Starbucks to Test Offering Drinks in Rental Cups

Tokyo, Nov. 17 (Jiji Press)--Starbucks Coffee Japan Ltd. said Wednesday that it will begin offering drinks to-go in rental cups in central Tokyo on a trial basis from Monday.

The initiative, to be tested in 10 stores in the Marunouchi district of the capital until the end of May 2022, is aimed at reducing the use of disposable cups.

Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Undervalued Dividend Growth Stock of the Week: Starbucks (SBUX)

by Jason Fieber, Mr. Free at 33 • February 6, 2022

https://www.mrfreeat33.com/undervalued- ... e-week-15/

Talk About Growth... This Company Has Blown Away My Expectations

11 330 wyświetleń7 lut 2022

by Jason Fieber, Mr. Free at 33 • February 6, 2022

https://www.mrfreeat33.com/undervalued- ... e-week-15/

Talk About Growth... This Company Has Blown Away My Expectations

11 330 wyświetleń7 lut 2022

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Kawiarnie Starbucks nadal działają w Rosji – i to się na razie nie zmieni

Mimo sankcji i ucieczki wielu europejskich i amerykańskich marek z rynku w Rosji, mieszkańcy rosyjskich miast nadal mogą pójść do Starbucksa na kawę. Amerykańska sieć kawiarni nie zamknęła swoich lokali w Rosji.

https://sukces.rp.pl/spoleczenstwo/art3 ... nie-zmieni

...

EDIT SBUX jednak zawiesza działalność w Rosji

ps.2 znalezione w necie

U nas też powinni zamknąć. 20zł za zwykłą kawę to spora przesada.

20zł za zwykłą kawę to spora przesada.  W Hiszpanii w normalnych kawiarniach max 1-1.5€

W Hiszpanii w normalnych kawiarniach max 1-1.5€

https://www.wykop.pl/link/6551551/starb ... e-w-rosji/

Mimo sankcji i ucieczki wielu europejskich i amerykańskich marek z rynku w Rosji, mieszkańcy rosyjskich miast nadal mogą pójść do Starbucksa na kawę. Amerykańska sieć kawiarni nie zamknęła swoich lokali w Rosji.

https://sukces.rp.pl/spoleczenstwo/art3 ... nie-zmieni

...

EDIT SBUX jednak zawiesza działalność w Rosji

ps.2 znalezione w necie

U nas też powinni zamknąć.

https://www.wykop.pl/link/6551551/starb ... e-w-rosji/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

The Wall Street Journal: Kluczowy rozwój

Starbucks zamiast przeprowadzać skupy akcji zajmie się inwestycjami.

https://www.parkiet.com/gospodarka-swia ... owy-rozwoj

Starbucks zamiast przeprowadzać skupy akcji zajmie się inwestycjami.

https://www.parkiet.com/gospodarka-swia ... owy-rozwoj

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Starbucks (SBUX)

Dywidenda w spółce Starbucks jeszcze nigdy nie była wyższa niż obecnie. Czy jest to więc już dobra okazja dla inwestora dywidendowego? Czy wycena sięgnęła już poziomy "niedowartościowania"? O tym i więcej w nowej analizie:

https://youtu.be/IGeKs9iZrFo

https://www.pamietnikgieldowy.pl/2013/0 ... iczna.html

Dywidenda w spółce Starbucks jeszcze nigdy nie była wyższa niż obecnie. Czy jest to więc już dobra okazja dla inwestora dywidendowego? Czy wycena sięgnęła już poziomy "niedowartościowania"? O tym i więcej w nowej analizie:

https://youtu.be/IGeKs9iZrFo

https://www.pamietnikgieldowy.pl/2013/0 ... iczna.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Starbucks' Schultz to remain interim CEO until Q1 2023

(Reuters) - Starbucks Corp (NASDAQ:SBUX) said on Monday Howard Schultz would remain the coffee chain's interim chief executive officer until the end of the first quarter next year, as it looks for a permanent successor.

