It's More Than Earnings Holding Back Walgreens

Walgreens Boots Alliance Inc. (NASDAQ: WBA) slid on Thursday after the company reported its fiscal third-quarter financial results. The company said that it had $0.83 in earnings per share (EPS) and $34.6 billion in revenue, which fell short of consensus estimates that called for $1.17 in EPS and $34.35 billion in revenue. The same period of last year reportedly had EPS of $1.47 in EPS and revenue of $34.59 billion.

During the fiscal third quarter, sales increased 0.1%, or 1.2% on a constant currency basis, led by Retail Pharmacy USA comparable sales growth of 3.0%.

Retail Pharmacy USA segment sales increased 3.2% to $27.4 billion, including the impact of previously announced store closures. Sales in comparable stores increased 3.0% from the year-ago quarter.

Retail Pharmacy International had third-quarter sales of $1.9 billion, a decrease of 31.5% year over year, including an adverse currency impact of 5.3%. Sales decreased 26.2% on a constant currency basis, mainly due to a 27.7% decrease in Boots UK sales as foot traffic in stores was severely disrupted by COVID-19 restrictions.

Pharmaceutical Wholesale had a third-quarter sales increase of 0.6% to $5.9 billion, including an adverse currency impact of 4.8%. On a constant currency basis, sales increased 5.3%, led by the United Kingdom and Germany.

Net cash from operating activities totaled $3.4 billion, an increase of $183 million from last year. Free cash flow increased 23.7% to $2.4 billion. The company ended the quarter with $768 million in cash and cash equivalents on the books, compared with $1.02 billion at the end of fiscal 2019.

Looking ahead, Walgreens expects to see full fiscal year EPS in the range of $4.65 to $4.75, including an estimated impact of COVID-19 of $1.03 to $1.14 per share. For the year, analysts are calling for $5.42 in EPS and $139.26 billion in revenue.

Walgreens stock traded down 9% on Thursday, at $38.41 in a 52-week range of $36.65 to $64.50. The consensus price target is $45.76.

https://247wallst.com/retail/2020/07/09 ... ens-stock/

Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

There's Plenty for Investors to Like About Walgreens

Walgreens Boots Alliance Inc. (NASDAQ: WBA) reported fiscal fourth-quarter and full-year 2020 results before markets opened Thursday. The drugstore chain reported quarterly adjusted diluted earnings per share (EPS) of $1.02 on net sales of $34.7 billion. In the same period a year ago, Walgreen reported EPS of $1.43 on revenue of $33.95 billion. Fourth-quarter results also compare to the consensus estimates for EPS of $0.96 and $34.37 billion in sales.

For the full fiscal year, Walgreens reported EPS of $4.74 and sales of $139.5 billion, compared to 2019 EPS of $5.99 and sales of $136.87 billion. Analysts were looking for EPS of $4.68 and revenue of $139.71 billion.

Walgreens estimated that COVID-19-related effects cost the company about $0.46 per share in the quarter. Lower U.S. pharmacy gross profits and higher bonus payments also weighed on earnings.

In the fourth quarter, the company spent $269 million on its transformational cost management initiative, running the annual total up to $793 million, nearly doubling the $477 million Walgreens spent on the program in 2019. The program gets credit for partially offsetting the impact of the pandemic on profits. According to the company, the transformation program is “on track” to deliver more than $2 billion in annual cost savings by fiscal year 2022.

In its outlook statement, Walgreens guided adjusted EPS growth in the low single digits on a constant currency basis. First-half results are expected to continue seeing negative effects from the coronavirus outbreak, but the company expects “strong” EPS growth in the second half of the 2021 fiscal year.

Analysts have a consensus first-quarter EPS estimate of $1.03 on revenue of $34.91 billion. For the full fiscal year, they’re looking for EPS of $4.80 and sales of $142.86 billion.

