Chevron Dividend and Buyback Policies Being Boosted by Shale

https://247wallst.com/energy-business/2 ... -by-shale/

Chevron Corporation NYSE: CVX przemysł naftowy

Re: Chevron Corporation NYSE: CVX p. naftowy

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Chevron Corporation NYSE: CVX p. naftowy

Chevron: Fueling Up; Earnings Overflowing

Summary

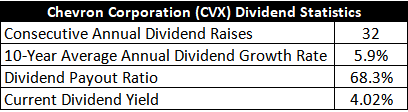

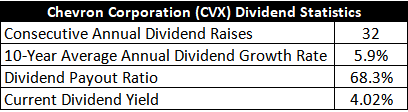

Chevron has been consistent with dividend payments to its shareholders which has been annually increasing by 2% per share on average since 2013.

Its fundamentals have always turned out strong and solid as its high-flying operating revenue and net earnings continued to move positively along with the balance sheet ratios.

Stock price has been moving with little to moderate volatility.

Its production strategy, as well as the renewal of its partnership with GS Caltex and other social initiatives, would further boost Chevron's performance this fiscal year.

https://seekingalpha.com/article/425189 ... ngcom_feed

Summary

Chevron has been consistent with dividend payments to its shareholders which has been annually increasing by 2% per share on average since 2013.

Its fundamentals have always turned out strong and solid as its high-flying operating revenue and net earnings continued to move positively along with the balance sheet ratios.

Stock price has been moving with little to moderate volatility.

Its production strategy, as well as the renewal of its partnership with GS Caltex and other social initiatives, would further boost Chevron's performance this fiscal year.

https://seekingalpha.com/article/425189 ... ngcom_feed

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Chevron Is Now An 'UltraMajor' With Anadarko's Permian, Deepwater Assets

Chevron (CVX) announced Friday that it would buy top shale producer Anadarko Petroleum (APC) for $33 billion vaulting it into the ranks of the biggest global oil majors.

The cash and stock deal values Anadarko at $65 per share and will add to Chevron's free cash flow and earnings a year after the deal closes. That is expected to happen in the second half of the year.

"The combination of Anadarko's premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our LNG business," Chevron CEO Michael Wirth said in a release.

The oil major will now have a "75-mile-wide corridor across the most attractive acreage in the Delaware basin" in the Permian, according to the oil major. The deal will also "enhance Chevron's existing high-margin position in the deepwater Gulf of Mexico."

In a conference call later, Wirth said investing in the Permian is the highest-return investment dollar it can spend.

Chevron also announced it would divest $15 billion- $20 billion of assets between 2020 and 2022 to reduce debt and return cash to shareholders and boost its share buyback program to $5 billion from $4 billion.

Chevron said the combined entity would have had free cash flow last year of $36.5 billion and produced 3.596 million barrels equivalent of oil a day.

The Anadarko acquisition is the biggest upstream deal since Royal Dutch Shell (RDSA) bought BG Group for $61 billion in 2015.

"Chevron now joins the ranks of the UltraMajors – and the big three becomes the big four," Wood Mackenzie senior analyst Roy Martin in a statement.

He added that Chevron will become the No. 2 largest oil major by production from No. 4, putting Exxon Mobil (XOM), Chevron, Shell and BP (BP) "in a league of their own."

Anadarko should also enhance Chevron's existing strength in shale oil, deepwater production and liquid natural gas, Martin said.

"By buying Anadarko, they take on a highly contiguous Delaware basin position in the Permian," he said. "Chevron ought to be able to do more with the acreage than Anadarko, which lagged behind in terms of well productivity. Chevron's deepwater Gulf of Mexico position is also strengthened."

https://www.investors.com/news/chevron- ... deepwater/

Chevron (CVX) announced Friday that it would buy top shale producer Anadarko Petroleum (APC) for $33 billion vaulting it into the ranks of the biggest global oil majors.

The cash and stock deal values Anadarko at $65 per share and will add to Chevron's free cash flow and earnings a year after the deal closes. That is expected to happen in the second half of the year.

"The combination of Anadarko's premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our LNG business," Chevron CEO Michael Wirth said in a release.

The oil major will now have a "75-mile-wide corridor across the most attractive acreage in the Delaware basin" in the Permian, according to the oil major. The deal will also "enhance Chevron's existing high-margin position in the deepwater Gulf of Mexico."

In a conference call later, Wirth said investing in the Permian is the highest-return investment dollar it can spend.