(Reuters) - Starbucks Corp (NASDAQ:SBUX) said on Monday Howard Schultz would remain the coffee chain's interim chief executive officer until the end of the first quarter next year, as it looks for a permanent successor.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

DUBAI (Reuters) - Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), has been shortlisted to buy a stake in the Middle East, North Africa and central Asia Starbucks (NASDAQ:SBUX) franchise held by Alshaya Group, two sources told Reuters.

Kuwait-based Alshaya Group, the region's leading brand franchise owner, last year hired JPMorgan (NYSE:JPM) to sell a significant minority stake in the business. The sources said it could sell up to 30%, generating $4 billion-$5 billion.

The PIF, which manages over $600 billion of assets, Alshaya, and JPMorgan all declined to comment.

The Starbucks franchise in the region has several hundred outlets in 14 countries across the Middle East, Russia, and central Asia. Its stores in Russia are closed in line with Starbucks' decision to suspend activity in the country after its invasion of Ukraine.

The PIF is among the bidders that have made it to the next round as the sale process nears its final stages, the source said.

Several private equity bidders were also in the race, including CVC Capital Partners and Brookfield, but it was not immediately clear if they had been shortlisted.

Abu Dhabi state fund Mubadala Investment Co and Abu Dhabi state holding fund ADQ are no longer in the race, the two sources said. Mubadala declined to comment, while ADQ did not immediately respond to a request for comment.

The deal would widen the investor base of a business privately held by the Alshaya family since 1999, one of the sources said.

Some of the Middle East's biggest privately-owned companies are warming to the idea of bringing in outside investors through listings or strategic stake sales.

Saudi Arabia has seen a spate of listings in recent years as the kingdom encourages more family-owned companies to float in a bid to deepen its capital markets under reforms aimed at reducing reliance on oil revenues.

The second source said funds raised could be used towards other businesses Alshaya owns, and that the valuation of the company is attractive, making the sale of a stake compelling.

The privately held Alshaya Group says it is the oldest company in Kuwait, first registered in 1890. It runs franchises including H&M, Mothercare, Debenhams, American Eagle Outfitters (NYSE:AEO) and Victoria’s Secret.

https://www.investing.com/news/stock-ma ... es-2833911

Kuwait-based Alshaya Group, the region's leading brand franchise owner, last year hired JPMorgan (NYSE:JPM) to sell a significant minority stake in the business. The sources said it could sell up to 30%, generating $4 billion-$5 billion.

The PIF, which manages over $600 billion of assets, Alshaya, and JPMorgan all declined to comment.

The Starbucks franchise in the region has several hundred outlets in 14 countries across the Middle East, Russia, and central Asia. Its stores in Russia are closed in line with Starbucks' decision to suspend activity in the country after its invasion of Ukraine.

The PIF is among the bidders that have made it to the next round as the sale process nears its final stages, the source said.

Several private equity bidders were also in the race, including CVC Capital Partners and Brookfield, but it was not immediately clear if they had been shortlisted.

Abu Dhabi state fund Mubadala Investment Co and Abu Dhabi state holding fund ADQ are no longer in the race, the two sources said. Mubadala declined to comment, while ADQ did not immediately respond to a request for comment.

The deal would widen the investor base of a business privately held by the Alshaya family since 1999, one of the sources said.

Some of the Middle East's biggest privately-owned companies are warming to the idea of bringing in outside investors through listings or strategic stake sales.

Saudi Arabia has seen a spate of listings in recent years as the kingdom encourages more family-owned companies to float in a bid to deepen its capital markets under reforms aimed at reducing reliance on oil revenues.

The second source said funds raised could be used towards other businesses Alshaya owns, and that the valuation of the company is attractive, making the sale of a stake compelling.

