. And thanks to PM’s attractive dividend yields and dividend increase history, we think it’s an ideal pick for income investors.

With the Federal Reserve’s decision to keep short-term interest rates anchored near zero and the stock market’s current fluctuations as the backdrop, we think PM could prove to be a solid bet from both stability and dividend viewpoints.

https://www.investing.com/news/stock-ma ... ow-2537744

Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

W piątek producent papierosów Philip Morris International poinformował, że kupi Vectura Group w ramach transakcji wyceniającej brytyjską firmę farmaceutyczną na 1,05 mld GBP.

https://www.pb.pl/brytyjska-vectura-zga ... bp-1121715

https://www.pb.pl/brytyjska-vectura-zga ... bp-1121715

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

This Dividend Stock With Smoking Yield Offers Buy Zone Amid Diversification Efforts

https://www.investors.com/research/the- ... ip-morris/

https://www.investors.com/research/the- ... ip-morris/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Jacek Olczak, prezes Philip Morris International (PMI) wezwał rząd Wielkiej Brytanii do wprowadzenia w ciągu dekady zakazu sprzedaży papierosów, donosi The Guardian.

Olczak powiedział, że jego firma „widzi świat bez papierosów” oraz że „im szybciej się to stanie, tym lepiej dla wszystkich”. Prezes PMI uważa, że papierosy powinny być traktowane tak samo jak auta z silnikami spalinowymi, których sprzedaż ma zostać zakazana od 2030 roku.

https://www.pb.pl/prezes-firmy-tytoniow ... ow-1123004

Olczak powiedział, że jego firma „widzi świat bez papierosów” oraz że „im szybciej się to stanie, tym lepiej dla wszystkich”. Prezes PMI uważa, że papierosy powinny być traktowane tak samo jak auta z silnikami spalinowymi, których sprzedaż ma zostać zakazana od 2030 roku.

https://www.pb.pl/prezes-firmy-tytoniow ... ow-1123004

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

(Reuters) - Cigarette maker Philip Morris (NYSE:PM) (PMI) clinched its 1.1 billion-pound takeover of asthma inhaler maker Vectura (LSE:VEC) on Thursday, winning the support of the British company's shareholders despite the concerns of health professionals.

Vectura's shareholders decided to take the 165 pence-per-share offer from PMI, with nearly 75% backing the deal.

Buying the London-listed inhaler maker is part of Philip Morris' long term plan to develop "smoke-free" products and switch to being a "broader healthcare and wellness" company.

But it has angered health groups such as Asthma UK and the British Lung Foundation that have questioned whether a tobacco group should own a company that cures the very respiratory illnesses cigarettes cause.

PMI Chief Executive Jacek Olczak has argued that acquiring Vectura is a critical part of his strategy to move the company "Beyond Nicotine".

He told the Telegraph last month that opponents of the deal were "not interested in progress" and accused them of "settling old scores" with the tobacco industry.

Olczak said on Thursday PMI would provide Vectura's scientists with the resources and expertise to reach its goal of generating at least $1 billion in net revenue from "Beyond Nicotine" products by 2025.

In the meantime, Asthma UK and the British Lung Foundation said they have sent a letter urging the government to look into any conflict of interest issues.

The letter was co-signed by 35 charities, public health experts and clinicians.

"There's now a very real risk that Vectura's deal with big tobacco will lead to the cigarette industry wielding undue influence on UK health policy," said Sarah Woolnough, Chief Executive of Asthma UK and the British Lung Foundation.

"We call on the government to stand by its commitment to the World Health Organization Framework Convention on Tobacco Control to prevent this happening," Woolnough added.

PMI has received regulatory clearances for the deal and following the public tender process, its offer cannot now be withdrawn.

While the company received the 50% threshold to make its offer unconditional, it has not yet reached the 75% of shares it needs to delist Vectura.

PMI said it was extending its offer to Sept 30., to give Vectura shareholders time to accept its proposal.

"Phillip Morris isn't ignoring the elephant; it's making us all take a long hard look. Discomfort is good, it tends to deliver change, but care must be taken that the promised change does come and there are no detours on the journey," AJ Bell financial analyst Danni Hewson said.

https://www.investing.com/news/stock-ma ... ed-2617797

Vectura's shareholders decided to take the 165 pence-per-share offer from PMI, with nearly 75% backing the deal.

Buying the London-listed inhaler maker is part of Philip Morris' long term plan to develop "smoke-free" products and switch to being a "broader healthcare and wellness" company.