Chevron also announced it would divest $15 billion- $20 billion of assets between 2020 and 2022 to reduce debt and return cash to shareholders and boost its share buyback program to $5 billion from $4 billion.

Chevron said the combined entity would have had free cash flow last year of $36.5 billion and produced 3.596 million barrels equivalent of oil a day.

The Anadarko acquisition is the biggest upstream deal since Royal Dutch Shell (RDSA) bought BG Group for $61 billion in 2015.

"Chevron now joins the ranks of the UltraMajors – and the big three becomes the big four," Wood Mackenzie senior analyst Roy Martin in a statement.

He added that Chevron will become the No. 2 largest oil major by production from No. 4, putting Exxon Mobil (XOM), Chevron, Shell and BP (BP) "in a league of their own."

Anadarko should also enhance Chevron's existing strength in shale oil, deepwater production and liquid natural gas, Martin said.

"By buying Anadarko, they take on a highly contiguous Delaware basin position in the Permian," he said. "Chevron ought to be able to do more with the acreage than Anadarko, which lagged behind in terms of well productivity. Chevron's deepwater Gulf of Mexico position is also strengthened."

https://www.investors.com/news/chevron- ... deepwater/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Exxon Mobil Earnings, Revenue Miss Badly; Chevron Revenue Also Weak

...

Chevron Earnings are seen falling 34% to $1.26 per share with revenue edging up 0.3% to $37.89 billion.

Results: EPS of $1.39, though it wasn't immediately clear if that's comparable to estimates, on revenue of $35.2 billion. Upstream income fell 7% to $3.12 billion, and downstream income sank 65% to $252 million, due to lower crude oil prices and weaker downstream and chemicals margins.

Oil-equivalent production climbed 7% to 3.04 million barrels per day due to increases in the Permian and Wheatstone in Australia. Cash flow from operations was little changed at $5.1 billion. Capital and exploratory expenditures rose to $4.7 billion from $4.4 billion a year ago.

In March, management announced plans to produce 600,000 barrels per day in the Permian by the end of 2020 and 900,000 bpd in 2023.

To fulfill that goal, earlier this month Chevron agreed to buy Anadarko Petroleum for $33 billion. But Occidental Petroleum (OXY) responded with a $38 billion counteroffer Wednesday, potentially triggering an Anadarko Petroleum (APC) bidding war.

"The combination of Anadarko's high-quality assets and people with Chevron's portfolio strengthens our leading position in the Permian, builds greater deepwater Gulf of Mexico capabilities and will grow our LNG business," Chevron Chairman and CEO Michael Wirth said in a statement Friday. "We believe this transaction will unlock significant value for shareholders."

https://www.investors.com/news/exxon-ea ... dow-jones/

...

Chevron Earnings are seen falling 34% to $1.26 per share with revenue edging up 0.3% to $37.89 billion.

Results: EPS of $1.39, though it wasn't immediately clear if that's comparable to estimates, on revenue of $35.2 billion. Upstream income fell 7% to $3.12 billion, and downstream income sank 65% to $252 million, due to lower crude oil prices and weaker downstream and chemicals margins.

Oil-equivalent production climbed 7% to 3.04 million barrels per day due to increases in the Permian and Wheatstone in Australia. Cash flow from operations was little changed at $5.1 billion. Capital and exploratory expenditures rose to $4.7 billion from $4.4 billion a year ago.

In March, management announced plans to produce 600,000 barrels per day in the Permian by the end of 2020 and 900,000 bpd in 2023.

To fulfill that goal, earlier this month Chevron agreed to buy Anadarko Petroleum for $33 billion. But Occidental Petroleum (OXY) responded with a $38 billion counteroffer Wednesday, potentially triggering an Anadarko Petroleum (APC) bidding war.

"The combination of Anadarko's high-quality assets and people with Chevron's portfolio strengthens our leading position in the Permian, builds greater deepwater Gulf of Mexico capabilities and will grow our LNG business," Chevron Chairman and CEO Michael Wirth said in a statement Friday. "We believe this transaction will unlock significant value for shareholders."

https://www.investors.com/news/exxon-ea ... dow-jones/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Chevron Won't Raise Anadarko Bid To Trump Occidental Offer?

Chevron (CVX) is walking away from its bid to take over Permian shale independent Anadarko Petroleum (APC). But it's walking away with a fatter wallet.