The privately held Alshaya Group says it is the oldest company in Kuwait, first registered in 1890. It runs franchises including H&M, Mothercare, Debenhams, American Eagle Outfitters (NYSE:AEO) and Victoria’s Secret.

https://www.investing.com/news/stock-ma ... es-2833911

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

We Just Bought More Shares of Starbucks (SBUX) and 2 Other Stocks for the Income Builder Portfolio

by Mike Nadel, Dividends & Income • June 30, 2022

https://dailytradealert.com/2022/06/30/ ... portfolio/

by Mike Nadel, Dividends & Income • June 30, 2022

https://dailytradealert.com/2022/06/30/ ... portfolio/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Undervalued Dividend Growth Stock of the Week: Starbucks (SBUX)Undervalued Dividend Growth Stock of the Week: Starbucks (SBUX)

by Jason Fieber, Mr. Free at 33 • February 6, 2022

https://www.mrfreeat33.com/undervalued- ... e-week-15/

Talk About Growth... This Company Has Blown Away My Expectations

11 330 wyświetleń7 lut 2022

by Jason Fieber, Mr. Free at 33 • July 10, 2022

https://dailytradealert.com/2022/07/10/ ... ks-sbux-3/

Even Though The Stock Has Fallen 40%, This World-Class Company is Better than Ever

https://www.youtube.com/watch?v=IxPPkqUkCJc

Ostatnio zmieniony 06 sie 2022 16:10 przez slayer74, łącznie zmieniany 1 raz.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

(Reuters) - Starbucks Corp (NASDAQ:SBUX) is exploring a sale of its UK operations as it faces competition from newer operators, The Times reported https://www.thetimes.co.uk/article/star ... -gmldppm6f on Saturday citing sources.

The coffee chain has asked Houlihan Lokey (NYSE:HLI) Inc to canvass interest for its UK business, the report said adding that the company has been facing competition from rival coffee chains like Pret A Manger, Tim Hortons and Costa.

Starbucks' UK business oversees more than 1000 coffee shops in UK and employs around 4000 people there, the report said.

According to the Times report, the company has not initiated a "formal sales process" of its UK business and it continued to "evaluate strategic options" for its company-owned international operations.

The company did not immediately respond to Reuters' request for comment outside business hours.

The company suspended its guidance for the fiscal year in its last quarter earnings report after missing Wall Street targets due to China's tough COVID-19 curbs which impacted their sales in the country.

The company which has been dealing with recent unionization efforts of its U.S. workforce is looking for a permanent successor meanwhile Howard Schultz remains the interim CEO.

The coffee chain has asked Houlihan Lokey (NYSE:HLI) Inc to canvass interest for its UK business, the report said adding that the company has been facing competition from rival coffee chains like Pret A Manger, Tim Hortons and Costa.

Starbucks' UK business oversees more than 1000 coffee shops in UK and employs around 4000 people there, the report said.

According to the Times report, the company has not initiated a "formal sales process" of its UK business and it continued to "evaluate strategic options" for its company-owned international operations.

The company did not immediately respond to Reuters' request for comment outside business hours.

The company suspended its guidance for the fiscal year in its last quarter earnings report after missing Wall Street targets due to China's tough COVID-19 curbs which impacted their sales in the country.

The company which has been dealing with recent unionization efforts of its U.S. workforce is looking for a permanent successor meanwhile Howard Schultz remains the interim CEO.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Choć Starbucks planował zamknąć jedynie 16 lokali, to teraz kawowy gigant zamierza zwinąć logo nad jeszcze większą liczbą knajp. I wcale nie chodzi tu o to, że miejsca te są nierentowne. Powodem ma być zagrożenie bezpieczeństwa w niektórych lokalizacjach w USA. Dodatkowo gigant myśli o całkowitym opuszczeniu Wielkiej Brytanii.

https://spidersweb.pl/bizblog/starbucks ... eczenstwa/

https://spidersweb.pl/bizblog/starbucks ... eczenstwa/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

NEW YORK (Reuters) -Starbucks Corp on Thursday named Laxman Narasimhan as its next chief executive officer, choosing an executive credited with revitalizing the maker of Lysol disinfectants to undertake a "reinvention" of the world's biggest coffee chain.

