Altria Cuts Juul Valuation to Below $5 Billion

Marlboro maker’s valuation of Juul is half of what e-cigarette company says it is worth and down from $38 billion two years ago

https://www.wsj.com/articles/altria-cut ... business_f

https://www.investing.com/news/stock-ma ... nt-2337197

Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Altria: Costly Lessons You Must Learn

Summary

Altria is best of breed in the world of smoke and smokeless products.

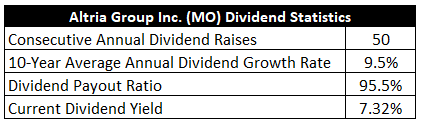

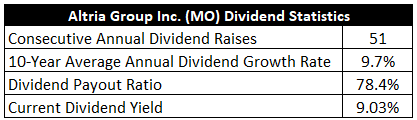

This is the top of all Dividend Kings, with a 9.53% yield and 54 consecutive dividend increases in the past 50 years.

All that glitters is not gold. Beware as Altria steals your capital to pay its dividend.

https://seekingalpha.com/article/438416 ... rIh-DEKaBs

Summary

Altria is best of breed in the world of smoke and smokeless products.

This is the top of all Dividend Kings, with a 9.53% yield and 54 consecutive dividend increases in the past 50 years.

All that glitters is not gold. Beware as Altria steals your capital to pay its dividend.

https://seekingalpha.com/article/438416 ... rIh-DEKaBs

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

RBC Capital Stick to Their Buy Rating for Altria Group Inc

RBC Capital analyst Nik Modi maintained a Buy rating on Altria Group (NYSE:MO) Inc on Monday, setting a price target of $68, which is approximately 86.40% above the present share price of $36.48.

Modi expects Altria Group Inc to post earnings per share (EPS) of $0.00 for the fourth quarter of 2020.

The current consensus among 4 TipRanks analysts is for a Strong Buy rating of shares in Altria Group, with an average price target of $54.67.

The analysts price targets range from a high of $68 to a low of $47.

In its latest earnings report, released on 09/30/2020, the company reported a quarterly revenue of $5.68 billion and a net profit of $3.16 billion. The company's market cap is $67.79 billion.

According to TipRanks.com, RBC Capital analyst Nik Modi is currently ranked with 5 stars on a 0-5 stars ranking scale, with an average return of 7.6% and a 64.26% success rate.

Altria Group, Inc. operates as a holding company, which engages in the manufacture and sale of cigarettes in the United States. It operates through the following segments: Smokeable Products, Smokeless Products, and Wine. The Smokeable Products segment comprised of cigarettes manufactured and sold by PM USA and machine-made large cigars and pipe tobacco manufactured and sold by Middleton. The Smokeless products segment manufactured and sold by or on behalf of USSTC and PM USA. The Wine segment producer of Washington State wines, primarily Chateau Ste. Michelle and Columbia Crest, and owns wineries in or distributes wines from several other wine regions. The company was founded in 1919 and is headquartered in Richmond, VA.

https://www.investing.com/news/rbc-capi ... nc-2340112

RBC Capital analyst Nik Modi maintained a Buy rating on Altria Group (NYSE:MO) Inc on Monday, setting a price target of $68, which is approximately 86.40% above the present share price of $36.48.

Modi expects Altria Group Inc to post earnings per share (EPS) of $0.00 for the fourth quarter of 2020.

The current consensus among 4 TipRanks analysts is for a Strong Buy rating of shares in Altria Group, with an average price target of $54.67.

The analysts price targets range from a high of $68 to a low of $47.

In its latest earnings report, released on 09/30/2020, the company reported a quarterly revenue of $5.68 billion and a net profit of $3.16 billion. The company's market cap is $67.79 billion.

According to TipRanks.com, RBC Capital analyst Nik Modi is currently ranked with 5 stars on a 0-5 stars ranking scale, with an average return of 7.6% and a 64.26% success rate.

Altria Group, Inc. operates as a holding company, which engages in the manufacture and sale of cigarettes in the United States. It operates through the following segments: Smokeable Products, Smokeless Products, and Wine. The Smokeable Products segment comprised of cigarettes manufactured and sold by PM USA and machine-made large cigars and pipe tobacco manufactured and sold by Middleton. The Smokeless products segment manufactured and sold by or on behalf of USSTC and PM USA. The Wine segment producer of Washington State wines, primarily Chateau Ste. Michelle and Columbia Crest, and owns wineries in or distributes wines from several other wine regions. The company was founded in 1919 and is headquartered in Richmond, VA.

https://www.investing.com/news/rbc-capi ... nc-2340112

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Undervalued Dividend Growth Stock Of The Week: Altria Group (MO)10.11.2019

