Latest Release

Jan 26, 2022

EPS / Forecast

8.53 / 8.51

Revenue / Forecast

4.23B / 4.41B

Investing.com - Lam Research (NASDAQ:LRCX) reported on Wednesday second quarter earnings that beat analysts' forecasts and revenue that fell short of expectations.

Lam Research announced earnings per share of $8.53 on revenue of $4.23B. Analysts polled by Investing.com anticipated EPS of $8.51 on revenue of $4.41B.

Lam Research shares are up 3% from the beginning of the year, still down 18.47% from its 52 week high of $731.85 set on January 4. They are outperforming the Nasdaq 100 which is down 13.16% from the start of the year.

Lam Research shares lost 9.16% in after-hours trade following the report.

Lam Research follows other major Information Technology sector earnings this month

Lam Research's report follows an earnings beat by Microsoft on Tuesday, who reported EPS of $2.48 on revenue of $51.73B, compared to forecasts EPS of $2.31 on revenue of $50.65B.

Taiwan Semiconductor had beat expectations on January 13 with fourth quarter EPS of $1.16 on revenue of $15.85B, compared to forecast for EPS of $1.12 on revenue of $15.69B.

Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

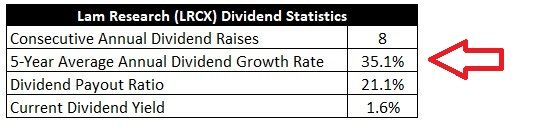

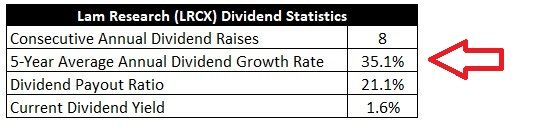

Undervalued Dividend Growth Stock Of The Week: Lam Research (LRCX)

by Jason Fieber, Mr. Free at 33 • September 4, 2022

https://www.mrfreeat33.com/undervalued- ... e-week-45/

by Jason Fieber, Mr. Free at 33 • September 4, 2022

https://www.mrfreeat33.com/undervalued- ... e-week-45/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

This Super High-Quality Stock Has Been Battered Down 40%!

https://www.youtube.com/watch?v=777Gq7woccA

https://www.youtube.com/watch?v=777Gq7woccA

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

Lam Research (LRCX) bumped up 2.3% after Stifel upgraded the semiconductor equipment stock to a buy rating from hold and raised its price target to 725 from 505. The move lifted the stock back above its 21-day exponential moving average.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

(Reuters) -Chip-making tools supplier Lam Research forecast quarterly revenue above Wall Street estimates, as semiconductor makers scramble to meet a surge in demand fueled by rising adoption of artificial intelligence (AI) technology.

Lam shares rose about 2% in extended trading.

Businesses across sectors have been racing to incorporate AI capabilities after OpenAI's ChatGPT caught the attention of consumers and investors alike, benefiting companies like Lam that are essential to the chip supply chain.

Lam Chief Executive Tim Archer said AI was in its initial stages with more investments in factories and in the company's tools as being critical over the next several years.

"Advanced AI servers have significantly higher leading-edge logic, memory and storage content versus traditional servers, and every incremental 1% penetration of AI servers and data centers is expected to drive $1 billion to $1.5 billion of additional (chip equipment) investment," Archer said on a conference call with analysts.

The company expects first-quarter revenue of $3.4 billion plus or minus $300 million, above expectations of $3.3 billion, according to IBES data from Refinitiv.

Lam, Applied Materials (NASDAQ:AMAT) and Dutch firm ASML are among a few main suppliers of wafer fabrication equipment - sophisticated and expensive machinery used to make semiconductors.

For the rest of 2023, Archer said he expects the total market for chipmaking equipment to be roughly $70 billion. It could receive a boost from demand from domestic Chinese purchases of equipment and high-speed memory tools.

Chinese companies have shifted purchasing to equipment used for older logic and memory chips following U.S. export control restrictions from October of 2022, the CEO said.

The AI boom has also helped chipmakers cushion a post-pandemic downturn in demand for personal computers and smartphones.

Lam reported fourth-quarter revenue of $3.21 billion, lower than $4.64 billion a year ago but above market expectations of $3.13 billion.

Excluding items, the company posted a profit of $5.97 per share, compared with estimates of $5.07.

Lam shares rose about 2% in extended trading.

Businesses across sectors have been racing to incorporate AI capabilities after OpenAI's ChatGPT caught the attention of consumers and investors alike, benefiting companies like Lam that are essential to the chip supply chain.

Lam Chief Executive Tim Archer said AI was in its initial stages with more investments in factories and in the company's tools as being critical over the next several years.

"Advanced AI servers have significantly higher leading-edge logic, memory and storage content versus traditional servers, and every incremental 1% penetration of AI servers and data centers is expected to drive $1 billion to $1.5 billion of additional (chip equipment) investment," Archer said on a conference call with analysts.

The company expects first-quarter revenue of $3.4 billion plus or minus $300 million, above expectations of $3.3 billion, according to IBES data from Refinitiv.

Lam, Applied Materials (NASDAQ:AMAT) and Dutch firm ASML are among a few main suppliers of wafer fabrication equipment - sophisticated and expensive machinery used to make semiconductors.

For the rest of 2023, Archer said he expects the total market for chipmaking equipment to be roughly $70 billion. It could receive a boost from demand from domestic Chinese purchases of equipment and high-speed memory tools.

