Źródło: Puls Biznesu

Treść chroniona prawem autorskim. Całość przeczytasz tu: https://www.pb.pl/3m-rozwija-sie-w-kszt ... -k-1111275

3M rozwija się w kształcie litery K

MAŁGORZATA GRZEGORCZYK

zobacz wszystkie moje teksty opublikowano: wczoraj, 16-03-2021, 20:00

Amerykański koncern zainwestuje w tym roku we Wrocławiu w hub i centrum usług – zapowiada Radosław ktoś, który kieruje Polską i regionem.

3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

EPS / Forecast

2.77 / 2.3

Revenue / Forecast

8.85B / 8.44B

2.77 / 2.3

Revenue / Forecast

8.85B / 8.44B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Latest Release

Jul 27, 2021

EPS / Forecast

2.59 / 2.29

Revenue / Forecast

8.95B / 8.53B

3M publikuje zadowalający raport kwartalny

Spółka 3M (NYSE: MMM) opublikowała dziś przed dzwonkiem wyniki finansowe za drugi kwartał, a po południu jej akcje spadły o 1,1% do 199,50 USD w odpowiedzi na raport. Konglomerat odnotował dochód netto w wysokości 1,524 mld USD, w porównaniu z 1,306 mld USD w poprzednim roku, co przekłada się na zysk na akcję według zasad GAAP wynoszący 2,59 USD, co przewyższyło szacunki wynoszące 2,25 USD. Firma odnotowała skorygowany zysk na akcję w wysokości 2,59 USD, w porównaniu z 1,81 USD, co stanowi wartość wyższą niż oczekiwane 2,28 USD. Spółka odnotowała przychody w wysokości 8,95 mld USD, co oznacza wzrost o 24,7% i wynik wyższy od szacowanej kwoty o 360 mln USD. Dyrektor generalny Mike Roman powiedział, że firma osiągnęła dobre wyniki we wszystkich branżach. Patrząc w przyszłość na cały rok, 3M wzmocniła swoje prognozy, spodziewając się teraz skorygowanego zysku w wysokości od 9,70 do 10,10 USD na akcję i 7–10% wzrostu sprzedaży ogółem.

https://www.paszport.ws/newsfeed

Jul 27, 2021

EPS / Forecast

2.59 / 2.29

Revenue / Forecast

8.95B / 8.53B

3M publikuje zadowalający raport kwartalny

Spółka 3M (NYSE: MMM) opublikowała dziś przed dzwonkiem wyniki finansowe za drugi kwartał, a po południu jej akcje spadły o 1,1% do 199,50 USD w odpowiedzi na raport. Konglomerat odnotował dochód netto w wysokości 1,524 mld USD, w porównaniu z 1,306 mld USD w poprzednim roku, co przekłada się na zysk na akcję według zasad GAAP wynoszący 2,59 USD, co przewyższyło szacunki wynoszące 2,25 USD. Firma odnotowała skorygowany zysk na akcję w wysokości 2,59 USD, w porównaniu z 1,81 USD, co stanowi wartość wyższą niż oczekiwane 2,28 USD. Spółka odnotowała przychody w wysokości 8,95 mld USD, co oznacza wzrost o 24,7% i wynik wyższy od szacowanej kwoty o 360 mln USD. Dyrektor generalny Mike Roman powiedział, że firma osiągnęła dobre wyniki we wszystkich branżach. Patrząc w przyszłość na cały rok, 3M wzmocniła swoje prognozy, spodziewając się teraz skorygowanego zysku w wysokości od 9,70 do 10,10 USD na akcję i 7–10% wzrostu sprzedaży ogółem.

https://www.paszport.ws/newsfeed

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

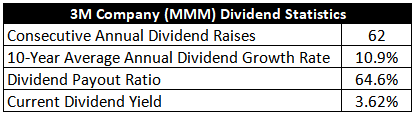

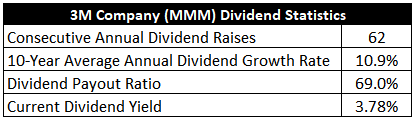

Undervalued Dividend Growth Stock of the Week: 3M Company (MMM)Undervalued Dividend Growth Stock of the Week: 3M Company (MMM)Undervalued Dividend Growth Stock of the Week

3M

https://dailytradealert.com/2020/02/09/ ... mpany-mmm/

https://dailytradealert.com/2020/07/05/ ... any-mmm-2/

by Jason Fieber, Mr. Free at 33 • September 12, 2021

https://dailytradealert.com/2021/09/12/ ... any-mmm-3/

https://www.youtube.com/watch?v=I6uZM3W ... sAndIncome

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Honeywell vs. 3M: Which Industrial Stock is a Better Investment?

oneywell International Inc. (HON - Get Rating) and 3M Company (MMM - Get Rating) are two well-known companies in the industrial space. HON operates as a diversified technology and manufacturing company worldwide. The company operates through four segments — Aerospace; Honeywell Building Technologies; Performance Materials and Technologies; and Safety and Productivity Solutions. MMM develops, manufactures, and markets various products worldwide.

