China Life Insurance, PetroChina i China Petroleum & Chemical zamierzają opuścić giełdę w Nowym Jorku, bo nie chcą być badane przez amerykańskich audytorów, informuje Bloomberg.

https://www.pb.pl/trzy-najwieksze-chins ... se-1158428

Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Re: Intercontinental Exchange NYSE: ICE commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Intercontinental Exchange NYSE: ICE commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

NEW YORK (Reuters) -A technical issue with the New York Stock Exchange's opening auction on Tuesday led to more than 80 stocks being briefly halted at the start of trading, sowing confusion among traders about which orders were filled and whether they were at the correct prices.

The NYSE, which is owned by Intercontinental Exchange (NYSE:ICE) Inc, said it was still investigating and that traders may want to consider filing for erroneous trade claims. The U.S. Securities and Exchange Commission also said it was reviewing the issue.

The glitch - the most recent in a series since the "flash crash" of 2010 - impacted stocks of major companies including ExxonMobil (NYSE:XOM), 3M, Verizon (NYSE:VZ), McDonald's Corp (NYSE:MCD), Wells Fargo (NYSE:WFC) and WalMart. The companies did not immediately respond to a request for comment.

"What appears to have happened is a technical glitch where all of my opening orders on the NYSE autocancelled even though some of them should have been fulfilled," said Dennis Dick, trader at Triple D Trading.

"They have corrected that now, but this is going to be a big mess to clean up."

The exact cost of the fallout from the glitch is unclear, but the cost to brokers and retail traders is likely to be in the eight-figure range, according to a person at a major brokerage who spoke on condition of anonymity because the matter is sensitive.

"Obviously, there were a lot of stocks that had major issues," said Joe Saluzzi, co-manager of trading at Themis Trading in Chatham, New Jersey. "It's a bit of a mess."

Saluzzi said there was "zero failure tolerance" among traders for glitches at the key open and close of trading.

"This is a failure, there is no sugarcoating it," said Saluzzi. "There are definitely people who are losing money today who are not happy."

The opening auction gaffe comes as the SEC is considering routing most retail stock orders through auctions, with the aim of getting individual investors better prices.

"The SEC's plan to make us all cool and groovy with consumer auctions leaves a lot to be desired," said James Angel, a finance professor at Georgetown University.

"Auctions are a lot more complicated than it looks. Lots of things can go wrong," said Angel, who helped work on Nasdaq Inc's auction process.

The NYSE-listed stocks trade on all 16 U.S. stock exchanges, which use the NYSE's prices.

Saluzzi said that having multiple exchanges does not help in a situation like this as the only place to trade an opening order on a New York Stock Exchange-listed stock is that exchange itself.

The NYSE is the only major U.S. stock exchange that still uses a trading floor, along with electronic trading, a hybrid model the exchange says facilitates price discovery during market opens, closes, and during periods of trading imbalances or instability.

Technical errors at exchanges can erode market confidence.

"I had a few discretionary trades to place but chose to wait an additional 30 minutes or so after things seemed to normalize to be sure there were no issues," said Seth Hickle, derivatives portfolio manager at Innovative Portfolios in Indianapolis, Indiana.

To hold exchanges accountable for such glitches, the SEC adopted a sweeping set of business continuity and disaster recovery rules called regulation system compliance and integrity (Reg SCI) in 2014.

In March 2018, the NYSE was the first exchange fined under Reg SCI. The $14 million fine partly related to a nearly four-hour trading halt in July 2015 that resulted from a flawed software rollout.

Steve Sosnick, chief strategist at Interactive Brokers (NASDAQ:IBKR) and head trader at Timber Hill, said the fact the NYSE was allowing member firms to consider filing for claims was "a tacit acknowledgement that there are customers who were victimized by poor or erroneous executions."

"I don't recall this many stocks halted around the open on an otherwise normal day," said Sosnick. "Something went wrong and the NYSE owes us an explanation."