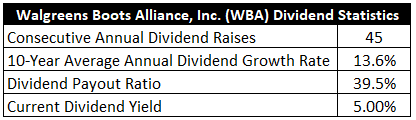

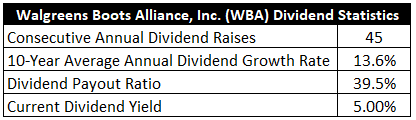

Walgreens shares have lost 44% of their value over the past 12 months and 55% over the past three years. The company raised its annual dividend by four cents a share in the fourth quarter to $1.87, yielding 5.21% at the current share price. The company has raised its dividend every year for 45 consecutive years and has paid a dividend in 87 years.

After jumping more than 4% in early premarket trading, shares pulled back a bit to trade up about 2.4%, at $36.77 in a 52-week range of $33.88 to $64.50. The consensus price target on the stock is $40.00, implying a potential upside of 10% on the stock based on Wednesday’s closing price. Shares are trading at about 7.5 times expected 2021 earnings and about 6.9 times expected 2022 earnings.

Most analysts rate the stock a Hold, although both BofA and Goldman Sachs have recent Sell ratings on it and price targets of $37 and $33, respectively.

https://247wallst.com/retail/2020/10/15 ... walgreens/

Walgreens Boots Alliance Inc. (NASDAQ: WBA) reported fiscal fourth-quarter and full-year 2020 results before markets opened Thursday. The drugstore chain reported quarterly adjusted diluted earnings per share (EPS) of $1.02 on net sales of $34.7 billion. In the same period a year ago, Walgreen reported EPS of $1.43 on revenue of $33.95 billion. Fourth-quarter results also compare to the consensus estimates for EPS of $0.96 and $34.37 billion in sales.

For the full fiscal year, Walgreens reported EPS of $4.74 and sales of $139.5 billion, compared to 2019 EPS of $5.99 and sales of $136.87 billion. Analysts were looking for EPS of $4.68 and revenue of $139.71 billion.

Walgreens estimated that COVID-19-related effects cost the company about $0.46 per share in the quarter. Lower U.S. pharmacy gross profits and higher bonus payments also weighed on earnings.

In the fourth quarter, the company spent $269 million on its transformational cost management initiative, running the annual total up to $793 million, nearly doubling the $477 million Walgreens spent on the program in 2019. The program gets credit for partially offsetting the impact of the pandemic on profits. According to the company, the transformation program is “on track” to deliver more than $2 billion in annual cost savings by fiscal year 2022.

In its outlook statement, Walgreens guided adjusted EPS growth in the low single digits on a constant currency basis. First-half results are expected to continue seeing negative effects from the coronavirus outbreak, but the company expects “strong” EPS growth in the second half of the 2021 fiscal year.

Analysts have a consensus first-quarter EPS estimate of $1.03 on revenue of $34.91 billion. For the full fiscal year, they’re looking for EPS of $4.80 and sales of $142.86 billion.

Walgreens shares have lost 44% of their value over the past 12 months and 55% over the past three years. The company raised its annual dividend by four cents a share in the fourth quarter to $1.87, yielding 5.21% at the current share price. The company has raised its dividend every year for 45 consecutive years and has paid a dividend in 87 years.

After jumping more than 4% in early premarket trading, shares pulled back a bit to trade up about 2.4%, at $36.77 in a 52-week range of $33.88 to $64.50. The consensus price target on the stock is $40.00, implying a potential upside of 10% on the stock based on Wednesday’s closing price. Shares are trading at about 7.5 times expected 2021 earnings and about 6.9 times expected 2022 earnings.

Most analysts rate the stock a Hold, although both BofA and Goldman Sachs have recent Sell ratings on it and price targets of $37 and $33, respectively.

https://247wallst.com/retail/2020/10/15 ... walgreens/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Undervalued Dividend Growth Stock of the Week: Walgreens Boots Alliance (WBA)

https://dailytradealert.com/2020/10/25/ ... iance-wba/

https://www.youtube.com/watch?v=AZ4GZ5h ... sAndIncome

https://dailytradealert.com/2020/10/25/ ... iance-wba/

https://www.youtube.com/watch?v=AZ4GZ5h ... sAndIncome

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens Boots Alliance WBA reports Thursday: EPS seen down 25.6% to $1.02 sales up 1.7% to $34.9 billion.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

AmerisourceBergen (NYSE:ABC) stock rose 4.3% after the drug distributor announced plans to buy Walgreens Boots Alliance (NASDAQ:WBA)'s distribution business, Alliance Healthcare, for $6.5 billion. Walgreens stock rose 2.3%.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens Tops Fiscal 1Q Forecasts As It Fights Pandemic Hit

Walgreens Boots Alliance lost $308 million in its first fiscal quarter on a big charge tied to its stake in the drug wholesaler AmerisourceBergen.