But it has angered health groups such as Asthma UK and the British Lung Foundation that have questioned whether a tobacco group should own a company that cures the very respiratory illnesses cigarettes cause.

PMI Chief Executive Jacek Olczak has argued that acquiring Vectura is a critical part of his strategy to move the company "Beyond Nicotine".

He told the Telegraph last month that opponents of the deal were "not interested in progress" and accused them of "settling old scores" with the tobacco industry.

Olczak said on Thursday PMI would provide Vectura's scientists with the resources and expertise to reach its goal of generating at least $1 billion in net revenue from "Beyond Nicotine" products by 2025.

In the meantime, Asthma UK and the British Lung Foundation said they have sent a letter urging the government to look into any conflict of interest issues.

The letter was co-signed by 35 charities, public health experts and clinicians.

"There's now a very real risk that Vectura's deal with big tobacco will lead to the cigarette industry wielding undue influence on UK health policy," said Sarah Woolnough, Chief Executive of Asthma UK and the British Lung Foundation.

"We call on the government to stand by its commitment to the World Health Organization Framework Convention on Tobacco Control to prevent this happening," Woolnough added.

PMI has received regulatory clearances for the deal and following the public tender process, its offer cannot now be withdrawn.

While the company received the 50% threshold to make its offer unconditional, it has not yet reached the 75% of shares it needs to delist Vectura.

PMI said it was extending its offer to Sept 30., to give Vectura shareholders time to accept its proposal.

"Phillip Morris isn't ignoring the elephant; it's making us all take a long hard look. Discomfort is good, it tends to deliver change, but care must be taken that the promised change does come and there are no detours on the journey," AJ Bell financial analyst Danni Hewson said.

https://www.investing.com/news/stock-ma ... ed-2617797

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Altria, Philip Morris banned from selling IQOS tobacco heating device after British American Tobacco wins court ruling

Altria Group (MO -2.7%) and Philip Morris (PM -2.0%) must end the sale and import of their IQOS heated tobacco device after the U.S. International Trade Commission ruled that it infringed on two patents held by rival R.J. Reynolds, a subsidiary of British American Tobacco (BTI -4.0%).

The ban will take effect in two months after an administrative review process. Philip Morris says it will appeal the decision.

British American Tobacco previously took action against Philip Morris in the U.K., Greece, and other international markets, but courts sided with Philip Morris in those cases.

IQOS is a cigarette alternative that heats, rather than burns tobacco and is the only inhalable tobacco product allowed to say that it exposes buyers to fewer dangerous chemicals than tobacco. It is manufactured by Philip Morris and Altria began selling the product in the U.S. two years ago under a licensing agreement.

The ruling deals a blow to Philip Morris' shift in focus from traditional tobacco to healthier alternatives. The Marlboro maker recently acquired asthma inhaler manufacturer Vectura.

https://seekingalpha.com/news/3746611-a ... urt-ruling

https://www.cnbc.com/2021/09/30/philip- ... he-us.html

Altria Group (MO -2.7%) and Philip Morris (PM -2.0%) must end the sale and import of their IQOS heated tobacco device after the U.S. International Trade Commission ruled that it infringed on two patents held by rival R.J. Reynolds, a subsidiary of British American Tobacco (BTI -4.0%).

The ban will take effect in two months after an administrative review process. Philip Morris says it will appeal the decision.

British American Tobacco previously took action against Philip Morris in the U.K., Greece, and other international markets, but courts sided with Philip Morris in those cases.

IQOS is a cigarette alternative that heats, rather than burns tobacco and is the only inhalable tobacco product allowed to say that it exposes buyers to fewer dangerous chemicals than tobacco. It is manufactured by Philip Morris and Altria began selling the product in the U.S. two years ago under a licensing agreement.

The ruling deals a blow to Philip Morris' shift in focus from traditional tobacco to healthier alternatives. The Marlboro maker recently acquired asthma inhaler manufacturer Vectura.

https://seekingalpha.com/news/3746611-a ... urt-ruling

https://www.cnbc.com/2021/09/30/philip- ... he-us.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