The NYSE, which is owned by Intercontinental Exchange (NYSE:ICE) Inc, said it was still investigating and that traders may want to consider filing for erroneous trade claims. The U.S. Securities and Exchange Commission also said it was reviewing the issue.

The glitch - the most recent in a series since the "flash crash" of 2010 - impacted stocks of major companies including ExxonMobil (NYSE:XOM), 3M, Verizon (NYSE:VZ), McDonald's Corp (NYSE:MCD), Wells Fargo (NYSE:WFC) and WalMart. The companies did not immediately respond to a request for comment.

"What appears to have happened is a technical glitch where all of my opening orders on the NYSE autocancelled even though some of them should have been fulfilled," said Dennis Dick, trader at Triple D Trading.

"They have corrected that now, but this is going to be a big mess to clean up."

The exact cost of the fallout from the glitch is unclear, but the cost to brokers and retail traders is likely to be in the eight-figure range, according to a person at a major brokerage who spoke on condition of anonymity because the matter is sensitive.

"Obviously, there were a lot of stocks that had major issues," said Joe Saluzzi, co-manager of trading at Themis Trading in Chatham, New Jersey. "It's a bit of a mess."

Saluzzi said there was "zero failure tolerance" among traders for glitches at the key open and close of trading.

"This is a failure, there is no sugarcoating it," said Saluzzi. "There are definitely people who are losing money today who are not happy."

The opening auction gaffe comes as the SEC is considering routing most retail stock orders through auctions, with the aim of getting individual investors better prices.

"The SEC's plan to make us all cool and groovy with consumer auctions leaves a lot to be desired," said James Angel, a finance professor at Georgetown University.

"Auctions are a lot more complicated than it looks. Lots of things can go wrong," said Angel, who helped work on Nasdaq Inc's auction process.

The NYSE-listed stocks trade on all 16 U.S. stock exchanges, which use the NYSE's prices.

Saluzzi said that having multiple exchanges does not help in a situation like this as the only place to trade an opening order on a New York Stock Exchange-listed stock is that exchange itself.

The NYSE is the only major U.S. stock exchange that still uses a trading floor, along with electronic trading, a hybrid model the exchange says facilitates price discovery during market opens, closes, and during periods of trading imbalances or instability.

Technical errors at exchanges can erode market confidence.

"I had a few discretionary trades to place but chose to wait an additional 30 minutes or so after things seemed to normalize to be sure there were no issues," said Seth Hickle, derivatives portfolio manager at Innovative Portfolios in Indianapolis, Indiana.

To hold exchanges accountable for such glitches, the SEC adopted a sweeping set of business continuity and disaster recovery rules called regulation system compliance and integrity (Reg SCI) in 2014.

In March 2018, the NYSE was the first exchange fined under Reg SCI. The $14 million fine partly related to a nearly four-hour trading halt in July 2015 that resulted from a flawed software rollout.

Steve Sosnick, chief strategist at Interactive Brokers (NASDAQ:IBKR) and head trader at Timber Hill, said the fact the NYSE was allowing member firms to consider filing for claims was "a tacit acknowledgement that there are customers who were victimized by poor or erroneous executions."

"I don't recall this many stocks halted around the open on an otherwise normal day," said Sosnick. "Something went wrong and the NYSE owes us an explanation."

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

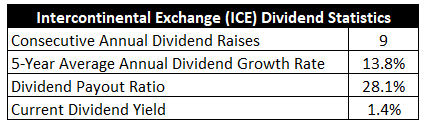

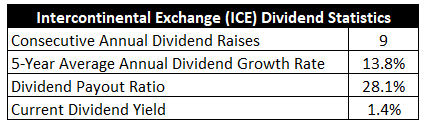

Undervalued Dividend Growth Stock of the Week: Intercontinental Exchange (ICE)

by Jason Fieber, Mr. Free at 33 • January 29, 2023

https://dailytradealert.com/2023/01/29/ ... hange-ice/

by Jason Fieber, Mr. Free at 33 • January 29, 2023

https://dailytradealert.com/2023/01/29/ ... hange-ice/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Latest Release