COVID-19 also continued to eat away at its business, particularly in the United Kingdom. But the drugstore chain’s overall performance topped expectations and shares climbed after markets opened.

Walgreens executives told analysts Thursday morning that the ongoing pandemic delivered a hit of between $290 million to $325 million to the company's adjusted operating income in the quarter.

That's a lower amount than in the two previous quarters, and company officials have said they expect the pandemic’s impact to subside in the second half of the fiscal year.

“We remain cautiously optimistic for the year as a whole,” said Executive Vice Chairman and CEO Stefano Pessina.

In its fiscal first quarter, Walgreens booked a $1.5 billion charge tied to its ownership share of AmerisourceBergen. Walgreens has a roughly 30% stake in the company, and the charge accounted for Walgreens’ portion of a recent AmerisourceBergen quarterly loss, a spokeswoman said.

Walgreens runs more than 21,000 stores mainly in the United States and United Kingdom. Its drugstores and the stores of other retailers were hit hard last year, particularly in the spring, by a global pandemic that kept customers away.

Walgreens said it still felt the pandemic in its fiscal first quarter, with fewer customer visits and new prescription starts as people stayed away from doctor offices as well. It also saw weaker sales of products to help with colds, coughs and the flu.

In the United Kingdom, sales at Boots stores opened at least a year dropped 9% compared to the previous year. That hit was countered, in part, by growth in Boots online sales.

Walgreens and rival CVS Health Corp. have delivered thousands of COVID-19 vaccinations at nursing homes and other long-term care locations since last month, and the drugstore chains expect to play a big role in doling out shots when they become available to more people later this year.

But Walgreens said gains from those shots will likely be countered in part by pandemic-related lockdowns or restrictions.

Overall, Walgreens booked adjusted earnings of $1.22 per share in the quarter that ended Nov. 30. Revenue grew nearly 6% to $36.31 billion.

Analysts expected, on average, earnings of $1.02 per share on $34.93 billion in revenue, according to Zacks Investment Research.

Walgreens announced last July that Pessina would step down as CEO as soon as the company finds his successor. The chief executive said Thursday that Walgreens' board has been “very active” in its search, and he hopes to have news to share soon.

Shares of Deerfield, Illinois-based Walgreens Boots Alliance Inc. jumped 7% to $46.05 Thursday morning while the Dow Jones industrial average — of which Walgreens is a component — climbed 1%.

Walgreens stock also climbed Wednesday after the company said it would sell its pharmaceutical wholesale business to AmerisourceBergen for $6.5 billion.

https://www.barchart.com/story/news/913 ... ndemic-hit

Walgreens Boots Alliance lost $308 million in its first fiscal quarter on a big charge tied to its stake in the drug wholesaler AmerisourceBergen.

COVID-19 also continued to eat away at its business, particularly in the United Kingdom. But the drugstore chain’s overall performance topped expectations and shares climbed after markets opened.

Walgreens executives told analysts Thursday morning that the ongoing pandemic delivered a hit of between $290 million to $325 million to the company's adjusted operating income in the quarter.

That's a lower amount than in the two previous quarters, and company officials have said they expect the pandemic’s impact to subside in the second half of the fiscal year.

“We remain cautiously optimistic for the year as a whole,” said Executive Vice Chairman and CEO Stefano Pessina.

In its fiscal first quarter, Walgreens booked a $1.5 billion charge tied to its ownership share of AmerisourceBergen. Walgreens has a roughly 30% stake in the company, and the charge accounted for Walgreens’ portion of a recent AmerisourceBergen quarterly loss, a spokeswoman said.