The company also operates through four business segments — Safety and Industrial; Transportation and Electronics; Health Care; and Consumer. It offers its products through e-commerce platforms and traditional wholesalers, retailers, jobbers, distributors, dealers, and directly to users.

The industrial sector has been recovering with the reopening of economic activities as there has been solid progress on the vaccination front. Rising demand for advanced equipment, machinery, and supplies should drive the sector’s growth. So, both HON and MMM should benefit. In terms of the past year’s performance, HON is a winner with a 34.9% gain versus MMM’s 13.4% return. But which of these stocks is a better pick now? Let’s find out.

Latest Developments

On September 27, 2021, HON acquired Performix Inc., a manufacturing execution system (MES) software provider for the pharmaceutical manufacturing and biotech industries. Adding Performix’s industry-leading manufacturing execution system software will further enhance HON’s ability to deliver a leading integrated software platform to pharmaceutical and biotech manufacturers that assures faster compliance, improved reliability, and better production throughput at the highest levels of quality.

On September 27, 2021, MMM’s Scotch-Brite Brand and Phylagen, a biotech company specializing in optimizing indoor microbial life, launched Scotch-Brite Clean Scan, the world’s first consumer home cleaning efficacy test. Clean Scan checks for microbial levels in the home’s common areas, providing lab-analyzed and personalized reports to help people better understand the cleanliness of their homes. Both companies expect to witness high demand for this test kit in the upcoming months.

Recent Financial Results

HON’s net sales for its fiscal second quarter that ended June 30, 2021, increased 17.8% year-over-year to $8.81 billion. The company’s total segment profit came in at $1.79 billion, indicating a 29.5% improvement year-over-year. Its operating income came in at $1.60 billion, up 57% from the prior-year period. HON’s adjusted net income came in at $1.42 billion for the quarter, representing a 58.8% year-over-year improvement. Its adjusted EPS increased 60.3% year-over-year to $2.02. As of June 30, 2021, the company had $11.43 billion in cash and cash equivalents.

For its fiscal second quarter that ended June 30, 2021, MMM’s net sales increased 24.7% year-over-year to $8.95 billion. The company’s adjusted operating income came in at $1.97 billion for the quarter, representing a 40% rise from the prior-year period. MMM’s adjusted net income came in at $1.52 billion, up 45.4% from the year-ago period. Its adjusted EPS increased 43.1% year-over-year to $2.59. The company had $4.70 billion in cash and cash equivalents as of June 30, 2021.

Past and Expected Financial Performance

HON’s net income and EPS have grown at CAGRs of 48% and 51.9% over the past three years, respectively. The company’s total assets have grown at a 2.2% CAGR over the past three years.

HON’s EPS is expected to grow 28.8% year-over-year in the current quarter ending September 30, 2021, 14.1% in the current year, and 13.6% next year. Its revenue is expected to grow 13.7% year-over-year in the current quarter and 7.8% in the current year. Analysts expect the stock’s EPS to grow at a 12.7% rate per annum over the next five years.

In comparison, MMM’s net income and EPS have grown at CAGRs of 10.3% and 11.8%, respectively, over the past three years. The company’s total assets have increased at a CAGR of 9.5% over the past three years.

Analysts expect MMM’s EPS to decline 2.8% year-over-year in the current quarter ending September 30, 2021, and increase 14.2% in the current year and 7.1% next year. Its revenue is expected to improve 4.9% year-over-year in the current quarter, 9.5% in the current year, and 3.5% next year. The stock’s EPS is expected to grow at an 8.9% rate per annum over the next five years.

Valuation

In terms of non-GAAP forward PEG, HON is currently trading at 2.44x, 1.7% higher than MMM’s 2.40x.

In terms of forward EV/Sales, HON’s 4.6x compares with MMM’s 3.36x.

Profitability

MMM’s trailing-12-month revenue is significantly higher than what HON generates. MMM is also profitable, with a 29% EBITDA margin versus HON’s 24.6%.

Also, MMM’s ROE, ROA, and ROTC values of 46.6%, 10.9%, and 15.4% compare favorably with HON’s 27.6%, 7.1%, and 11%, respectively.

POWR Ratings

While MMM has an overall grade of C, which translates into a Neutral rating in our proprietary POWR Ratings system, HON has an overall grade of B, equating to Buy rating. The POWR Ratings are calculated considering 118 different factors, each weighted to an optimal degree.

Both MMM and HON have a C grade for Value, consistent with their slightly higher-than-industry valuation ratios. MMM’s 2.40x non-GAAP forward PEG is 52.1% higher than the 1.58x industry average. HON has a non-GAAP forward PEG of 2.44x, 54.5% higher than the industry average of 1.58x.