The oil major announced Thursday that it would not increase its $33 billion offer for Anadarko and expects Anadarko to choose the higher Occidental Petroleum (OXY) $38 billion bid. Anadarko will pay Chevron a termination fee of $1 billion, which Occidental said it would cover.

https://www.investors.com/news/chevron- ... tal-offer/

Chevron (CVX) is walking away from its bid to take over Permian shale independent Anadarko Petroleum (APC). But it's walking away with a fatter wallet.

The oil major announced Thursday that it would not increase its $33 billion offer for Anadarko and expects Anadarko to choose the higher Occidental Petroleum (OXY) $38 billion bid. Anadarko will pay Chevron a termination fee of $1 billion, which Occidental said it would cover.

https://www.investors.com/news/chevron- ... tal-offer/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Giganci branży naftowej, w tym Occidental (OXY) oraz Chevron (CVX), prześcigają się w rywalizacji o kupno Andarko Petroleum i przejęcie dużej części Basenu Permskiego.

Basen Permski to pole naftowe rozciągające się od Nowego Meksyku po zachodni Teksas, z którego w kwietniu wydobywano aż 4,1 mln baryłek ropy dziennie. Póki co większą produkcją może pochwalić się tylko Arabia Saudyjska z Pola Ghawar.

Na ten moment Chevron przegrywa w walce o Andarko. Occidental prowadzi dzięki wsparciu finansowym w wysokości 10 mld dolarów od króla inwestycji Warrena Buffeta.

"Najwięksi gracze tacy jak Chevron i ExxonMobil dominują Basen Permski w coraz większym stopniu" - napisał w najnowszym raporcie James Reeve, główny ekonomista Samba Financial Group. - "Obie te firmy mają na tyle wysoki przepływ pieniężny, by przetrwać okresy niskich cen ropy, a także technologię, która pomoże im pokonać problemy wynikające z gęstego rozmieszczenia szybów naftowych. Zarówno Chevron jak i Exxon zamierzają potroić wydobycie ropy z Basenu Permskiego w ciągu pięciu lub więcej lat".

Vicki Hollub, dyrektor generalna Occidental, jest zdeterminowana, by dobić targu za wszelką cenę. Agresywne próby sfinalizowania transakcji zostały potępione przez wielu ważnych inwestorów. Może to być spowodowane faktem, iż do 2025 roku Occidental ma zostać piątym największym na świecie przedsiębiorstwem naftowym, pod warunkiem, że pozostanie przy swoich obecnych praktykach.

A jednak, jest jedna rzecz, która zapewnia Chevron nieco przewagi nad Occidental. Chodzi o rozmiar działalności. Prezes i dyrektor generalny tej międzynarodowej korporacji Michael Wirth powiedział w jednym z wywiadów, że gra o łupki to gra między największymi spółkami. Co więcej, Chervon jest w posiadaniu ziemi, na której wydobywa ropę, dlatego też nie ponosi kosztów z tytuł praw wiertniczych.

David Katz, prezes i dyrektor ds inwestycji Matrix Asset Advisor powiedział: "Vicki Hollub zdaje się robić wszystko, aby załatwić tę sprawę". Mężczyzna dodał jednak, że przedsiębiorczyni powinna skupić się na polepszaniu jakości usług, a nie na powiększaniu swojego imperium. Poza tym doradza sprzedaż, a nie kupno.

...

https://www.paszport.ws//bitwa-o-basen-permski

Basen Permski to pole naftowe rozciągające się od Nowego Meksyku po zachodni Teksas, z którego w kwietniu wydobywano aż 4,1 mln baryłek ropy dziennie. Póki co większą produkcją może pochwalić się tylko Arabia Saudyjska z Pola Ghawar.

Na ten moment Chevron przegrywa w walce o Andarko. Occidental prowadzi dzięki wsparciu finansowym w wysokości 10 mld dolarów od króla inwestycji Warrena Buffeta.

"Najwięksi gracze tacy jak Chevron i ExxonMobil dominują Basen Permski w coraz większym stopniu" - napisał w najnowszym raporcie James Reeve, główny ekonomista Samba Financial Group. - "Obie te firmy mają na tyle wysoki przepływ pieniężny, by przetrwać okresy niskich cen ropy, a także technologię, która pomoże im pokonać problemy wynikające z gęstego rozmieszczenia szybów naftowych. Zarówno Chevron jak i Exxon zamierzają potroić wydobycie ropy z Basenu Permskiego w ciągu pięciu lub więcej lat".