Chinese companies have shifted purchasing to equipment used for older logic and memory chips following U.S. export control restrictions from October of 2022, the CEO said.

The AI boom has also helped chipmakers cushion a post-pandemic downturn in demand for personal computers and smartphones.

Lam reported fourth-quarter revenue of $3.21 billion, lower than $4.64 billion a year ago but above market expectations of $3.13 billion.

Excluding items, the company posted a profit of $5.97 per share, compared with estimates of $5.07.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

On August 24, 2023, Lam Research Corp (LRCX) announced a substantial 15.9% dividend boost to $2.00 per share quarterly. This builds on last year's 15.0% dividend raise, maintaining a 9-year streak of consecutive dividend growth since the company's inaugural dividend in 2014.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Lam Research NASDAQ: LRCX sprzęt do produkcji półprzewodników

Semiconductor equipment maker Lam Research (NASDAQ:LRCX) (NASDAQ:LCRX) reported Q1 FY2024 results exceeding Wall Street analysts' expectations, with revenue down 31.4% year on year to $3.48 billion. Guidance for next quarter's revenue was also better than expected at $3.7 billion at the midpoint, 1.41% above analysts' estimates. Turning to EPS, Lam Research made a non-GAAP profit of $6.85 per share, down from its profit of $10.42 per share in the same quarter last year.

Is now the time to buy Lam Research? Find out by reading the original article on StockStory.

Lam Research (LRCX) Q1 FY2024 Highlights:

Revenue: $3.48 billion vs analyst estimates of $3.42 billion (1.94% beat)

EPS (non-GAAP): $6.85 vs analyst estimates of $6.13 (11.8% beat)

Revenue Guidance for Q2 2024 is $3.7 billion at the midpoint, above analyst estimates of $3.65 billion

Free Cash Flow of $874.2 million, down 16.3% from the previous quarter

Inventory Days Outstanding: 236, down from 252 in the previous quarter

Gross Margin (GAAP): 47.5%, up from 46.1% in the same quarter last year

"Lam continues to deliver strong results despite a cyclically soft year for wafer fabrication equipment spending," said Tim Archer, Lam Research's President and Chief Executive Officer.

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Semiconductor ManufacturingThe semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales GrowthLam Research's revenue growth over the last three years has been mediocre, averaging 15.6% annually. But as you can see below, its revenue declined from $5.07 billion in the same quarter last year to $3.48 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Lam Research surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 31.4% year on year. This could mean that the current downcycle is deepening.

Lam Research's revenue growth has decelerated over the last three quarters and its management team projects growth to turn negative next quarter. As such, the company is guiding for a 29.9% year-on-year revenue decline while analysts are expecting a 0.19% drop over the next 12 months.

Product Demand & Outstanding InventoryDays Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Lam Research's DIO came in at 236, which is 100 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Lam Research's Q1 Results Sporting a market capitalization of $85.9 billion, more than $5.16 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Lam Research is attractively positioned to invest in growth.

We were impressed by how significantly Lam Research blew past analysts' EPS expectations this quarter, driven by better-than-expected systems and customer support revenue. We were also glad its inventory levels shrunk. On the other hand, its operating margin declined. Overall, we think this was a strong quarter that should satisfy shareholders. The stock, however, is down 3.5% immediately after reporting and currently trades at $619.98 per share.

Is now the time to buy Lam Research? Find out by reading the original article on StockStory.

Lam Research (LRCX) Q1 FY2024 Highlights:

Revenue: $3.48 billion vs analyst estimates of $3.42 billion (1.94% beat)

EPS (non-GAAP): $6.85 vs analyst estimates of $6.13 (11.8% beat)

Revenue Guidance for Q2 2024 is $3.7 billion at the midpoint, above analyst estimates of $3.65 billion

Free Cash Flow of $874.2 million, down 16.3% from the previous quarter

Inventory Days Outstanding: 236, down from 252 in the previous quarter

Gross Margin (GAAP): 47.5%, up from 46.1% in the same quarter last year

"Lam continues to deliver strong results despite a cyclically soft year for wafer fabrication equipment spending," said Tim Archer, Lam Research's President and Chief Executive Officer.

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Semiconductor ManufacturingThe semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales GrowthLam Research's revenue growth over the last three years has been mediocre, averaging 15.6% annually. But as you can see below, its revenue declined from $5.07 billion in the same quarter last year to $3.48 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Lam Research surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 31.4% year on year. This could mean that the current downcycle is deepening.

Lam Research's revenue growth has decelerated over the last three quarters and its management team projects growth to turn negative next quarter. As such, the company is guiding for a 29.9% year-on-year revenue decline while analysts are expecting a 0.19% drop over the next 12 months.

Product Demand & Outstanding InventoryDays Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Lam Research's DIO came in at 236, which is 100 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Lam Research's Q1 Results Sporting a market capitalization of $85.9 billion, more than $5.16 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Lam Research is attractively positioned to invest in growth.

We were impressed by how significantly Lam Research blew past analysts' EPS expectations this quarter, driven by better-than-expected systems and customer support revenue. We were also glad its inventory levels shrunk. On the other hand, its operating margin declined. Overall, we think this was a strong quarter that should satisfy shareholders. The stock, however, is down 3.5% immediately after reporting and currently trades at $619.98 per share.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 90 gości