Narasimhan was CEO of Reckitt, which also makes Durex condoms, Enfamil baby formula and Mucinex cold syrup. He announced his departure from that post earlier in the day, and FTSE-listed Reckitt's shares fell 4%.

Starbucks (NASDAQ:SBUX) faces a turbulent period. More than 200 of its U.S. stores have unionized in the past year, with workers pushing for better benefits and wages at a time of surging inflation.

The company is also reworking its business model from a focus on cafes that encouraged long visits to mobile pickup and delivery, while facing higher costs for ingredients and labor. Also, COVID restrictions in China have slowed the U.S. coffee chain's business in one of its biggest overseas markets.

Narasimhan will join Starbucks in October but will take the helm in April 2023, after spending a few months learning about the company and its "Reinvention" plan, which includes paying better wages for baristas, improving employee welfare and customer experience and re-imagining stores.

Until then, interim-CEO Howard Schultz, who took back the reins of the company for the third time in April after Kevin Johnson retired, will continue to lead the company.

"He is a strategic and transformational leader with deep experience in building powerful consumer brands," Schultz said in a letter to employees welcoming Narasimhan.

BALANCED APPROACH

Narasimhan joined Reckitt in September 2019 and was the first external candidate to take the helm at Reckitt since it was formed in 1999.

He led the company through the pandemic, which boosted sales of its health and hygiene products, and more recently navigated a baby formula crisis in the United States, culminating in a raise in its annual forecast earlier this year.

The 55-year old, who previously worked at PepsiCo (NASDAQ:PEP) as its global chief commercial officer, gained plaudits from Reckitt investors for his management style after helping revitalize the company after a sales slump.

"He took a very balanced approach to strategy ... he didn't go in all guns blazing - he took a very systematic approach to get things right," said Ashish Sinha, portfolio manager at Reckitt shareholder Gabelli.

Starbucks said Narasimhan will spend his time with Schultz and the management team, spending time as a barista, meeting employees and visiting manufacturing plants and coffee farms during the transition period.

"While we are surprised Starbucks chose a successor outside the discretionary sector, we are optimistic Mr. Narasimhan's global perspectives as a CEO of a public multinational corporation and background in beverages at PepsiCo will serve Starbucks well into the next chapter," Cowen analyst Andrew Charles wrote in a note.

The coffee chain's shares were barely changed in after-hours trade, gaining less than 1%. They are down 24% since Schultz's return as interim CEO.

https://www.investing.com/news/stock-ma ... eo-2884615

Narasimhan was CEO of Reckitt, which also makes Durex condoms, Enfamil baby formula and Mucinex cold syrup. He announced his departure from that post earlier in the day, and FTSE-listed Reckitt's shares fell 4%.

Starbucks (NASDAQ:SBUX) faces a turbulent period. More than 200 of its U.S. stores have unionized in the past year, with workers pushing for better benefits and wages at a time of surging inflation.

The company is also reworking its business model from a focus on cafes that encouraged long visits to mobile pickup and delivery, while facing higher costs for ingredients and labor. Also, COVID restrictions in China have slowed the U.S. coffee chain's business in one of its biggest overseas markets.

Narasimhan will join Starbucks in October but will take the helm in April 2023, after spending a few months learning about the company and its "Reinvention" plan, which includes paying better wages for baristas, improving employee welfare and customer experience and re-imagining stores.

Until then, interim-CEO Howard Schultz, who took back the reins of the company for the third time in April after Kevin Johnson retired, will continue to lead the company.

"He is a strategic and transformational leader with deep experience in building powerful consumer brands," Schultz said in a letter to employees welcoming Narasimhan.

BALANCED APPROACH

Narasimhan joined Reckitt in September 2019 and was the first external candidate to take the helm at Reckitt since it was formed in 1999.