Walgreens runs more than 21,000 stores mainly in the United States and United Kingdom. Its drugstores and the stores of other retailers were hit hard last year, particularly in the spring, by a global pandemic that kept customers away.

Walgreens said it still felt the pandemic in its fiscal first quarter, with fewer customer visits and new prescription starts as people stayed away from doctor offices as well. It also saw weaker sales of products to help with colds, coughs and the flu.

In the United Kingdom, sales at Boots stores opened at least a year dropped 9% compared to the previous year. That hit was countered, in part, by growth in Boots online sales.

Walgreens and rival CVS Health Corp. have delivered thousands of COVID-19 vaccinations at nursing homes and other long-term care locations since last month, and the drugstore chains expect to play a big role in doling out shots when they become available to more people later this year.

But Walgreens said gains from those shots will likely be countered in part by pandemic-related lockdowns or restrictions.

Overall, Walgreens booked adjusted earnings of $1.22 per share in the quarter that ended Nov. 30. Revenue grew nearly 6% to $36.31 billion.

Analysts expected, on average, earnings of $1.02 per share on $34.93 billion in revenue, according to Zacks Investment Research.

Walgreens announced last July that Pessina would step down as CEO as soon as the company finds his successor. The chief executive said Thursday that Walgreens' board has been “very active” in its search, and he hopes to have news to share soon.

Shares of Deerfield, Illinois-based Walgreens Boots Alliance Inc. jumped 7% to $46.05 Thursday morning while the Dow Jones industrial average — of which Walgreens is a component — climbed 1%.

Walgreens stock also climbed Wednesday after the company said it would sell its pharmaceutical wholesale business to AmerisourceBergen for $6.5 billion.

https://www.barchart.com/story/news/913 ... ndemic-hit

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens to Add Bank Accounts in Venture With InComm

Walgreens is expanding its financial-services offerings with a new bank account and debit card.

TONY OWUSU18 HOURS AGO

Walgreens Boots Alliance (WBA) - Get Report will debut a bank account for customers that will offer rewards tied to the drugstore giant's loyalty program.

The Deerfield, Ill., company unveiled an agreement with InComm Payments, the Atlanta global payment-technology company, to expand financial-services options for its customers.

Read More: Walgreens Jumps as Wall Street Weight In on New CEO Hire

Walgreens and InComm will launch bank accounts, to be established at MetaBank, the Sioux Falls, S.D., financial-services company focused on lower-income individuals.

Alongside the accounts will be a Mastercard (MA) - Get Report debit card that customers can use in store and online and enables them to earn cash rewards on purchases.

Walgreens launched its myWalgreens customer-loyalty program in November.

"This new product offering will establish Walgreens as a destination for financial services, building on Walgreens’ legacy as a one-stop shop for pharmacy and convenience," InComm President Stefan Happ said.

Additionally, Walgreens and InComm plan to relaunch the Walgreens-branded gift- card program.

Video: Roz Brewer Takes the Helm at Walgreens

Last week, Walgreens was added to Deutsche Bank's Catalyst Call Buy Idea list while the firm boosted its price target to $55 a share from $49.

Walgreens is scheduled to report its quarterly results before the opening bell on Wednesday.

The company is expected to report net income of $948.4 million, or $1.13 a share, on sales of $36.5 billion, based on a FactSet survey of 20 analysts.

For the year-earlier quarter the company posted earnings of $844 million, or $1.52 a share, on sales of $35.8 billion.

The stock has risen 14% since the company last reported earnings on Jan. 7.

https://www.thestreet.com/investing/wal ... debit-card

Walgreens is expanding its financial-services offerings with a new bank account and debit card.

TONY OWUSU18 HOURS AGO

Walgreens Boots Alliance (WBA) - Get Report will debut a bank account for customers that will offer rewards tied to the drugstore giant's loyalty program.

The Deerfield, Ill., company unveiled an agreement with InComm Payments, the Atlanta global payment-technology company, to expand financial-services options for its customers.