Feb 02, 2023

EPS / Forecast

1.25 / 1.27

Revenue / Forecast

2.38B / 1.79B

Feb 02, 2023

EPS / Forecast

1.25 / 1.27

Revenue / Forecast

2.38B / 1.79B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Profit of NYSE parent ICE hit by mortgage headwinds, misses views

(Reuters) -New York Stock Exchange-owner Intercontinental Exchange (NYSE:ICE) Inc on Thursday reported a fourth-quarter profit slightly below Wall Street expectations, as rising interest rates weighed on the company's mortgage software business, and its energy and financial futures volumes fell.

The NYSE had a systems glitch at the market open on Tuesday last week that sowed widespread confusion among traders, caused erroneous prices for 251 securities, and resulted in thousands of trades being nullified.

NYSE members have submitted compensation claims for losses, and the exchange could potentially face additional claims from regulators, ICE said in the legal and regulatory risks section of a regulatory filing related to its financial results.

ICE executives did not mention the NYSE glitch on a post-earnings call with analysts.

For the quarter ended Dec. 31, not including one-time costs such as merger and acquisition expenses, ICE reported net income of $1.25 per share, which was a penny off the consensus estimate of analysts, according to Refinitiv.

Aggressive interest rate hikes by the Federal Reserve in the quarter to tame high inflation sapped demand for ICE's mortgage origination business, with its revenues down 28% from a year earlier to $249 million.

The rising rate environment, Russia's war against Ukraine, strict COVID measures in China, and fears of a recession all added headwinds to global markets, with ICE's financial and energy futures revenues slumping 12% and 17%, respectively, to $100 million and $278 million.

Revenue for ICE's exchanges business dropped 3% to $982 million, while revenue for the company's fixed income and data unit rose 12% to $537 million.

Overall revenues dipped 2% to $1.77 billion.

Rival Nasdaq Inc missed analysts' estimates last week for its fourth-quarter profit, recording a significant hit to its indexing revenues as exchange-traded products, which heavily reference its indexes, declined sharply.

(Reuters) -New York Stock Exchange-owner Intercontinental Exchange (NYSE:ICE) Inc on Thursday reported a fourth-quarter profit slightly below Wall Street expectations, as rising interest rates weighed on the company's mortgage software business, and its energy and financial futures volumes fell.

The NYSE had a systems glitch at the market open on Tuesday last week that sowed widespread confusion among traders, caused erroneous prices for 251 securities, and resulted in thousands of trades being nullified.

NYSE members have submitted compensation claims for losses, and the exchange could potentially face additional claims from regulators, ICE said in the legal and regulatory risks section of a regulatory filing related to its financial results.

ICE executives did not mention the NYSE glitch on a post-earnings call with analysts.

For the quarter ended Dec. 31, not including one-time costs such as merger and acquisition expenses, ICE reported net income of $1.25 per share, which was a penny off the consensus estimate of analysts, according to Refinitiv.

Aggressive interest rate hikes by the Federal Reserve in the quarter to tame high inflation sapped demand for ICE's mortgage origination business, with its revenues down 28% from a year earlier to $249 million.

The rising rate environment, Russia's war against Ukraine, strict COVID measures in China, and fears of a recession all added headwinds to global markets, with ICE's financial and energy futures revenues slumping 12% and 17%, respectively, to $100 million and $278 million.

Revenue for ICE's exchanges business dropped 3% to $982 million, while revenue for the company's fixed income and data unit rose 12% to $537 million.

Overall revenues dipped 2% to $1.77 billion.

Rival Nasdaq Inc missed analysts' estimates last week for its fourth-quarter profit, recording a significant hit to its indexing revenues as exchange-traded products, which heavily reference its indexes, declined sharply.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Intercontinental Exchange and Black Knight announce agreement to sell LOS business to ease regulator concerns

Intercontinental Exchange (NYSE:ICE) and Black Knight Inc. (NYSE:BKI) jumped Tuesday morning after the companies said they have agreed to sell Black Knight's Empower loan origination system (LOS) business, including its Exchange, LendingSpace, and AIVA solutions, to a subsidiary of Constellation Software Inc. (OTC:CNSWF).