He led the company through the pandemic, which boosted sales of its health and hygiene products, and more recently navigated a baby formula crisis in the United States, culminating in a raise in its annual forecast earlier this year.

The 55-year old, who previously worked at PepsiCo (NASDAQ:PEP) as its global chief commercial officer, gained plaudits from Reckitt investors for his management style after helping revitalize the company after a sales slump.

"He took a very balanced approach to strategy ... he didn't go in all guns blazing - he took a very systematic approach to get things right," said Ashish Sinha, portfolio manager at Reckitt shareholder Gabelli.

Starbucks said Narasimhan will spend his time with Schultz and the management team, spending time as a barista, meeting employees and visiting manufacturing plants and coffee farms during the transition period.

"While we are surprised Starbucks chose a successor outside the discretionary sector, we are optimistic Mr. Narasimhan's global perspectives as a CEO of a public multinational corporation and background in beverages at PepsiCo will serve Starbucks well into the next chapter," Cowen analyst Andrew Charles wrote in a note.

The coffee chain's shares were barely changed in after-hours trade, gaining less than 1%. They are down 24% since Schultz's return as interim CEO.

https://www.investing.com/news/stock-ma ... eo-2884615

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Starbucks plans about 9,000 China outlets by 2025

(Reuters) - Starbucks Corp (NASDAQ:SBUX) said on Tuesday it plans to have about 9,000 stores in China by 2025, a 56% increase from its current count.

That increase equates to one new store opening nearly every nine hours for the next three years, Starbucks said.

Przejmuje rynek po Luckin Coffee?

(Reuters) - Starbucks Corp (NASDAQ:SBUX) said on Tuesday it plans to have about 9,000 stores in China by 2025, a 56% increase from its current count.

That increase equates to one new store opening nearly every nine hours for the next three years, Starbucks said.

Przejmuje rynek po Luckin Coffee?

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

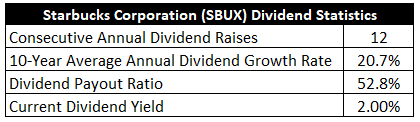

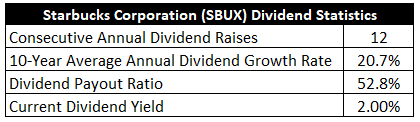

On September 28, 2022, Starbucks Corporation (SBUX) announced that it will raise its quarterly dividend by 8.2% to $0.53 per share. This follows a dividend hike of 8.9 percent to $0.49 per share in 2021 and will mark the 12th consecutive year of annual dividend increases by the specialty coffee company.

This increase will be effective with the dividend payment to be distributed on November 25, 2022, to shareholders of record on November 11, 2022, and raises the company’s annual dividend rate to $2.12 per share. Starbucks initiated its dividend in 2010 and has increased it in each of the past 12 years. A new annual rate of $2.12 per share yields 2.4% at a stock price of $87.

Starbucks Corporation (Starbucks) is a roaster, marketer and retailer of specialty coffee. The company purchases and roasts high-quality coffees that are sold, along with handcrafted coffee, tea and other beverages and a variety of high-quality food items through company-operated stores. Starbucks also sells a variety of coffee and tea products and licenses its trademarks through other channels such as licensed stores, grocery and foodservice accounts. In addition to its flagship Starbucks Coffee brand, the company sells goods and services under the following brands: Teavana, Seattle’s Best Coffee, Evolution Fresh, La Boulange, Ethos, Starbucks Reserve and Princi. Starbucks Corporation was formed in 1985 and has paid a dividend every year since 2010.

This increase will be effective with the dividend payment to be distributed on November 25, 2022, to shareholders of record on November 11, 2022, and raises the company’s annual dividend rate to $2.12 per share. Starbucks initiated its dividend in 2010 and has increased it in each of the past 12 years. A new annual rate of $2.12 per share yields 2.4% at a stock price of $87.