Read More: Walgreens Jumps as Wall Street Weight In on New CEO Hire

Walgreens and InComm will launch bank accounts, to be established at MetaBank, the Sioux Falls, S.D., financial-services company focused on lower-income individuals.

Alongside the accounts will be a Mastercard (MA) - Get Report debit card that customers can use in store and online and enables them to earn cash rewards on purchases.

Walgreens launched its myWalgreens customer-loyalty program in November.

"This new product offering will establish Walgreens as a destination for financial services, building on Walgreens’ legacy as a one-stop shop for pharmacy and convenience," InComm President Stefan Happ said.

Additionally, Walgreens and InComm plan to relaunch the Walgreens-branded gift- card program.

Video: Roz Brewer Takes the Helm at Walgreens

Last week, Walgreens was added to Deutsche Bank's Catalyst Call Buy Idea list while the firm boosted its price target to $55 a share from $49.

Walgreens is scheduled to report its quarterly results before the opening bell on Wednesday.

The company is expected to report net income of $948.4 million, or $1.13 a share, on sales of $36.5 billion, based on a FactSet survey of 20 analysts.

For the year-earlier quarter the company posted earnings of $844 million, or $1.52 a share, on sales of $35.8 billion.

The stock has risen 14% since the company last reported earnings on Jan. 7.

https://www.thestreet.com/investing/wal ... debit-card

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Latest Release

Mar 31, 2021

EPS / Forecast

1.4 / 1.13

Revenue / Forecast

-- / 36.49B

Mar 31, 2021

EPS / Forecast

1.4 / 1.13

Revenue / Forecast

-- / 36.49B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

PUBLIKACJA: 06.04.2021 05:10

Perspektywy rozwoju zachęcają

Walgreens Boots Alliance. Jedna z najwyższych stóp zwrotu w indeksie Dow Jones.

Amerykański gigant włączył się aktywnie w zwalczanie pandemii koronawirusa, co może pozytywnie wpłynąć na wyniki. Notowania idą w górę, a zachętą jest również dywidenda.

Walgreens Boots Alliance to amerykańska spółka, która jest właścicielem Walgreens, jednej z największych sieci farmaceutycznych w USA, oraz brytyjskiej sieci Boots. Ponadto spółka kontroluje wiele innych firm farmaceutycznych zajmujących się produkcją, sprzedażą hurtową i dystrybucją.

https://www.parkiet.com/Zagraniczna-Spo ... ecaja.html

Perspektywy rozwoju zachęcają

Walgreens Boots Alliance. Jedna z najwyższych stóp zwrotu w indeksie Dow Jones.

Amerykański gigant włączył się aktywnie w zwalczanie pandemii koronawirusa, co może pozytywnie wpłynąć na wyniki. Notowania idą w górę, a zachętą jest również dywidenda.

Walgreens Boots Alliance to amerykańska spółka, która jest właścicielem Walgreens, jednej z największych sieci farmaceutycznych w USA, oraz brytyjskiej sieci Boots. Ponadto spółka kontroluje wiele innych firm farmaceutycznych zajmujących się produkcją, sprzedażą hurtową i dystrybucją.

https://www.parkiet.com/Zagraniczna-Spo ... ecaja.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Latest Release

Jul 01, 2021

EPS / Forecast

1.51 / 1.15

Revenue / Forecast

34.03B / 33.49B

Walgreens Boots Earnings, Revenue Beat in Q3

Investing.com - Walgreens Boots (NASDAQ:WBA) reported on Thursday third quarter earnings that beat analysts' forecasts and revenue that topped expectations.

Walgreens Boots announced earnings per share of $1.38 on revenue of $34.03B. Analysts polled by Investing.com anticipated EPS of $1.15 on revenue of $33.49B.

Walgreens Boots shares are up 31.92% from the beginning of the year, still down 7.77% from its 52 week high of $57.04 set on April 6. They are outperforming the Nasdaq which is up 12.54% from the start of the year.

Walgreens Boots follows other major Consumer Staples sector earnings this month

Walgreens Boots's report follows an earnings missed by Constellation Brands B on Wednesday, who reported EPS of $2.33 on revenue of $2.03B, compared to forecasts EPS of $2.37 on revenue of $2.03B.