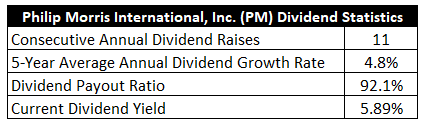

Undervalued Dividend Growth Stock of the Week: Philip Morris (PM)https://dailytradealert.com/2019/12/15/ ... -week-240/UNDERVALUED DIVIDEND GROWTH STOCK OF THE WEEK

https://www.mrfreeat33.com/undervalued- ... -week-147/

30.06.2019

Undervalued Dividend Growth Stock of the Week: Philip Morris (PM)

by Jason Fieber, Mr. Free at 33 • September 6, 2020

https://dailytradealert.com/2020/09/06/ ... morris-pm/

by Jason Fieber, Mr. Free at 33 • April 18, 2021

https://www.youtube.com/watch?v=qjSh8I4bTrk

dywidendy

Undervalued Dividend Growth Stock of the Week: Philip Morris (PM)

by Jason Fieber, Mr. Free at 33 • November 14, 2021

https://dailytradealert.com/2021/11/14/ ... rris-pm-3/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Philip Morris International (PMI), jeden z największych producentów papierosów na świecie, zamierza wyjść z Rosji. „Od 4 tygodni wszystkie nasze wysiłki skupiają się na zapewnieniu bezpieczeństwa naszym kolegom z Ukrainy. Wyrażamy solidarność z cierpiącymi, niewinnymi dziećmi, kobietami i mężczyznami” – powiedział Jacek Olczak, CEO Philip Morris International. „W Rosji zatrudniamy ponad 3200 pracowników. Nadal będziemy ich wspierać i wypłacać pensje. Naszym priorytetem jest zapewnienie im ochrony i w oparciu o to będziemy podejmować dalsze decyzje” – dodał CEO PMI.

Więcej: https://wiadomosci.radiozet.pl/Swiat/Wo ... -z-dzisiaj

Więcej: https://wiadomosci.radiozet.pl/Swiat/Wo ... -z-dzisiaj

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

STOCKHOLM (Reuters) – Shares in Swedish Match soared 26%

in early trade on Tuesday after U.S. rival Philip Morris International Inc said it was in talks to buy the Stockholm-based tobacco products company betting on a growing market for alternatives to cigarettes.

in early trade on Tuesday after U.S. rival Philip Morris International Inc said it was in talks to buy the Stockholm-based tobacco products company betting on a growing market for alternatives to cigarettes.

https://www.fxempire.com/news/article/s ... ove-995364

https://www.fxempire.com/news/article/s ... ove-995364

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

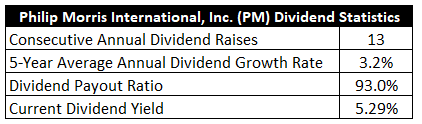

On september 14, 2022, Philip Morris International (PM) declared a 1.6% dividend hike to $1.27 per share quarterly. This follows a dividend hike of 4.2 percent to $1.25 per share in 2021 and marks 15 consecutive years of dividend growth by the tobacco company. The average 5 year CAGR for the dividend is just 3.5% now.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

BRUSSELS (Reuters) - Marlboro maker Philip Morris (NYSE:PM) has offered concessions to address EU antitrust concerns over its $16 billion bid for tobacco and nicotine products maker Swedish Match, a European Commission filing showed on Wednesday.

The EU competition enforcer did not provide details of the concessions in line with its policy. It will seek feedback from rivals and customers before deciding whether to accept them or demand more.

The Commission extended its deadline for a decision to Oct. 25 from Oct. 11. Companies typically offer remedies during the preliminary review if they are confident that the EU antitrust watchdog will accept them.

The Commission had been expected to clear the deal unconditionally but no final decision had been made, people close to the matter said on Tuesday.

The deal, which has been cleared in the United States and Brazil, is complex and EU regulators have to take into account the scope and characteristics of the European market, another person said.

The EU competition enforcer did not provide details of the concessions in line with its policy. It will seek feedback from rivals and customers before deciding whether to accept them or demand more.

The Commission extended its deadline for a decision to Oct. 25 from Oct. 11. Companies typically offer remedies during the preliminary review if they are confident that the EU antitrust watchdog will accept them.

The Commission had been expected to clear the deal unconditionally but no final decision had been made, people close to the matter said on Tuesday.

The deal, which has been cleared in the United States and Brazil, is complex and EU regulators have to take into account the scope and characteristics of the European market, another person said.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Philip Morris International (NYSE:PM) was raised to Buy from Hold, with its price target lifted to $118 from $86 per share by Jefferies analysts in a note to clients on Thursday.

In a wide-ranging note focused on tobacco stocks, the analysts told investors they adjusted the rating on PM as they also now capture the contribution from the Swedish Match deal.