Vicki Hollub, dyrektor generalna Occidental, jest zdeterminowana, by dobić targu za wszelką cenę. Agresywne próby sfinalizowania transakcji zostały potępione przez wielu ważnych inwestorów. Może to być spowodowane faktem, iż do 2025 roku Occidental ma zostać piątym największym na świecie przedsiębiorstwem naftowym, pod warunkiem, że pozostanie przy swoich obecnych praktykach.

A jednak, jest jedna rzecz, która zapewnia Chevron nieco przewagi nad Occidental. Chodzi o rozmiar działalności. Prezes i dyrektor generalny tej międzynarodowej korporacji Michael Wirth powiedział w jednym z wywiadów, że gra o łupki to gra między największymi spółkami. Co więcej, Chervon jest w posiadaniu ziemi, na której wydobywa ropę, dlatego też nie ponosi kosztów z tytuł praw wiertniczych.

David Katz, prezes i dyrektor ds inwestycji Matrix Asset Advisor powiedział: "Vicki Hollub zdaje się robić wszystko, aby załatwić tę sprawę". Mężczyzna dodał jednak, że przedsiębiorczyni powinna skupić się na polepszaniu jakości usług, a nie na powiększaniu swojego imperium. Poza tym doradza sprzedaż, a nie kupno.

...

https://www.paszport.ws//bitwa-o-basen-permski

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Why Exxon and Chevron Sank After Reporting Q2 Earnings

https://247wallst.com/energy-business/2 ... -earnings/

https://247wallst.com/energy-business/2 ... -earnings/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Undervalued Dividend Growth Stock of the Week Chevron Corp. NYSE: CVX

https://dailytradealert.com/2019/12/22/ ... -week-241/

https://dailytradealert.com/2019/12/22/ ... -week-241/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Chevron Corp. (NYSE: CVX) reported fourth-quarter results before markets opened Friday. For the quarter, the oil and gas supermajor posted a diluted loss per share of $3.51 on total revenues of $36.35 billion. In the same period a year ago, the company reported earnings per share (EPS) of $2.11 on total revenues of $42.1 billion. Fourth-quarter results also compare to the consensus estimates for EPS of $1.95 and $42.35 billion in revenues.

For the full year, Chevron reported EPS of $1.54 on revenues of $139.87 billion, compared with 2018 EPS of $7.74 on revenues of $158.9 billion. Analysts had estimated EPS of $6.27 and revenues of $149.95 billion.

In the latest quarter, Chevron took impairment charges and write-downs of $10.4 billion and recognized the sale of $1.2 billion in North Sea assets. For the year, profits were hammered by net charges of $8.7 billion.

Even adjusted for these items, Chevron’s profits would have been lower than a year ago for both the quarter and the year. To bolster investor enthusiasm, the company raised its quarterly dividend by $0.10 a share, but that was having little impact on investor sentiment Friday morning.

The net loss for the quarter totaled $6.6 billion, compared to net earnings of $3.73 billion in the year-ago quarter. The net loss in upstream operations totaled $7.47 billion, due primarily to impairment charges of $8.2 billion. In the fourth quarter of 2018, Chevron posted a profit of $964 million in its upstream division.

U.S. capital expenditures totaled $2.89 billion in the quarter and $10.43 billion for 2019, while international capex saw a quarterly total of $2.75 billion, along with annual spending of $9.63 billion. Worldwide capital spending totaled $20.99 billion for the year, roughly flat compared with 2018.

Net oil-equivalent production in the first quarter totaled 3.08 million barrels a day, essentially unchanged compared with the year-ago quarter. Net oil-equivalent production in the United States totaled 998,000 barrels a day, up by 140,000 barrels year over year. Average U.S. price realizations per barrel of oil dropped from $62.20 a year ago to $55.91.

Internationally, liquids prices fell from $59.11 a barrel a year ago to $56.52 a barrel and net oil-equivalent production fell by 145,000 barrels a day to 2.08 million barrels a day.

...

https://247wallst.com/energy-business/2 ... 4-charges/

For the full year, Chevron reported EPS of $1.54 on revenues of $139.87 billion, compared with 2018 EPS of $7.74 on revenues of $158.9 billion. Analysts had estimated EPS of $6.27 and revenues of $149.95 billion.

In the latest quarter, Chevron took impairment charges and write-downs of $10.4 billion and recognized the sale of $1.2 billion in North Sea assets. For the year, profits were hammered by net charges of $8.7 billion.