Last May, ICE revealed it had reached a definitive agreement to acquire Black Knight, but it raised scrutiny regarding antitrust concerns and data privacy issues.

The deal to sell Black Knight's Empower loan origination system business is part of a move to ease regulator concerns.

"ICE and Black Knight entered into the divestiture agreement in connection with efforts to secure clearance of ICE's proposed acquisition of Black Knight under the Hart-Scott Rodino Act," ICE and BKI said in a statement.

The amended merger agreement terms value Black Knight at $75 per share or $11.7 billion. Ice's acquisition of BKI remains under review by the Federal Trade Commission (FTC).

Black Knight shares are currently up over 4%, while ICE is trading more than 2% above Monday's close.

Intercontinental Exchange (NYSE:ICE) and Black Knight Inc. (NYSE:BKI) jumped Tuesday morning after the companies said they have agreed to sell Black Knight's Empower loan origination system (LOS) business, including its Exchange, LendingSpace, and AIVA solutions, to a subsidiary of Constellation Software Inc. (OTC:CNSWF).

Last May, ICE revealed it had reached a definitive agreement to acquire Black Knight, but it raised scrutiny regarding antitrust concerns and data privacy issues.

The deal to sell Black Knight's Empower loan origination system business is part of a move to ease regulator concerns.

"ICE and Black Knight entered into the divestiture agreement in connection with efforts to secure clearance of ICE's proposed acquisition of Black Knight under the Hart-Scott Rodino Act," ICE and BKI said in a statement.

The amended merger agreement terms value Black Knight at $75 per share or $11.7 billion. Ice's acquisition of BKI remains under review by the Federal Trade Commission (FTC).

Black Knight shares are currently up over 4%, while ICE is trading more than 2% above Monday's close.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

NEW YORK, April 12 (Reuters) - Short interest on the New York Stock Exchange rose 2.0 percent in late March, the exchange said on Wednesday.

As of March 31, short interest rose to about 16.178 billion shares, compared with 15.868 billion shares as of March 15.

Investors who sell securities short borrow shares and then sell them, expecting the stock to fall so they can buy the shares back at the lower price, return them to the lender and pocket the difference.

As of March 31, short interest rose to about 16.178 billion shares, compared with 15.868 billion shares as of March 15.

Investors who sell securities short borrow shares and then sell them, expecting the stock to fall so they can buy the shares back at the lower price, return them to the lender and pocket the difference.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Britain’s top 100 companies would be worth towards £500 billion more if they moved their stock market listings to New York, shock analysis for the Evening Standard shows.

Amidst growing fears that the London stock market, once the premier equity index in the world, is in danger of becoming a backwater for equities, research shows the gap in valuations is worse than previously realised.

More and more large businesses are threatening to move their share listing away from London in frustration at the low value given to their shares.

The FTSE 100 market value is today about £2.55 trillion. Based on its combined profits and earnings, it would be £460 billion higher were US share values applied.

The world of investment did not take the UK’s decision to leave the EU too kindly. In fact ever since June 2016 confidence in the UK as a country to invest in has slowly dissipated.

Alan Miller of SCM Direct, who compiled the figures, says Brexit and a focus on ESG (environmental, social and governance) issues have made investors wary of UK shares.

He said: “The world of investment did not take the UK’s decision to leave the EU too kindly, with confidence in the UK as a country to invest in slowly dissipating since June 2016.

“However, the real gulf in valuations is between the US and UK. In the last seven years, the average US company coming to market is valued over a 3-year period at 25x earnings. In the UK it is only roughly 15x earnings.

“UK companies on a like for like basis are valued 18% less than their Us counterparts. This anomaly ventures to suggest that if the UK companies were quoted in New York their valuation would probably be £460 billion higher than it currently is. No wonder investors have become wary.”