HON has a B grade for Sentiment, which is consistent with favorable analyst estimates. Analysts expect HON’s EPS to grow 29% year-over-year in the current quarter ending September 30, 2021, to $2.01. However, MMM’s D grade for Sentiment is in sync with analysts’ relatively lower estimates. Its EPS is expected to come in at $2.36 for the current quarter ending September 30, 2021, representing a 2.8% year-over-year decline.

Of the 83 stocks in the A-rated Industrial – Machinery industry, MMM is ranked #57. On the other hand, HON is ranked #13 out of 45 stocks in the A-rated Industrial – Manufacturing industry.

Beyond what we’ve stated above, our POWR Ratings system has also graded HON and MMM for Growth, Stability, Momentum, and Quality.

Get all of MMM’s grades here. Also, click here to see additional grades for HON.

The Winner

With ongoing solid demand, as rising investments drive the industrial sector’s growth, HON and MMM should benefit. However, we think better earnings growth prospects make HON a better buy here.

Our research shows that the odds of success increase if one bets on stocks with an Overall POWR Rating of Buy or Strong Buy. Click here to access the top-rated stocks in the Industrial – Machinery industry, and here for those in the Industrial – Manufacturing industry.

https://stocknews.com/news/hon-mmm-hone ... nvestment/

oneywell International Inc. (HON - Get Rating) and 3M Company (MMM - Get Rating) are two well-known companies in the industrial space. HON operates as a diversified technology and manufacturing company worldwide. The company operates through four segments — Aerospace; Honeywell Building Technologies; Performance Materials and Technologies; and Safety and Productivity Solutions. MMM develops, manufactures, and markets various products worldwide.

The company also operates through four business segments — Safety and Industrial; Transportation and Electronics; Health Care; and Consumer. It offers its products through e-commerce platforms and traditional wholesalers, retailers, jobbers, distributors, dealers, and directly to users.

The industrial sector has been recovering with the reopening of economic activities as there has been solid progress on the vaccination front. Rising demand for advanced equipment, machinery, and supplies should drive the sector’s growth. So, both HON and MMM should benefit. In terms of the past year’s performance, HON is a winner with a 34.9% gain versus MMM’s 13.4% return. But which of these stocks is a better pick now? Let’s find out.

Latest Developments

On September 27, 2021, HON acquired Performix Inc., a manufacturing execution system (MES) software provider for the pharmaceutical manufacturing and biotech industries. Adding Performix’s industry-leading manufacturing execution system software will further enhance HON’s ability to deliver a leading integrated software platform to pharmaceutical and biotech manufacturers that assures faster compliance, improved reliability, and better production throughput at the highest levels of quality.

On September 27, 2021, MMM’s Scotch-Brite Brand and Phylagen, a biotech company specializing in optimizing indoor microbial life, launched Scotch-Brite Clean Scan, the world’s first consumer home cleaning efficacy test. Clean Scan checks for microbial levels in the home’s common areas, providing lab-analyzed and personalized reports to help people better understand the cleanliness of their homes. Both companies expect to witness high demand for this test kit in the upcoming months.

Recent Financial Results

HON’s net sales for its fiscal second quarter that ended June 30, 2021, increased 17.8% year-over-year to $8.81 billion. The company’s total segment profit came in at $1.79 billion, indicating a 29.5% improvement year-over-year. Its operating income came in at $1.60 billion, up 57% from the prior-year period. HON’s adjusted net income came in at $1.42 billion for the quarter, representing a 58.8% year-over-year improvement. Its adjusted EPS increased 60.3% year-over-year to $2.02. As of June 30, 2021, the company had $11.43 billion in cash and cash equivalents.

For its fiscal second quarter that ended June 30, 2021, MMM’s net sales increased 24.7% year-over-year to $8.95 billion. The company’s adjusted operating income came in at $1.97 billion for the quarter, representing a 40% rise from the prior-year period. MMM’s adjusted net income came in at $1.52 billion, up 45.4% from the year-ago period. Its adjusted EPS increased 43.1% year-over-year to $2.59. The company had $4.70 billion in cash and cash equivalents as of June 30, 2021.

Past and Expected Financial Performance

HON’s net income and EPS have grown at CAGRs of 48% and 51.9% over the past three years, respectively. The company’s total assets have grown at a 2.2% CAGR over the past three years.

HON’s EPS is expected to grow 28.8% year-over-year in the current quarter ending September 30, 2021, 14.1% in the current year, and 13.6% next year. Its revenue is expected to grow 13.7% year-over-year in the current quarter and 7.8% in the current year. Analysts expect the stock’s EPS to grow at a 12.7% rate per annum over the next five years.

In comparison, MMM’s net income and EPS have grown at CAGRs of 10.3% and 11.8%, respectively, over the past three years. The company’s total assets have increased at a CAGR of 9.5% over the past three years.