UNDERVALUED DIVIDEND GROWTH STOCK OF THE WEEK

Altria Group, Inc. NYSE: MO

https://www.mrfreeat33.com/undervalued- ... -week-166/

by Jason Fieber, Mr. Free at 33 • November 8, 2020

https://dailytradealert.com/2020/11/08/ ... -group-mo/

https://www.youtube.com/watch?v=KSWSKF8 ... sAndIncome

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Altria to convert its non-voting JUUL shares to voting shares, but will remain a 'passive investor'

Altria Group Inc. MO, 2.31% said it has chosen to convert the non-voting shares of e-cigarette company JUUL Labs Inc. it owns to voting shares. Altria said, however, that it does not intend to exercise its rights as part of the conversion to elect directors to JUUL's board, or to use its voting power other than as a "passive investor," pending the outcome of litigation with the U.S. Federal Trade Commission. In December 2018, Altria had bought a 35% non-voting stake in JUUL for $12.8 billon, with conversion to voting shares contingent on antitrust clearance. In April 2020, the FTC sued to unwind Altria's investment in JUUL. Altria's stock, which slipped 0.4% in premarket trading, has dropped 20.3% year to date, while the SPDR Consumer Staples Select Sector ETF XLP, 0.48% has gained 6.1% and the S&P 500 SPX, 0.88% has advanced 10.6%.

https://www.marketwatch.com/story/altri ... 2020-11-12

Altria Group Inc. MO, 2.31% said it has chosen to convert the non-voting shares of e-cigarette company JUUL Labs Inc. it owns to voting shares. Altria said, however, that it does not intend to exercise its rights as part of the conversion to elect directors to JUUL's board, or to use its voting power other than as a "passive investor," pending the outcome of litigation with the U.S. Federal Trade Commission. In December 2018, Altria had bought a 35% non-voting stake in JUUL for $12.8 billon, with conversion to voting shares contingent on antitrust clearance. In April 2020, the FTC sued to unwind Altria's investment in JUUL. Altria's stock, which slipped 0.4% in premarket trading, has dropped 20.3% year to date, while the SPDR Consumer Staples Select Sector ETF XLP, 0.48% has gained 6.1% and the S&P 500 SPX, 0.88% has advanced 10.6%.

https://www.marketwatch.com/story/altri ... 2020-11-12

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Altria keeps 2020 profit outlook intact*

*nienaruszony

Published: Dec. 2, 2020 at 7:45 a.m. ET

By Tomi Kilgore

Altria Group Inc. MO, -1.16% affirmed on Wednesday its 2020 financial guidance, ahead of the cigarette and smokeless tobacco products maker's presentation at the Morgan Stanley Global Consumer and Retail Conference. The company expects adjusted earnings per share, which excludes non-recurring items, of $4.30 to $4.38, which surrounds the FactSet EPS consensus of $4.37. The company has beat quarterly earnings expectations the past five quarters. The stock, which slipped 0.5% in premarket trading, has lost 18.9% year to date through Tuesday, while the SPDR Consumer Staples Select Sector ETF XLP, -0.83% has gained 7.2% and the S&P 500 SPX, +0.17% has climbed 13.4%.

https://www.marketwatch.com/story/altri ... 2020-12-02

*nienaruszony

Published: Dec. 2, 2020 at 7:45 a.m. ET

By Tomi Kilgore

Altria Group Inc. MO, -1.16% affirmed on Wednesday its 2020 financial guidance, ahead of the cigarette and smokeless tobacco products maker's presentation at the Morgan Stanley Global Consumer and Retail Conference. The company expects adjusted earnings per share, which excludes non-recurring items, of $4.30 to $4.38, which surrounds the FactSet EPS consensus of $4.37. The company has beat quarterly earnings expectations the past five quarters. The stock, which slipped 0.5% in premarket trading, has lost 18.9% year to date through Tuesday, while the SPDR Consumer Staples Select Sector ETF XLP, -0.83% has gained 7.2% and the S&P 500 SPX, +0.17% has climbed 13.4%.

https://www.marketwatch.com/story/altri ... 2020-12-02

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

How Tobacco Became One of the Greatest Investments in History

By Joe Weisenthal and Tracy Alloway

15 października 2020, 10:00 CEST

For over a century, tobacco stocks have been among the greatest investments in history, consistently outperforming other sectors decade after decade. But what is it about tobacco companies specifically that has led to this incredible performance? On this episode, we speak with financial advisor Lawrence Hamtil along with Gene Hoots, a financial advisor and the author of Going Down Tobacco Road, to discuss the extraordinary performance of this sector.