Alimentation Couchen A had beat expectations on Tuesday with fourth quarter EPS of $0.52 on revenue of $12.24B, compared to forecast for EPS of $0.44 on revenue of $11,435M.

https://www.investing.com/news/stock-ma ... q3-2547385

Jul 01, 2021

EPS / Forecast

1.51 / 1.15

Revenue / Forecast

34.03B / 33.49B

Walgreens Boots Earnings, Revenue Beat in Q3

Investing.com - Walgreens Boots (NASDAQ:WBA) reported on Thursday third quarter earnings that beat analysts' forecasts and revenue that topped expectations.

Walgreens Boots announced earnings per share of $1.38 on revenue of $34.03B. Analysts polled by Investing.com anticipated EPS of $1.15 on revenue of $33.49B.

Walgreens Boots shares are up 31.92% from the beginning of the year, still down 7.77% from its 52 week high of $57.04 set on April 6. They are outperforming the Nasdaq which is up 12.54% from the start of the year.

Walgreens Boots follows other major Consumer Staples sector earnings this month

Walgreens Boots's report follows an earnings missed by Constellation Brands B on Wednesday, who reported EPS of $2.33 on revenue of $2.03B, compared to forecasts EPS of $2.37 on revenue of $2.03B.

Alimentation Couchen A had beat expectations on Tuesday with fourth quarter EPS of $0.52 on revenue of $12.24B, compared to forecast for EPS of $0.44 on revenue of $11,435M.

https://www.investing.com/news/stock-ma ... q3-2547385

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Latest Release

Oct 14, 2021

EPS / Forecast

1.17 / 1.02

Revenue / Forecast

34.26B / 33.01B

Oct 14, 2021

EPS / Forecast

1.17 / 1.02

Revenue / Forecast

34.26B / 33.01B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens inwestuje 5,2 mld USD w VillageMD, obejmując większościowy udział

Walgreens Boots Alliance (NASDAQ: WBA) ogłosił w czwartek, że zgodził się nabyć większościowy pakiet udziałów w prywatnej firmie świadczącej podstawową opiekę zdrowotną, VillageMD. Gigant opieki zdrowotnej i farmacji otwiera setki gabinetów lekarskich we współpracy z VillageMD. W ramach umowy Walgreens zainwestuje 5,2 mld USD w VillageMD, co zwiększy udziały Walgreens z 30% do 63%. Jednak VillageMD pozostanie niezależnym podmiotem z własnym kierownictwem i zarządem. Dyrektor generalny Walgreens powiedział, że nowe kliniki uproszczą opiekę nad pacjentami, a farmaceuci i lekarze Walgreens i VillageMD będą ze sobą współpracować. Ich celem jest otwarcie co najmniej 600 przychodni podstawowej opieki zdrowotnej w Stanach Zjednoczonych do 2025 r. i 1000 do 2027 r. Spółka Walgreens dodała, że oczekuje, że umowa VillageMD zostanie sfinalizowana do końca roku. Obecnie oczekuje ona na zatwierdzenie przez organy regulacyjne. W południe cena akcji Walgreens wzrosła o 4,8% do 49,55 USD za sztukę.

https://www.paszport.ws/newsfeed

Walgreens Boots Alliance (NASDAQ: WBA) ogłosił w czwartek, że zgodził się nabyć większościowy pakiet udziałów w prywatnej firmie świadczącej podstawową opiekę zdrowotną, VillageMD. Gigant opieki zdrowotnej i farmacji otwiera setki gabinetów lekarskich we współpracy z VillageMD. W ramach umowy Walgreens zainwestuje 5,2 mld USD w VillageMD, co zwiększy udziały Walgreens z 30% do 63%. Jednak VillageMD pozostanie niezależnym podmiotem z własnym kierownictwem i zarządem. Dyrektor generalny Walgreens powiedział, że nowe kliniki uproszczą opiekę nad pacjentami, a farmaceuci i lekarze Walgreens i VillageMD będą ze sobą współpracować. Ich celem jest otwarcie co najmniej 600 przychodni podstawowej opieki zdrowotnej w Stanach Zjednoczonych do 2025 r. i 1000 do 2027 r. Spółka Walgreens dodała, że oczekuje, że umowa VillageMD zostanie sfinalizowana do końca roku. Obecnie oczekuje ona na zatwierdzenie przez organy regulacyjne. W południe cena akcji Walgreens wzrosła o 4,8% do 49,55 USD za sztukę.