Analysts expect MMM’s EPS to decline 2.8% year-over-year in the current quarter ending September 30, 2021, and increase 14.2% in the current year and 7.1% next year. Its revenue is expected to improve 4.9% year-over-year in the current quarter, 9.5% in the current year, and 3.5% next year. The stock’s EPS is expected to grow at an 8.9% rate per annum over the next five years.

Valuation

In terms of non-GAAP forward PEG, HON is currently trading at 2.44x, 1.7% higher than MMM’s 2.40x.

In terms of forward EV/Sales, HON’s 4.6x compares with MMM’s 3.36x.

Profitability

MMM’s trailing-12-month revenue is significantly higher than what HON generates. MMM is also profitable, with a 29% EBITDA margin versus HON’s 24.6%.

Also, MMM’s ROE, ROA, and ROTC values of 46.6%, 10.9%, and 15.4% compare favorably with HON’s 27.6%, 7.1%, and 11%, respectively.

POWR Ratings

While MMM has an overall grade of C, which translates into a Neutral rating in our proprietary POWR Ratings system, HON has an overall grade of B, equating to Buy rating. The POWR Ratings are calculated considering 118 different factors, each weighted to an optimal degree.

Both MMM and HON have a C grade for Value, consistent with their slightly higher-than-industry valuation ratios. MMM’s 2.40x non-GAAP forward PEG is 52.1% higher than the 1.58x industry average. HON has a non-GAAP forward PEG of 2.44x, 54.5% higher than the industry average of 1.58x.

HON has a B grade for Sentiment, which is consistent with favorable analyst estimates. Analysts expect HON’s EPS to grow 29% year-over-year in the current quarter ending September 30, 2021, to $2.01. However, MMM’s D grade for Sentiment is in sync with analysts’ relatively lower estimates. Its EPS is expected to come in at $2.36 for the current quarter ending September 30, 2021, representing a 2.8% year-over-year decline.

Of the 83 stocks in the A-rated Industrial – Machinery industry, MMM is ranked #57. On the other hand, HON is ranked #13 out of 45 stocks in the A-rated Industrial – Manufacturing industry.

Beyond what we’ve stated above, our POWR Ratings system has also graded HON and MMM for Growth, Stability, Momentum, and Quality.

Get all of MMM’s grades here. Also, click here to see additional grades for HON.

The Winner

With ongoing solid demand, as rising investments drive the industrial sector’s growth, HON and MMM should benefit. However, we think better earnings growth prospects make HON a better buy here.

Our research shows that the odds of success increase if one bets on stocks with an Overall POWR Rating of Buy or Strong Buy. Click here to access the top-rated stocks in the Industrial – Machinery industry, and here for those in the Industrial – Manufacturing industry.

https://stocknews.com/news/hon-mmm-hone ... nvestment/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

3M Company (NYSE:MMM) stock fell 1.7% on the back of a federal jury awarding an army veteran $8.2 million, the biggest verdict yet against the company in mass tort litigation over its combat earplugs.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

3M (MMM) to spin food unit in merger with Neogen (NEOG)

ndustrial conglomerate 3M plans to spin off its food safety business and merge it with food testing and animal healthcare products company Neogen.

The combination will create a new company with an enterprise value of $9.3bn, the companies announced in a press release Tuesday.

The spin-off will allow 3M, one of the largest manufacturers of N95 masks, to better focus its healthcare segment that includes products in hand hygiene, surgical items, casting and patient monitoring. It also makes various adhesives, automotive parts, cleaning supplies, home products and office supplies.

“By combining our food safety business with Neogen, we will create an organisation well positioned to capture long-term profitable growth,” 3M CEO Mike Roman said in the press release. “This transaction further evolves our strategy, focuses our healthcare business and benefits our stakeholders, as we actively manage our portfolio to drive growth and deliver shareholder value”.

Financial overview

Neogen’s stock shot up as much as 4.6% at Tuesday’s open to $42.00 per share. Meanwhile, 3M’s stock was up as much as 1.11% from Monday’s close at a price of $176.53 per share.

The deal values 3M’s food and safety business at $5.3bn, including debt.

The new combined company will pay 3M $1bn that will be paid for with new debt giving Neogen an expected net leverage ratio of less than 2.5 times at the time of the deal’s close, according to the release.

3M shareholders will own approximately 50.1% of the new combined company, and existing Neogen shareholders will continue to own approximately 49.9%.

Using what is known as a “Reverse Morris Trust,” 3M will also realise a number of tax savings.

Food safety

3M’s food safety business focuses on indicator and allergen testing as well as pathogen detection, which the companies say will complement Neogen’s microbiology lines for E. coli testing.

The combined company is looking to grow more internationally beyond just the US and Europe as well as usher in new digitised products for the industry.