Even adjusted for these items, Chevron’s profits would have been lower than a year ago for both the quarter and the year. To bolster investor enthusiasm, the company raised its quarterly dividend by $0.10 a share, but that was having little impact on investor sentiment Friday morning.

The net loss for the quarter totaled $6.6 billion, compared to net earnings of $3.73 billion in the year-ago quarter. The net loss in upstream operations totaled $7.47 billion, due primarily to impairment charges of $8.2 billion. In the fourth quarter of 2018, Chevron posted a profit of $964 million in its upstream division.

U.S. capital expenditures totaled $2.89 billion in the quarter and $10.43 billion for 2019, while international capex saw a quarterly total of $2.75 billion, along with annual spending of $9.63 billion. Worldwide capital spending totaled $20.99 billion for the year, roughly flat compared with 2018.

Net oil-equivalent production in the first quarter totaled 3.08 million barrels a day, essentially unchanged compared with the year-ago quarter. Net oil-equivalent production in the United States totaled 998,000 barrels a day, up by 140,000 barrels year over year. Average U.S. price realizations per barrel of oil dropped from $62.20 a year ago to $55.91.

Internationally, liquids prices fell from $59.11 a barrel a year ago to $56.52 a barrel and net oil-equivalent production fell by 145,000 barrels a day to 2.08 million barrels a day.

...

https://247wallst.com/energy-business/2 ... 4-charges/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Financial Times: Chevron zadba o inwestorów

Chevron ma zamiar wypłacić inwestorom 80 mld USD w ciągu najbliższych pięciu lat. Spółka zapowiada podniesienie dywidend i przeprowadzenie hojnych programów skupowania z rynku akcji.

...

https://www.parkiet.com/Gospodarka---Sw ... torow.html

Chevron ma zamiar wypłacić inwestorom 80 mld USD w ciągu najbliższych pięciu lat. Spółka zapowiada podniesienie dywidend i przeprowadzenie hojnych programów skupowania z rynku akcji.

...

https://www.parkiet.com/Gospodarka---Sw ... torow.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Chevron's Dividend Declared Sacred Despite COVID-19 Impact

https://247wallst.com/energy-business/2 ... 19-impact/

https://247wallst.com/energy-business/2 ... 19-impact/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX p. naftowy

Exxon Mobil (XOM) reported better-than-expected first-quarter earnings and revenue early Friday, as the industry reels from the collapse in crude oil prices. Chevron (CVX) had mixed results cut capital spending yet again. Shares of both Dow Jones energy giants fell early Monday.

The Exxon and Chevron earnings reports also come as OPEC+ formally begins implementing its landmark deal to cut production for two years and prop up crude oil prices, starting with a reduction of 9.7 million barrels a day in May and June. Crude oil futures rose early Friday.

Exxon Earnings

Estimates: Analysts saw Exxon earnings plunging 93% to 4 cents with revenue down 15% to $53.8 billion.

Results: Exxon earnings on a non-GAAP basis fell to 53 cents, excluding a massive charge of $2.9 billion, or 67 cents a share, to account for lower inventory values from cheaper oil prices. Revenue sank nearly 12% to $56.16 billion. Total oil-equivalent production of 4.05 million barrels per day was up 1.6% from a year ago but flat from Q4. Permian Basin production jumped 56% from a year ago and 20% from Q4. Cash flow from operations was $6.3 billion.

Exxon reiterated cuts announced last month, when management said it sees 2020 capital spending of $23 billion, down from an earlier estimate of $33 billion, with the largest of the capital spending cuts in the Permian Basin.

The Dow Jones oil major also sees a 15% decline in cash operating expenses as the company looks to "increase efficiencies and reduce costs."

Stock: Shares fell 1.3% to 45.88 on the stock market today. Exxon stock recent retook the 50-day average recently, according to MarketSmith analysis.

Chevron Earnings

Estimates: Chevron earnings were expected to fall 59% to 64 cents with revenue down nearly 16% to $29.88 billion.

Results: Chevron earnings came in at $1.29 a share. Revenue fell nearly 16% to $29.71 billion. Oil-equivalent production grew 6% to 3.24 million bpd. Permian Basin shale production jumped 48% to 580,000 bpd. Cash flow from operations was $4.7 billion.

Chevron will cut operating costs by another $1 billion and slashed its planned 2020 capital spending yet again, to as low as $14 billion.