Starbucks Corporation (Starbucks) is a roaster, marketer and retailer of specialty coffee. The company purchases and roasts high-quality coffees that are sold, along with handcrafted coffee, tea and other beverages and a variety of high-quality food items through company-operated stores. Starbucks also sells a variety of coffee and tea products and licenses its trademarks through other channels such as licensed stores, grocery and foodservice accounts. In addition to its flagship Starbucks Coffee brand, the company sells goods and services under the following brands: Teavana, Seattle’s Best Coffee, Evolution Fresh, La Boulange, Ethos, Starbucks Reserve and Princi. Starbucks Corporation was formed in 1985 and has paid a dividend every year since 2010.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Starbucks Corporation NASDAQ: SBUX sieć kawiarni

Starbucks Edges Higher on Earnings Beat, Analysts Raise Targets

Shares of Starbucks (NASDAQ:SBUX) are trading more than 3% higher in pre-open Friday trading after the company delivered better-than-expected Q3 results.

Starbucks posted an EPS of $0.81 on revenue of $8.4 billion to top the consensus that called for an EPS of $0.73 on sales of $8.33 billion. On a 13-week basis, revenue rose 3%. Starbucks said its global comparable store sales were up 7%, driven by the strong performance in North America and U.S. sales. Comparable sales in China fell 16%.

The average ticket price was up 8%, again fueled by North America (+10), which offset a drop of 1% in the International average ticket price.

“We saw accelerating demand for Starbucks coffee around the world in Q4 and throughout the year. And our Q4 results demonstrate early evidence of the success of our U.S. Reinvention investments,” said Howard Schultz, interim chief executive officer of Starbucks.

During the earnings call, Starbucks presented guidance that came in line with the recent Investor Day commentary. The company expects steady U.S. growth, coupled with a recovery in China.

Citi analysts raised the price target to $93 per share from the prior $90 after a “solid” quarter. Still, they remain Neutral-rated and cautious on the setup.

“Shares may see a pop on a US headline beat/FY23 EPS estimates coming up, but we see little reason for a meaningful, sustained leg-up without color on how these initiatives build to LT guidance,” they wrote in a client note.

Piper Sandler analysts also reaffirmed the Natural rating on SBUX stock.

“From a stock perspective, it's not unit growth or tech investments alone that are the unlock to upside, rather balancing the transactional and relational nature of the brand equity,” the analysts said.

Shares of Starbucks (NASDAQ:SBUX) are trading more than 3% higher in pre-open Friday trading after the company delivered better-than-expected Q3 results.

Starbucks posted an EPS of $0.81 on revenue of $8.4 billion to top the consensus that called for an EPS of $0.73 on sales of $8.33 billion. On a 13-week basis, revenue rose 3%. Starbucks said its global comparable store sales were up 7%, driven by the strong performance in North America and U.S. sales. Comparable sales in China fell 16%.

The average ticket price was up 8%, again fueled by North America (+10), which offset a drop of 1% in the International average ticket price.

“We saw accelerating demand for Starbucks coffee around the world in Q4 and throughout the year. And our Q4 results demonstrate early evidence of the success of our U.S. Reinvention investments,” said Howard Schultz, interim chief executive officer of Starbucks.

During the earnings call, Starbucks presented guidance that came in line with the recent Investor Day commentary. The company expects steady U.S. growth, coupled with a recovery in China.

Citi analysts raised the price target to $93 per share from the prior $90 after a “solid” quarter. Still, they remain Neutral-rated and cautious on the setup.

“Shares may see a pop on a US headline beat/FY23 EPS estimates coming up, but we see little reason for a meaningful, sustained leg-up without color on how these initiatives build to LT guidance,” they wrote in a client note.

Piper Sandler analysts also reaffirmed the Natural rating on SBUX stock.

“From a stock perspective, it's not unit growth or tech investments alone that are the unlock to upside, rather balancing the transactional and relational nature of the brand equity,” the analysts said.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 79 gości