“The heightened global focus on food security, sustainability and supply chain solutions around the world presents exciting opportunities for Neogen to be positioned as an innovative leader at the forefront of the growth and digitisation of the industry,” John Adent, Neogen’s CEO, said in the press release.

https://capital.com/3m-mmm-to-spin-food ... eogen-neog

ndustrial conglomerate 3M plans to spin off its food safety business and merge it with food testing and animal healthcare products company Neogen.

The combination will create a new company with an enterprise value of $9.3bn, the companies announced in a press release Tuesday.

The spin-off will allow 3M, one of the largest manufacturers of N95 masks, to better focus its healthcare segment that includes products in hand hygiene, surgical items, casting and patient monitoring. It also makes various adhesives, automotive parts, cleaning supplies, home products and office supplies.

“By combining our food safety business with Neogen, we will create an organisation well positioned to capture long-term profitable growth,” 3M CEO Mike Roman said in the press release. “This transaction further evolves our strategy, focuses our healthcare business and benefits our stakeholders, as we actively manage our portfolio to drive growth and deliver shareholder value”.

Financial overview

Neogen’s stock shot up as much as 4.6% at Tuesday’s open to $42.00 per share. Meanwhile, 3M’s stock was up as much as 1.11% from Monday’s close at a price of $176.53 per share.

The deal values 3M’s food and safety business at $5.3bn, including debt.

The new combined company will pay 3M $1bn that will be paid for with new debt giving Neogen an expected net leverage ratio of less than 2.5 times at the time of the deal’s close, according to the release.

3M shareholders will own approximately 50.1% of the new combined company, and existing Neogen shareholders will continue to own approximately 49.9%.

Using what is known as a “Reverse Morris Trust,” 3M will also realise a number of tax savings.

Food safety

3M’s food safety business focuses on indicator and allergen testing as well as pathogen detection, which the companies say will complement Neogen’s microbiology lines for E. coli testing.

The combined company is looking to grow more internationally beyond just the US and Europe as well as usher in new digitised products for the industry.

“The heightened global focus on food security, sustainability and supply chain solutions around the world presents exciting opportunities for Neogen to be positioned as an innovative leader at the forefront of the growth and digitisation of the industry,” John Adent, Neogen’s CEO, said in the press release.

https://capital.com/3m-mmm-to-spin-food ... eogen-neog

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Why We Just Bought More 3M (MMM) for the Income Builder Portfolio

https://www.youtube.com/watch?v=tj6o34kwnC0

https://www.youtube.com/watch?v=tj6o34kwnC0

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

3M (NYSE:MMM) stock fell 1.1% after the industrial giant reported a fall in quarterly adjusted profit, hurt by waning demand for its disposable N95 masks as Covid-19 recedes.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

(Reuters) - Industrial conglomerate 3M Co said on Friday it will exit its Neoplast and Neobun brands in Thailand and some other Southeast Asian countries, and sell manufacturing assets at its Ladlumkaew plant, as part of its strategic portfolio management.

The brands — part of the company's Consumer Health and Safety Division (CHSD) — and the assets from its Thailand-based Ladlumkaew plant will be sold to Selic Corp PCL, 3M said.

The St. Paul, Minnesota-based company did not disclose the terms of the deal, but said the sale will not have a material impact on its financial results.

"As part of ongoing strategic portfolio management, 3M has decided to exit these brands and prioritize other areas within its Consumer Health & Safety Division," 3M said.

Neoplast makes surgical tapes, dressings and first aid bandages, while Neobun makes menthol plasters for muscle pain.

The brands are sold primarily in Thailand and Southeast Asia and were a part of 3M's larger CHSD that includes sports and medical tapes, bandages and medicated products for the consumer and healthcare industry, according to the company.

3M also said its plan to sell the Ladlumkaew plant will impact about 250 employees in the country, and the affected employees are eligible for severance and outplacement assistance.

The U.S.-based company had acquired Neoplast in 2007.

The brands — part of the company's Consumer Health and Safety Division (CHSD) — and the assets from its Thailand-based Ladlumkaew plant will be sold to Selic Corp PCL, 3M said.

The St. Paul, Minnesota-based company did not disclose the terms of the deal, but said the sale will not have a material impact on its financial results.

"As part of ongoing strategic portfolio management, 3M has decided to exit these brands and prioritize other areas within its Consumer Health & Safety Division," 3M said.

Neoplast makes surgical tapes, dressings and first aid bandages, while Neobun makes menthol plasters for muscle pain.

The brands are sold primarily in Thailand and Southeast Asia and were a part of 3M's larger CHSD that includes sports and medical tapes, bandages and medicated products for the consumer and healthcare industry, according to the company.

3M also said its plan to sell the Ladlumkaew plant will impact about 250 employees in the country, and the affected employees are eligible for severance and outplacement assistance.

The U.S.-based company had acquired Neoplast in 2007.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Latest Release

Jul 26, 2022

EPS / Forecast

2.48 / 2.43

Revenue / Forecast

8.7B / 8.6B

3M (NYSE:MMM) and General Electric (NYSE:GE) delivered quarterly results that surprised to the upside, sending their shares more than 5% higher.