These low valuations leave top UK companies vulnerable to bids from private equity. In February Canaccord Genuity drew up a list of 20 top UK companies at risk, including Hikma Pharma, Computacenter, Playtech and RWS.

Last night Dechra Pharma said it is in talks over a £4.6 billion bid from EQT, a Swedish private equity house.

There are growing calls for the government to act to prevent an exodus of companies away from the City. In particular, pension funds, which are encouraged by regulators to buy bonds rather than shares, should be set free, say many.

Miller adds: “The Government must pull the led out to encourage reluctant visitors back into the fold. London must offer attractive regulatory requirements and taxation benefits as soon as possible.”

Alasdair Haynes of Acquis Exchange said: "This is a startling gap in valuations between the US and London and a worrying sign. Regulations need to change. I have been calling for a radical overhaul of stock exchange rules and I hope that the FCA and the government will address these issues with a sense of urgency.”

Miller’s detailed analysis, which can be read below, applies across most sectors. Even the UK’s unloved banking sector would be valued around 25% higher if they were listed in America.

Figures earlier this week showed there have been just five new stock market floats in London this year, raising a paltry £81 million. That is thin gruel for the brokers who rely on deals to stay in business. Job cuts across the City are beginning to cut deep.

The government is planning a series of measures in the Autumn statement to bolster City competitiveness, but there are fears this may be too-little-too late.

https://www.standard.co.uk/business/bri ... 74084.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Latest Release

May 04, 2023

EPS / Forecast

1.41 / 1.4

Revenue / Forecast

1.9B / 1.89B

May 04, 2023

EPS / Forecast

1.41 / 1.4

Revenue / Forecast

1.9B / 1.89B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

NYSE-parent ICE beats profit estimates on upbeat trading volumes

(Reuters) -Intercontinental Exchange on Thursday reported second-quarter profit above Wall Street estimates as higher trading volumes at the New York Stock Exchange parent more than offset weakness in its mortgage technology unit.

Revenue from ICE (NYSE:ICE)'s exchanges segment, its biggest business, rose 9% to $1.09 billion from a year earlier, while the company's mortgage technology segment saw a slump of 16% to $249 million.

The results round out an upbeat quarter for the biggest U.S. exchanges as Nasdaq and CME Group (NASDAQ:CME) also reported a rise in profit last month.

On an adjusted basis, ICE reported a profit of $1.43 per share for the quarter ended June 30, above analysts' average estimates of $1.37 a piece, according to Refinitiv data.

https://www.investing.com/news/stock-ma ... it-3143584

(Reuters) -Intercontinental Exchange on Thursday reported second-quarter profit above Wall Street estimates as higher trading volumes at the New York Stock Exchange parent more than offset weakness in its mortgage technology unit.

Revenue from ICE (NYSE:ICE)'s exchanges segment, its biggest business, rose 9% to $1.09 billion from a year earlier, while the company's mortgage technology segment saw a slump of 16% to $249 million.

The results round out an upbeat quarter for the biggest U.S. exchanges as Nasdaq and CME Group (NASDAQ:CME) also reported a rise in profit last month.

On an adjusted basis, ICE reported a profit of $1.43 per share for the quarter ended June 30, above analysts' average estimates of $1.37 a piece, according to Refinitiv data.

https://www.investing.com/news/stock-ma ... it-3143584

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Intercontinental Exchange NYSE: ICE exchange and commodity clearing house wł. giełdy w Nowym Jorku - NYSE, LIFFE

Undervalued Dividend Growth Stock of the Week: Intercontinental Exchange (ICE)Undervalued Dividend Growth Stock of the Week: Intercontinental Exchange (ICE)

by Jason Fieber, Mr. Free at 33 • January 29, 2023

https://dailytradealert.com/2023/01/29/ ... hange-ice/

by Jason Fieber, Mr. Free at 33 • October 1, 2023

https://dailytradealert.com/2023/10/01/ ... nge-ice-2/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 91 gości