In March, Chevron reduced its investment budget for the year by $4 billion to $16 billion globally, while also halving its Permian Basin spending. The oil major also suspended share buybacks but raised its quarterly dividend 8% to $1.29 in January.

Stock: Chevron stock dipped 0.5% to 91.50.

https://www.investors.com/news/chevron- ... il-prices/

The Exxon and Chevron earnings reports also come as OPEC+ formally begins implementing its landmark deal to cut production for two years and prop up crude oil prices, starting with a reduction of 9.7 million barrels a day in May and June. Crude oil futures rose early Friday.

Exxon Earnings

Estimates: Analysts saw Exxon earnings plunging 93% to 4 cents with revenue down 15% to $53.8 billion.

Results: Exxon earnings on a non-GAAP basis fell to 53 cents, excluding a massive charge of $2.9 billion, or 67 cents a share, to account for lower inventory values from cheaper oil prices. Revenue sank nearly 12% to $56.16 billion. Total oil-equivalent production of 4.05 million barrels per day was up 1.6% from a year ago but flat from Q4. Permian Basin production jumped 56% from a year ago and 20% from Q4. Cash flow from operations was $6.3 billion.

Exxon reiterated cuts announced last month, when management said it sees 2020 capital spending of $23 billion, down from an earlier estimate of $33 billion, with the largest of the capital spending cuts in the Permian Basin.

The Dow Jones oil major also sees a 15% decline in cash operating expenses as the company looks to "increase efficiencies and reduce costs."

Stock: Shares fell 1.3% to 45.88 on the stock market today. Exxon stock recent retook the 50-day average recently, according to MarketSmith analysis.

Chevron Earnings

Estimates: Chevron earnings were expected to fall 59% to 64 cents with revenue down nearly 16% to $29.88 billion.

Results: Chevron earnings came in at $1.29 a share. Revenue fell nearly 16% to $29.71 billion. Oil-equivalent production grew 6% to 3.24 million bpd. Permian Basin shale production jumped 48% to 580,000 bpd. Cash flow from operations was $4.7 billion.

Chevron will cut operating costs by another $1 billion and slashed its planned 2020 capital spending yet again, to as low as $14 billion.

In March, Chevron reduced its investment budget for the year by $4 billion to $16 billion globally, while also halving its Permian Basin spending. The oil major also suspended share buybacks but raised its quarterly dividend 8% to $1.29 in January.

Stock: Chevron stock dipped 0.5% to 91.50.

https://www.investors.com/news/chevron- ... il-prices/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX przemysł naftowy

Why Investors Are Wary of Chevron Stock After Q1 Earnings

https://247wallst.com/energy-business/2 ... -earnings/

https://247wallst.com/energy-business/2 ... -earnings/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX przemysł naftowy

On the S&P 500, Noble Energy (NBL) spiked 10% after Chevron (CVX) said it would takle over the Houston-based producer in a $5 billion deal. Including debt, the transaction had a $13 billion value. Chevron stock slipped 0.3%.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Chevron Corporation NYSE: CVX przemysł naftowy

Chevron Earnings Report

Estimates: A loss of 85 cents per share vs. a gain of $2.27 per share in the year-ago quarter. Revenue is expected to decline 47.3% to $20.49 billion.

Results: Check back before the market opens Friday.

Stock: Chevron shares were down 4.2% to 86.28.

Earlier in July, Chevron announced it was buying oil and gas producer Noble Energy in an all-stock deal valued at $5 billion. CEO Michael Wirth said the deal will improve the firm's "ability to generate strong cash flow."

Also early Thursday, ConocoPhillips (COP) reported a larger-than-expected quarterly earnings loss. Revenue also missed Wall Street expectations.

https://www.investors.com/news/exxon-st ... il-prices/

Estimates: A loss of 85 cents per share vs. a gain of $2.27 per share in the year-ago quarter. Revenue is expected to decline 47.3% to $20.49 billion.

Results: Check back before the market opens Friday.

Stock: Chevron shares were down 4.2% to 86.28.

Earlier in July, Chevron announced it was buying oil and gas producer Noble Energy in an all-stock deal valued at $5 billion. CEO Michael Wirth said the deal will improve the firm's "ability to generate strong cash flow."

Also early Thursday, ConocoPhillips (COP) reported a larger-than-expected quarterly earnings loss. Revenue also missed Wall Street expectations.

https://www.investors.com/news/exxon-st ... il-prices/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 71 gości