Jul 26, 2022

EPS / Forecast

2.48 / 2.43

Revenue / Forecast

8.7B / 8.6B

3M (NYSE:MMM) and General Electric (NYSE:GE) delivered quarterly results that surprised to the upside, sending their shares more than 5% higher.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

3M demerger: MMM spin-off of food safety business Garden SpinCo in merger with Neogen – timing and details in full.

https://capital.com/3m-demerger-mmm-foo ... te-details

https://capital.com/3m-demerger-mmm-foo ... te-details

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

Veterans seeking earplug damages sue to block 3M healthcare spinoff

(Reuters) -Two U.S. military veterans on Thursday sued 3M Co to block its planned spinoff of its healthcare business, which they called an illegal attempt to avoid compensating veterans for hearing damage caused by the company's military-issue earplugs.

The veterans said in a lawsuit in federal court in Pensacola, Florida, that the spinoff was "little more than a formalism" intended to "wall off" assets, violating a Florida law barring debtors from fraudulently transferring assets in order to shield them from creditors.

The case is expected to go before U.S. District Judge M. Casey Rodgers, who is already overseeing more than 220,000 lawsuits over the earplugs and has been harshly critical of the company's legal strategy.

"Fortunately, the law does not allow companies to gift their assets to shareholders when doing so leaves them unable to pay their debts," Ashley Keller, a lawyer for the veterans, said in a statement.

3M spokesperson Tamara Sander said in an email "the suit is without merit and we will vigorously defend ourselves."

Thursday's lawsuit comes after a bankruptcy court in Indianapolis rejected 3M's bid to halt the cases before Rodgers and instead resolve the veterans' claims through the bankruptcy of 3M subsidiary Aearo Technologies LLC, the original maker of the Combat Arms Earplugs version 2.

The veterans' lawsuits, which allege that the earplugs failed to protect their hearing in combat or training, make up the largest mass tort litigation in U.S. history.

Aearo filed for bankruptcy in July, agreeing to indemnify 3M against earplug claims and setting aside $1 billion to settle them. Rodgers called the attempted maneuver "naked duplicity."

The same day, 3M announced its plan to spin off its healthcare business, which accounted for about 25% of $35.35 billion in sales last year, into a new public company. Chief Executive Michael Roman told investors on a July 26 call that the spinoff and the Aearo bankruptcy were the result "separate ... strategies and decisions."

The plaintiffs in Thursday's lawsuit said the company had already depleted its cash reserves through dividends and stock buybacks, and that the spinoff would leave it unable to meet its earplug liabilities, which they said were at least $82 billion but likely much more.

The company has lost 10 of the 16 earplug cases that have gone to trial so far, with about $265 million being awarded in total to 13 plaintiffs.

(Reuters) -Two U.S. military veterans on Thursday sued 3M Co to block its planned spinoff of its healthcare business, which they called an illegal attempt to avoid compensating veterans for hearing damage caused by the company's military-issue earplugs.

The veterans said in a lawsuit in federal court in Pensacola, Florida, that the spinoff was "little more than a formalism" intended to "wall off" assets, violating a Florida law barring debtors from fraudulently transferring assets in order to shield them from creditors.

The case is expected to go before U.S. District Judge M. Casey Rodgers, who is already overseeing more than 220,000 lawsuits over the earplugs and has been harshly critical of the company's legal strategy.

"Fortunately, the law does not allow companies to gift their assets to shareholders when doing so leaves them unable to pay their debts," Ashley Keller, a lawyer for the veterans, said in a statement.

3M spokesperson Tamara Sander said in an email "the suit is without merit and we will vigorously defend ourselves."

Thursday's lawsuit comes after a bankruptcy court in Indianapolis rejected 3M's bid to halt the cases before Rodgers and instead resolve the veterans' claims through the bankruptcy of 3M subsidiary Aearo Technologies LLC, the original maker of the Combat Arms Earplugs version 2.

The veterans' lawsuits, which allege that the earplugs failed to protect their hearing in combat or training, make up the largest mass tort litigation in U.S. history.

Aearo filed for bankruptcy in July, agreeing to indemnify 3M against earplug claims and setting aside $1 billion to settle them. Rodgers called the attempted maneuver "naked duplicity."

The same day, 3M announced its plan to spin off its healthcare business, which accounted for about 25% of $35.35 billion in sales last year, into a new public company. Chief Executive Michael Roman told investors on a July 26 call that the spinoff and the Aearo bankruptcy were the result "separate ... strategies and decisions."

The plaintiffs in Thursday's lawsuit said the company had already depleted its cash reserves through dividends and stock buybacks, and that the spinoff would leave it unable to meet its earplug liabilities, which they said were at least $82 billion but likely much more.