https://www.paszport.ws/newsfeed

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens Boots (NASDAQ:WBA) stock rose 2.7% after the pharmacy chain posted a profit for the first quarter versus a loss a year ago, allowing the company to raise its full-year forecast. Heavy customer demand for Covid vaccines and tests were a big factor behind the results.

https://www.fxempire.com/forecasts/arti ... sed-858052

https://www.fxempire.com/forecasts/arti ... sed-858052

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Drugstore chain Walgreens Boots Alliance (NASDAQ:WBA) fell 4.8% after the company kept its 2022 forecast of low-single digit earnings growth unchanged.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Walgreens Boots Alliance Inc. NASDAQ: WBA apteki, p. farmaceutyczny

Walgreens zawiera ugodę z władzami Florydy w sprawie opioidów na kwotę 683 mln USD

Firma Walgreens Boots Alliance (NASDAQ: WBA) poinformowała w czwartek, że zawarła ugodę z władzami stanu Floryda na kwotę 683 mln USD w celu rozstrzygnięcia sporu, w którym oskarżono firmę farmaceutyczną o zaostrzenie epidemii opioidów w tym stanie. Prokurator generalna Ashley Moody powiedziała: „Cieszę się, że udało nam się zakończyć ten monumentalny spór sądowy i opuścić salę sądową”. Ugoda obejmuje 620 mln USD, które Walgreens zapłaci Florydzie w ciągu 18 lat, plus 63 mln USD opłat prawnych. Ugoda kończy również proces sądowy, który rozpoczął się 11 kwietnia, po tym jak firma Walgreens zdecydowała się nie przyłączać do ugody o łącznej wartości 878 mln USD, zawartej z czterema innymi firmami z branży opieki zdrowotnej. W ramach ugody Walgreens nie przyznał się do popełnienia wykroczeń. Według Moody, Floryda odzyskała ponad 3 mld USD w procesach sądowych dotyczących opioidów wytoczonych przeciwko firmom farmaceutycznym, dystrybutorom i aptekom, a większość pieniędzy przeznaczy na działania mające na celu złagodzenie kryzysu opioidowego. W połowie dnia notowania Walgreens spadły o 1,55%.

https://www.paszport.ws/newsfeed#

Firma Walgreens Boots Alliance (NASDAQ: WBA) poinformowała w czwartek, że zawarła ugodę z władzami stanu Floryda na kwotę 683 mln USD w celu rozstrzygnięcia sporu, w którym oskarżono firmę farmaceutyczną o zaostrzenie epidemii opioidów w tym stanie. Prokurator generalna Ashley Moody powiedziała: „Cieszę się, że udało nam się zakończyć ten monumentalny spór sądowy i opuścić salę sądową”. Ugoda obejmuje 620 mln USD, które Walgreens zapłaci Florydzie w ciągu 18 lat, plus 63 mln USD opłat prawnych. Ugoda kończy również proces sądowy, który rozpoczął się 11 kwietnia, po tym jak firma Walgreens zdecydowała się nie przyłączać do ugody o łącznej wartości 878 mln USD, zawartej z czterema innymi firmami z branży opieki zdrowotnej. W ramach ugody Walgreens nie przyznał się do popełnienia wykroczeń. Według Moody, Floryda odzyskała ponad 3 mld USD w procesach sądowych dotyczących opioidów wytoczonych przeciwko firmom farmaceutycznym, dystrybutorom i aptekom, a większość pieniędzy przeznaczy na działania mające na celu złagodzenie kryzysu opioidowego. W połowie dnia notowania Walgreens spadły o 1,55%.

https://www.paszport.ws/newsfeed#

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 28 gości