Lowe's NYSE: LOW markety budowlane

Re: Lowe's NYSE: LOW markety budowlane

Lowe’s (NYSE:LOW) stock fell 1.6% after Citigroup downgraded the home improvement chain to ‘neutral’ from ‘buy’, saying the housing market is cooling and this will hit demand.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Lowe's NYSE: LOW markety budowlane

Home Depot, Lowe's Risk-Rewards are 'Attractive' - Atlantic Equities

An Atlantic Equities analyst reiterated an Overweight rating on both Home Depot (NYSE:HD) and Lowe's Cos. (NYSE:LOW) in a note Thursday, stating the current risk rewards are attractive.

"Home Depot (HD) and Lowe's (LOW) robust 3-yr comp trends, despite cautious commentary from multiple suppliers, are indicative of the companies' unique positions as diversified home improvement retailers, primarily exposed to big-ticket project demand and repair & maintenance activity," said the analyst, who has a $370 per share price target on Home Depot and $300 per share price target on Lowe's.

He added that this demand is "underpinned by >40% house price appreciation in two years and a structurally higher utilisation of the home post-Covid, strong long-term trends should continue."

"While we acknowledge the near-term risk of a recession, we believe the market is already pricing in >10% and >18% EPS declines in FY23 at HD and LOW respectively. However, at the former, we believe a low-single-digit EPS decline is a more realistic downside scenario, while at the latter, flat or even low-single-digit growth is achievable," the analyst concluded.

https://www.investing.com/news/stock-ma ... SI-2884464

An Atlantic Equities analyst reiterated an Overweight rating on both Home Depot (NYSE:HD) and Lowe's Cos. (NYSE:LOW) in a note Thursday, stating the current risk rewards are attractive.

"Home Depot (HD) and Lowe's (LOW) robust 3-yr comp trends, despite cautious commentary from multiple suppliers, are indicative of the companies' unique positions as diversified home improvement retailers, primarily exposed to big-ticket project demand and repair & maintenance activity," said the analyst, who has a $370 per share price target on Home Depot and $300 per share price target on Lowe's.

He added that this demand is "underpinned by >40% house price appreciation in two years and a structurally higher utilisation of the home post-Covid, strong long-term trends should continue."

"While we acknowledge the near-term risk of a recession, we believe the market is already pricing in >10% and >18% EPS declines in FY23 at HD and LOW respectively. However, at the former, we believe a low-single-digit EPS decline is a more realistic downside scenario, while at the latter, flat or even low-single-digit growth is achievable," the analyst concluded.

https://www.investing.com/news/stock-ma ... SI-2884464

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

Latest Release

Mar 01, 2023

EPS / Forecast

2.28 / 2.21

Revenue / Forecast

22.4B / 22.73B

On the earnings front, Lowe’s Companies Inc (NYSE:LOW) fell nearly 6% after the home improvement retailer reported fourth-quarter revenue that missed Wall Street estimates and annual sales guidance that also surprised to the downside.

“[W]e note weaker than expected ongoing sales trends that are set to persist, a sharp decline in credit income achieved in the quarter, and a margin outlook that remains muted relative to history,” Goldman Sachs said in a note.

Mar 01, 2023

EPS / Forecast

2.28 / 2.21

Revenue / Forecast

22.4B / 22.73B

On the earnings front, Lowe’s Companies Inc (NYSE:LOW) fell nearly 6% after the home improvement retailer reported fourth-quarter revenue that missed Wall Street estimates and annual sales guidance that also surprised to the downside.

“[W]e note weaker than expected ongoing sales trends that are set to persist, a sharp decline in credit income achieved in the quarter, and a margin outlook that remains muted relative to history,” Goldman Sachs said in a note.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

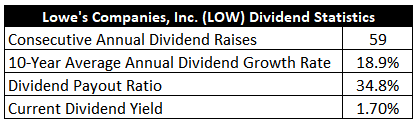

Undervalued Dividend Growth Stock of the Week: Lowe’s (LOW)Undervalued Dividend Growth Stock of the Week: Lowe’s (LOW)

by Jason Fieber, Mr. Free at 33 • August 15, 2021

https://dailytradealert.com/2021/08/15/ ... lowes-low/

https://www.youtube.com/watch?v=D8r3BEBoqfE

Undervalued Dividend Growth Stock of the Week: Lowe’s (LOW)

by Jason Fieber, Mr. Free at 33 • May 15, 2022

by Jason Fieber, Mr. Free at 33 • March 19, 2023

https://dailytradealert.com/2023/03/19/ ... wes-low-3/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

Lowe’s Companies Inc (NYSE:LOW) shares rose 1.6% after the home improvement retailer reported better than expected adjusted earnings per share in the first quarter but cut its fiscal year revenue outlook as households cut back on do-it-yourself projects.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

Lowe's Companies hikes dividend by 5%. $LOWing dividend growth.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

22/08/23

Lowe’s (NYSE:LOW) stock rose 3.7% after the home improvement retailer posted a smaller-than-expected drop in quarterly comparable sales, helped by a boost from delayed spring season sales and sustained consumer spending on smaller projects.

Lowe’s (NYSE:LOW) stock rose 3.7% after the home improvement retailer posted a smaller-than-expected drop in quarterly comparable sales, helped by a boost from delayed spring season sales and sustained consumer spending on smaller projects.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lowe's NYSE: LOW markety budowlane

Lowe's raised at Bernstein as analysts bullish on long-term drivers of home improvement spending

Bernstein analysts upgraded Lowe's Cos. (NYSE:LOW) to Outperform from Market Perform in a note on Tuesday, raising the price target for the stock to $282 from $252 per share.

The analysts stated in a note that the firm now sees a confluence of positive and mutually reinforcing trends for the company that they expect to continue.

"We believe LOW will continue to deliver modest op margin expansion over the next 24 months, driven by the continued modest gross margin expansion of 5-10bps / year combined with stable to modestly improving OpEx % of sales," wrote the analysts.

"We expect LOW’s PRO growth to continue to outpace HD’s as LOW continues to close the Pro 'primary source for' preference vs. HD, driving LOW gain share from HD in the store-based, immediate-need occasion, which will bolster LOW's OpEX leverage," they added.

Bernstein is comfortable with the home improvement market outlook in the near term and sees a return to low-single-digit growth into 2024-25 "as the housing market stabilizes."

Furthermore, the firm "remains unequivocally bullish on the long-term drivers" of home improvement spending."

Bernstein analysts upgraded Lowe's Cos. (NYSE:LOW) to Outperform from Market Perform in a note on Tuesday, raising the price target for the stock to $282 from $252 per share.

The analysts stated in a note that the firm now sees a confluence of positive and mutually reinforcing trends for the company that they expect to continue.

"We believe LOW will continue to deliver modest op margin expansion over the next 24 months, driven by the continued modest gross margin expansion of 5-10bps / year combined with stable to modestly improving OpEx % of sales," wrote the analysts.

"We expect LOW’s PRO growth to continue to outpace HD’s as LOW continues to close the Pro 'primary source for' preference vs. HD, driving LOW gain share from HD in the store-based, immediate-need occasion, which will bolster LOW's OpEX leverage," they added.

Bernstein is comfortable with the home improvement market outlook in the near term and sees a return to low-single-digit growth into 2024-25 "as the housing market stabilizes."

Furthermore, the firm "remains unequivocally bullish on the long-term drivers" of home improvement spending."

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 72 gości