The company has lost 10 of the 16 earplug cases that have gone to trial so far, with about $265 million being awarded in total to 13 plaintiffs.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

These 2 Dividend Stocks Haven’t Been This Cheap in Years

by Dan Caplinger, The Motley Fool • September 30, 2022

The Dow Jones industrial Average (^DJI) officially entered a bear market earlier this week, as it closed more than 20% below the record levels it hit early in January 2022. Other major benchmarks had seen even larger losses, but it took the most recent downturn in the stock market to pull the venerable Dow along with them.

As you’d expect from a downturn, some of the 30 stocks of the Dow Jones Industrials have taken harder hits than others. Indeed, there are still a handful of stocks that are up on the year. However, there are many more Dow stocks that are down 30% or more — and two, in particular, are trading at multiyear lows, despite having extremely attractive dividend yields. Below, we’ll look at that pair of companies to see whether they’re poised to rebound or likely to keep struggling.

1. 3M

Industrial conglomerate 3M (MMM) has seen its stock fall 37% so far in 2022. That has boosted its dividend yield by 2 full percentage points since the beginning of the year, with its current yield weighing in at 5.3%.

3M has had to deal with the same macroeconomic headwinds that other Dow stocks have faced, with sales falling 3% in its most recent quarter, compared to year-earlier levels, and adjusted earnings declining nearly 10%. Yet the risk that stands out more than any other stems from potential legal liability on multiple fronts.

Users of military-grade earplugs have argued that products from a company that 3M acquired failed to prevent hearing problems, affecting hundreds of thousands of people. Meanwhile, controversy over the effectiveness of 3M’s respirators could also result in costly litigation.

Those issues are affecting 3M’s efforts to make strategic business shifts. The conglomerate wants to spin off its healthcare business, leaving its legacy business to keep serving consumers, the electronics and transportation industries, and the safety needs of manufacturing clients worldwide. Yet plaintiffs want to ensure they can make claims against all of 3M’s current assets.

The last time 3M shares were this low was in 2013. While revenue has grown incrementally in the ensuing nine years, 3M’s net income is actually lower. That doesn’t bode well for the conglomerate’s future efforts, although it does justify why it’s working so hard to unlock value from its highest-performing business segments.

2. Intel

Semiconductor-pioneer Intel (INTC) has dealt with tough times for a while. It’s the poorest performer in the entire Dow so far in 2022, losing nearly half of its value. That has doubled the tech-stock’s dividend yield to more than 5.4%.

Intel’s recent financial performance explains why its stock has done so poorly. Revenue fell 17% year over year in the second quarter of 2022, sending earnings per share down nearly 80%. Weakness in PC demand and reduced client spending on data centers offset higher sales of network and edge-computing products.

More broadly, Intel has lost its first-mover edge in semiconductors, with Nvidia having usurped its place as industry leader. Even Advanced Micro Devices has found viable niche advantages.

Yet Intel’s also fighting back, tapping capital from Brookfield Infrastructure to help it build new fabrication facilities. If that’s successful, then Intel might finally start to win back market share and get back on the cutting edge of chip technology.

Intel shares haven’t been this low since 2014, but both revenue and earnings have made sizable gains since then, including a near-doubling on the bottom line. That suggests that between these two stocks, Intel has the better chance of eventually rebounding once the Dow’s bear market gives way to more favorable business conditions.

— Dan Caplinger

by Dan Caplinger, The Motley Fool • September 30, 2022

The Dow Jones industrial Average (^DJI) officially entered a bear market earlier this week, as it closed more than 20% below the record levels it hit early in January 2022. Other major benchmarks had seen even larger losses, but it took the most recent downturn in the stock market to pull the venerable Dow along with them.

As you’d expect from a downturn, some of the 30 stocks of the Dow Jones Industrials have taken harder hits than others. Indeed, there are still a handful of stocks that are up on the year. However, there are many more Dow stocks that are down 30% or more — and two, in particular, are trading at multiyear lows, despite having extremely attractive dividend yields. Below, we’ll look at that pair of companies to see whether they’re poised to rebound or likely to keep struggling.

1. 3M

Industrial conglomerate 3M (MMM) has seen its stock fall 37% so far in 2022. That has boosted its dividend yield by 2 full percentage points since the beginning of the year, with its current yield weighing in at 5.3%.

3M has had to deal with the same macroeconomic headwinds that other Dow stocks have faced, with sales falling 3% in its most recent quarter, compared to year-earlier levels, and adjusted earnings declining nearly 10%. Yet the risk that stands out more than any other stems from potential legal liability on multiple fronts.

Users of military-grade earplugs have argued that products from a company that 3M acquired failed to prevent hearing problems, affecting hundreds of thousands of people. Meanwhile, controversy over the effectiveness of 3M’s respirators could also result in costly litigation.