...

https://www.bloomberg.com/news/articles ... in-history

By Joe Weisenthal and Tracy Alloway

15 października 2020, 10:00 CEST

For over a century, tobacco stocks have been among the greatest investments in history, consistently outperforming other sectors decade after decade. But what is it about tobacco companies specifically that has led to this incredible performance? On this episode, we speak with financial advisor Lawrence Hamtil along with Gene Hoots, a financial advisor and the author of Going Down Tobacco Road, to discuss the extraordinary performance of this sector.

...

https://www.bloomberg.com/news/articles ... in-history

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Earnings Previews: Altria, Apple, Facebook, McDonald's and Tesla

Altria

Altria Group Inc. (NYSE: MO) had a tough 2020. The share price fell by more than 10%, but lowered expectations meant that the company beat EPS estimates in every quarter and is likely to beat the fourth-quarter consensus as well. What matters for investors is Altria’s generous 8.2% dividend yield, and there is little chance that the company will dial that back. Operating cash flow still exceeds dividends paid by nearly $2.2 billion and capital spending is negligible.

The consensus analyst estimate for quarterly EPS is $1.02, flat year over year. Revenue is tabbed at $5.01 billion, an increase of 4.3%. Full-year EPS is forecast at $4.38, up 3.8% and revenue is expected to rise by 5% to nearly $21 billion.

The stock has added about 2.3% for the year to date as investors get in line for the dividend payout. Altria trades at a multiple of 9.6 times expected 2020 EPS and 9.1 times expected earnings for this year.

https://247wallst.com/investing/2021/01 ... d-tesla/2/

Altria

Altria Group Inc. (NYSE: MO) had a tough 2020. The share price fell by more than 10%, but lowered expectations meant that the company beat EPS estimates in every quarter and is likely to beat the fourth-quarter consensus as well. What matters for investors is Altria’s generous 8.2% dividend yield, and there is little chance that the company will dial that back. Operating cash flow still exceeds dividends paid by nearly $2.2 billion and capital spending is negligible.

The consensus analyst estimate for quarterly EPS is $1.02, flat year over year. Revenue is tabbed at $5.01 billion, an increase of 4.3%. Full-year EPS is forecast at $4.38, up 3.8% and revenue is expected to rise by 5% to nearly $21 billion.

The stock has added about 2.3% for the year to date as investors get in line for the dividend payout. Altria trades at a multiple of 9.6 times expected 2020 EPS and 9.1 times expected earnings for this year.

https://247wallst.com/investing/2021/01 ... d-tesla/2/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

EPS / Forecast

0.99 / 1.01

Revenue / Forecast

5.05B / 5B

0.99 / 1.01

Revenue / Forecast

5.05B / 5B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Marlboro maker Altria asks FDA to spread the word that nicotine doesn’t cause cancer

Marlboro parent Altria is asking the Food and Drug Administration to help it spread the word that nicotine doesn’t cause cancer.

CNBC obtained a copy of a letter that Altria sent to the FDA asking the agency to help get the message out about nicotine as part of a proposed advertising campaign about the risks of tobacco use.

The company said the move would help traditional smokers transition to noncombustible methods of using nicotine that are potentially less risky than products with smoke.

https://www.cnbc.com/2021/03/04/altria- ... eport.html

Marlboro parent Altria is asking the Food and Drug Administration to help it spread the word that nicotine doesn’t cause cancer.

CNBC obtained a copy of a letter that Altria sent to the FDA asking the agency to help get the message out about nicotine as part of a proposed advertising campaign about the risks of tobacco use.

The company said the move would help traditional smokers transition to noncombustible methods of using nicotine that are potentially less risky than products with smoke.

https://www.cnbc.com/2021/03/04/altria- ... eport.html

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

EPS / Forecast

1.07 / 1.04

Revenue / Forecast

4.88B / 4.97B

1.07 / 1.04

Revenue / Forecast

4.88B / 4.97B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Altria poinformowała w piątek, że sprzeda Ste. Michelle Wine Estates firmie private equity Sycamore Partners Management. Transakcja będzie miała wartość 1,2 mld USD.

https://www.pb.pl/altria-sprzeda-ste-mi ... sd-1121783

https://www.pb.pl/altria-sprzeda-ste-mi ... sd-1121783

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

Latest Release

Jul 29, 2021

EPS / Forecast

1.23 / 1.18

Revenue / Forecast

5.61B / 5.38B

Jul 29, 2021

EPS / Forecast

1.23 / 1.18

Revenue / Forecast

5.61B / 5.38B

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Altria Group, Inc. NYSE: MO papierosy, wyroby tytoniowe

#Altria hikes dividend by 4.7 percent. $MO

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 11 gości