Coca-Cola or PepsiCo? One Stock is the Clear Winner

Coca-Cola or PepsiCo? One Stock is the Clear Winner

Posted by Ethan Feller, Zacks | Oct 22, 2023

The age-old debate: Coke or Pepsi? Except here we aren’t talking about the beverage, we’re talking about the stocks.

Without a doubt both Coca-Cola (KO) and PepsiCo (PEP) are fantastic long-term investment options. However, after breaking down the returns from multiple look-back periods, looking at sales and earnings prospects, and future business opportunities one is the clear winner.

Furthermore, in addition to a long-term perspective on these stocks, we are also comparing them on a more granular near-term basis, as PepsiCo reported earnings last week, and Coca-Cola reports next week. And lastly, we are informed by each stock’s respective Zacks Rank, which further improves the near-term estimates of stock performance.

It is also worth noting that both stocks have struggled so far in 2023. Many defensive stocks, PEP and KO included recently experienced sharp corrections in response to steeply rising interest rates. Not surprisingly, conservative investors have rotated into Treasuries as they now offer nearly a 5% yield. But now at these levels, Coca-Cola, PepsiCo, and other defensive names look quite appealing.

Image Source: TradingView - patrz link

Earnings Estimates

PepsiCo’s earnings report last week came in strong as the company beat expectations on both the top and bottom line. PepsiCo also enjoys a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions from analysts. Additionally, FY23 sales are projected to grow 6.2% YoY to $91.75 billion and EPS are expected to climb 10.9% YoY to $7.53 per share.

Coca-Cola is reporting earnings next Tuesday, October 24, before the market opens, and analysts have not been particularly bullish. KO has a Zacks Rank #4 (Sell) rating, reflecting downward trending earnings revisions. Current quarter earnings are forecast to be unchanged YoY and sales are expected to grow 3.6% to $11.5 billion. For FY23, sales are expected to grow 4.5% YoY to $44.9 billion and EPS are expected to increase 6.1% to $2.63 per share.

So, we can clearly see that PepsiCo has both analysts raising estimates on its side, and higher forecasted growth for both sales and earnings this year.

Valuation

In the valuation chart below, we see that KO and PEP have very similar forward earnings multiples. PepsiCo trades at 21.3x, which is below its 10-year median of 22.3x, and Coca-Cola is trading at 20.7x, also below its 10-year median of 23.1x.

However, 3–5-year EPS forecasts show that PepsiCo has 33% higher growth expectations. Over that time PEP is expected to grow EPS 8.3% annually, while KO is expected to grow at 6.2% annually. That essentially means PEP is cheaper.

Image Source: TradingView

Stock Performance

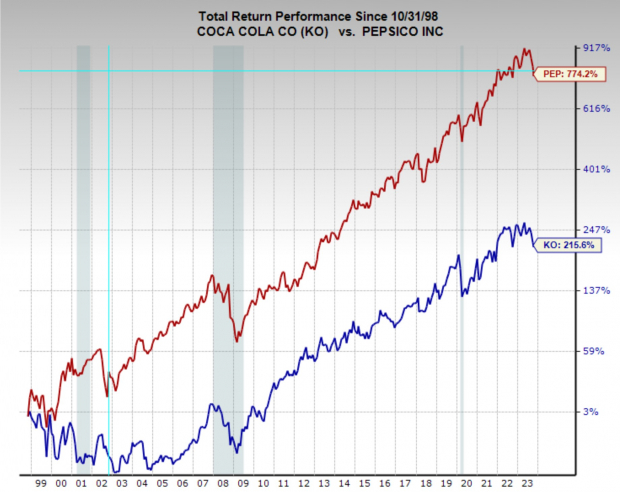

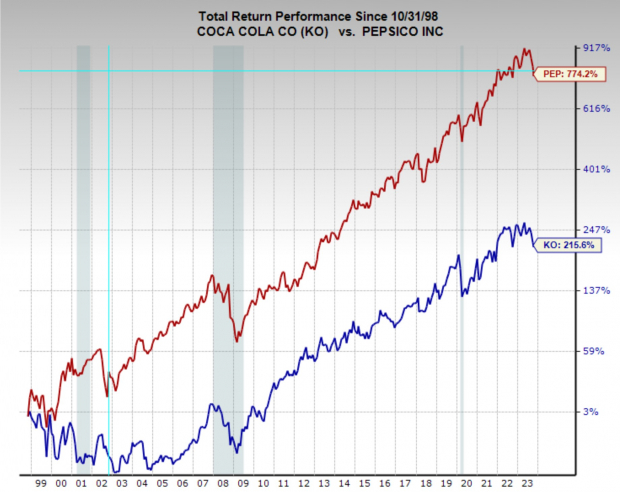

When looking at stock performance PepsiCo has outperformed Coca-Cola in every time frame. Looking back 10, 20, 30 years, Pepsi comes out on top. Even more impressive is that PepsiCo has done it with less risk and volatility as its maximum drawdown since 1985 was -36%, while Coca-Cola’s was -50%.

Over the last 25 years PEP has compounded at an annual rate of 9.9% and KO has compounded 4.6% annually.

Image Source: Zacks Investment Research

Business Developments

While many people associate each of these companies with the respective beverage brands, both are far more than just these two brands. Coca-Cola is the leader in non-alcoholic beverages, with a 40% market share, and includes brands like Powerade, SmartWater, Minute Maid and many others.

PepsiCo on the other hand has much less sway in the beverage industry, but boasts an array of complimentary brands including Frito-Lay, Lay’s Chips, Cheetos, and the range of Quaker cereals, as well as Aunt Jemima mixes.

From a margin perspective, KO is exceptional. Coca-Cola has net margins of 23.8%, an incredibly impressive figure, while PEP has net margins of just 9%. However, when looking at Return on Capital, PEP edges out the lead with 19.2% versus KO’s 18.2%

Based on these measures, PepsiCo and Coca-Cola have surprisingly different business models, and even though KO enjoys those higher margins, PEP’s stock performance over the years speaks for itself.

Image Source: Zacks Investment Research

Bottom Line

I believe that PepsiCo is the superior investment over both the short and long-term. That isn’t to say the KO is a poor stock, but when taking both a quantitative and qualitative approach, PEP appears superior. I will say personally, I prefer Coke to Pepsi, and I think the Coke brand is more recognizable, but the data doesn’t agree with that sentiment. Additionally, each company owns a huge portfolio of brands which of course influence the performance of business and stock.

— Ethan Feller