"On a longer-term basis, we have consistently been constructive on PM because it is leading the shift over to the tobacco model of the future, both RRP and Beyond Nicotine," argues Jefferies. "On the former, it is the global leader, with estimated RRP share of 23%, compared to 21% share in combustibles."

The analysts explained that their firm's previous near-term caution on Philip Morris was based on an assumption of an unfavorable European Tobacco Tax Directive for RRP taxes, as well as PM's lack of current RRP exposure to the US, and potential share and cost implications.

However, it has now changed its outlook on those areas.

"In the EU TTD, this will be important for PM in a couple of ways. First, EU RRP is significant for PM, and expected to make up over 16% of PM group sales in FY22, while in the EU specifically, it is expected to contribute around 40% of sales," the analysts said. "Second, with favorable economics also present in most other markets globally due to lower taxes, if the EU was to implement aggressive increases, it is fair to assume such an outcome would also be priced in elsewhere," they added.

In a wide-ranging note focused on tobacco stocks, the analysts told investors they adjusted the rating on PM as they also now capture the contribution from the Swedish Match deal.

"On a longer-term basis, we have consistently been constructive on PM because it is leading the shift over to the tobacco model of the future, both RRP and Beyond Nicotine," argues Jefferies. "On the former, it is the global leader, with estimated RRP share of 23%, compared to 21% share in combustibles."

The analysts explained that their firm's previous near-term caution on Philip Morris was based on an assumption of an unfavorable European Tobacco Tax Directive for RRP taxes, as well as PM's lack of current RRP exposure to the US, and potential share and cost implications.

However, it has now changed its outlook on those areas.

"In the EU TTD, this will be important for PM in a couple of ways. First, EU RRP is significant for PM, and expected to make up over 16% of PM group sales in FY22, while in the EU specifically, it is expected to contribute around 40% of sales," the analysts said. "Second, with favorable economics also present in most other markets globally due to lower taxes, if the EU was to implement aggressive increases, it is fair to assume such an outcome would also be priced in elsewhere," they added.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Investing.com - Philip Morris (NYSE: PM) reported first quarter EPS of $1.38, $0.03 better than the analyst estimate of $1.35. Revenue for the quarter came in at $8B versus the consensus estimate of $8.03B.

Guidance

Philip Morris sees FY 2023 EPS of $6.10-$6.22 versus the analyst consensus of $6.34.

Philip Morris's stock price closed at $101.51. It is down -0.30% in the last 3 months and down -3.38% in the last 12 months.

Philip Morris saw 0 positive EPS revisions and 7 negative EPS revisions in the last 90 days. See Philip Morris's stock price’s past reactions to earnings here.

According to InvestingPro, Philip Morris's Financial Health score is "great performance".

Check out Philip Morris's recent earnings performance, and Philip Morris's financials here.

Guidance

Philip Morris sees FY 2023 EPS of $6.10-$6.22 versus the analyst consensus of $6.34.

Philip Morris's stock price closed at $101.51. It is down -0.30% in the last 3 months and down -3.38% in the last 12 months.

Philip Morris saw 0 positive EPS revisions and 7 negative EPS revisions in the last 90 days. See Philip Morris's stock price’s past reactions to earnings here.

According to InvestingPro, Philip Morris's Financial Health score is "great performance".

Check out Philip Morris's recent earnings performance, and Philip Morris's financials here.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

(Reuters) -Philip Morris International beat analysts' expectations for quarterly profit and raised the lower end of its annual earnings forecast, as tobacco and labor costs ease, and demand remains robust for its smokeless Zyn and IQOS products.

In December last year, Philip Morris (NYSE:PM) acquired Hay-maker Swedish Match for a share of the popular smokeless and spitless nicotine pouches as younger customers increasingly prefer alternatives to traditional combustible cigarettes.

Shipment volume growth for Zyn in the U.S. jumped more than 50% in the three months ended June 30, the company said on Thursday.

From mid-2024, Philip Morris will have the sole rights to market and sell IQOS products - which heat cigarettes instead of burning them - in the U.S., as per its deal with Altria Group (NYSE:MO).

Total IQOS users at the end of June were up by 1.4 million from March, the company said, taking the total number to 27.2 million.

Its second-quarter adjusted profit per share of $1.60 beat analysts' average estimates for a profit of $1.47, as per Refinitiv data.

Net revenue rose 14.5% to $8.97 billion, topping estimates of $8.65 billion.

The 176-year old company is also benefiting from higher prices for its traditional combustible cigarettes, after supply-chain snags inflated freight and raw-material costs last year.