Those issues are affecting 3M’s efforts to make strategic business shifts. The conglomerate wants to spin off its healthcare business, leaving its legacy business to keep serving consumers, the electronics and transportation industries, and the safety needs of manufacturing clients worldwide. Yet plaintiffs want to ensure they can make claims against all of 3M’s current assets.

The last time 3M shares were this low was in 2013. While revenue has grown incrementally in the ensuing nine years, 3M’s net income is actually lower. That doesn’t bode well for the conglomerate’s future efforts, although it does justify why it’s working so hard to unlock value from its highest-performing business segments.

2. Intel

Semiconductor-pioneer Intel (INTC) has dealt with tough times for a while. It’s the poorest performer in the entire Dow so far in 2022, losing nearly half of its value. That has doubled the tech-stock’s dividend yield to more than 5.4%.

Intel’s recent financial performance explains why its stock has done so poorly. Revenue fell 17% year over year in the second quarter of 2022, sending earnings per share down nearly 80%. Weakness in PC demand and reduced client spending on data centers offset higher sales of network and edge-computing products.

More broadly, Intel has lost its first-mover edge in semiconductors, with Nvidia having usurped its place as industry leader. Even Advanced Micro Devices has found viable niche advantages.

Yet Intel’s also fighting back, tapping capital from Brookfield Infrastructure to help it build new fabrication facilities. If that’s successful, then Intel might finally start to win back market share and get back on the cutting edge of chip technology.

Intel shares haven’t been this low since 2014, but both revenue and earnings have made sizable gains since then, including a near-doubling on the bottom line. That suggests that between these two stocks, Intel has the better chance of eventually rebounding once the Dow’s bear market gives way to more favorable business conditions.

— Dan Caplinger

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: 3M NYSE: MMM producent ponad 55000 produktów w wielu branżach

(Reuters) -Post-it maker 3M Co said on Tuesday it expected weak consumer spending to continue into the upcoming holiday season and cut its full-year forecasts, echoing broader concerns of an uncertain economic environment.

"Consumer spending continues to be weak," 3M Chief Financial Officer Monish Patolawala said on a post-earnings call with analysts. He expects inflation to impact consumer spending through the holiday season.

U.S. retailers, dealing with billions of dollars worth of unsold stock, have taken a more cautious view of this year's holiday season as consumers facing decades-high inflation cut back on discretionary spending.

That cut in spending has also impacted 3M, which makes equipment such as electronic accessories and power cable connectors. Now, a strong dollar is also having an impact.

The diversified manufacturer, which gets 60 percent of its revenue from outside the United States, cut its full-year revenue and profit forecasts earlier on Tuesday, while also citing ongoing macroeconomic and geopolitical uncertainty.

The company is also facing claims from more than 290,000 former and active military members who say the company's earplugs are defective and damaged their hearing.

"We think lowered 2022 guidance, a still challenging macro backdrop and litigation-related overhang could weigh on stock performance," Citi analysts said in a note.

3M was able to offset higher raw material and logistics costs by raising prices, helping it post a third-quarter adjusted profit of $2.69 per share, beating estimates of $2.60, according to Refinitiv data.

It now expects full-year revenue to fall between 3.5% and 3%, down from its previous guidance of a 2.5% to 0.5% fall, while adjusted earnings per share are forecast between $10.10 and $10.35, compared with its previous outlook of $10.30 to $10.80.

3M reported third-quarter revenue of $8.62 billion, missing the average analyst estimate of $8.70 billion, according to Refinitiv data.

"Consumer spending continues to be weak," 3M Chief Financial Officer Monish Patolawala said on a post-earnings call with analysts. He expects inflation to impact consumer spending through the holiday season.

U.S. retailers, dealing with billions of dollars worth of unsold stock, have taken a more cautious view of this year's holiday season as consumers facing decades-high inflation cut back on discretionary spending.

That cut in spending has also impacted 3M, which makes equipment such as electronic accessories and power cable connectors. Now, a strong dollar is also having an impact.

The diversified manufacturer, which gets 60 percent of its revenue from outside the United States, cut its full-year revenue and profit forecasts earlier on Tuesday, while also citing ongoing macroeconomic and geopolitical uncertainty.

The company is also facing claims from more than 290,000 former and active military members who say the company's earplugs are defective and damaged their hearing.

"We think lowered 2022 guidance, a still challenging macro backdrop and litigation-related overhang could weigh on stock performance," Citi analysts said in a note.

3M was able to offset higher raw material and logistics costs by raising prices, helping it post a third-quarter adjusted profit of $2.69 per share, beating estimates of $2.60, according to Refinitiv data.

It now expects full-year revenue to fall between 3.5% and 3%, down from its previous guidance of a 2.5% to 0.5% fall, while adjusted earnings per share are forecast between $10.10 and $10.35, compared with its previous outlook of $10.30 to $10.80.

3M reported third-quarter revenue of $8.62 billion, missing the average analyst estimate of $8.70 billion, according to Refinitiv data.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 59 gości