Philip Morris now expects these pressures to ease in the second half of the year, allowing the company to raise the lower-end of its full-year profit forecast.

The company boosted the lower end to $6.13 per share from $6.10, while retaining the upper end at $6.22.

In December last year, Philip Morris (NYSE:PM) acquired Hay-maker Swedish Match for a share of the popular smokeless and spitless nicotine pouches as younger customers increasingly prefer alternatives to traditional combustible cigarettes.

Shipment volume growth for Zyn in the U.S. jumped more than 50% in the three months ended June 30, the company said on Thursday.

From mid-2024, Philip Morris will have the sole rights to market and sell IQOS products - which heat cigarettes instead of burning them - in the U.S., as per its deal with Altria Group (NYSE:MO).

Total IQOS users at the end of June were up by 1.4 million from March, the company said, taking the total number to 27.2 million.

Its second-quarter adjusted profit per share of $1.60 beat analysts' average estimates for a profit of $1.47, as per Refinitiv data.

Net revenue rose 14.5% to $8.97 billion, topping estimates of $8.65 billion.

The 176-year old company is also benefiting from higher prices for its traditional combustible cigarettes, after supply-chain snags inflated freight and raw-material costs last year.

Philip Morris now expects these pressures to ease in the second half of the year, allowing the company to raise the lower-end of its full-year profit forecast.

The company boosted the lower end to $6.13 per share from $6.10, while retaining the upper end at $6.22.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Philip Morris International Inc. (PMI) NYSE: PM papierosy, wyroby tytoniowe

Philip Morris International Inc. (NYSE:PM), the maker of Marlboro cigarettes, is contemplating selling a stake in its largest pharmaceutical unit, Vectura. The company is exploring this move as part of its strategy to find a new partner to help operate and grow Vectura's drug manufacturing outsourcing business, the Wall Street Journal reported on Wednesday.

The tobacco giant is considering different options including a licensing or royalties deal, a commercial partnership, or the sale of either a majority or minority stake in Vectura. However, a spokesperson for Philip Morris declined to comment on the WSJ report.

This decision comes two years after Philip Morris acquired UK-based Vectura, which manufactures asthma inhalers, for £1.1 billion (£1 = $1.24). The acquisition was part of the company's long-term strategy to transition into a 'broader healthcare and wellness' company.

In 2021, Philip Morris also acquired Fertin Pharma, a nicotine gum manufacturer, and OtiTopic, a respiratory drug development company. These acquisitions were part of a broader plan to pivot away from cigarette sales and enter the market for inhalers and other treatments for respiratory diseases linked to cigarette smoking.

The company has been discussing various options with Deutsche Bank to expand its healthcare and wellness division. However, due to issues with the unit, Philip Morris booked a total impairment charge of $680 million (€636.8 million) for the segment in the second quarter of this year and is expected to delay its 2025 target to reach over $1 billion (€940 million) of net revenues.

Despite these obstacles, Emmanuel Babeau, Chief Financial Officer of Philip Morris, reaffirmed the company's commitment to developing its wellness healthcare segment in July. He stated that they aim "to accelerate Vectura’s growth and will be exploring potential partnerships to enhance its contract development and manufacturing organization business."

The tobacco giant is considering different options including a licensing or royalties deal, a commercial partnership, or the sale of either a majority or minority stake in Vectura. However, a spokesperson for Philip Morris declined to comment on the WSJ report.

This decision comes two years after Philip Morris acquired UK-based Vectura, which manufactures asthma inhalers, for £1.1 billion (£1 = $1.24). The acquisition was part of the company's long-term strategy to transition into a 'broader healthcare and wellness' company.

In 2021, Philip Morris also acquired Fertin Pharma, a nicotine gum manufacturer, and OtiTopic, a respiratory drug development company. These acquisitions were part of a broader plan to pivot away from cigarette sales and enter the market for inhalers and other treatments for respiratory diseases linked to cigarette smoking.

The company has been discussing various options with Deutsche Bank to expand its healthcare and wellness division. However, due to issues with the unit, Philip Morris booked a total impairment charge of $680 million (€636.8 million) for the segment in the second quarter of this year and is expected to delay its 2025 target to reach over $1 billion (€940 million) of net revenues.

Despite these obstacles, Emmanuel Babeau, Chief Financial Officer of Philip Morris, reaffirmed the company's commitment to developing its wellness healthcare segment in July. He stated that they aim "to accelerate Vectura’s growth and will be exploring potential partnerships to enhance its contract development and manufacturing organization business."

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 97 gości