Broadcom Stock: Growth at a More-than-Reasonable Price

Bouncing back after the late September market selloff, does Broadcom (NASDAQ:AVGO) stock have room to hit new highs? It's possible.

Shares in the semiconductor and infrastructure software name made their way above $500 per share last month. This was after delivering solid numbers for the past fiscal quarter, and strong guidance for the quarters ahead.

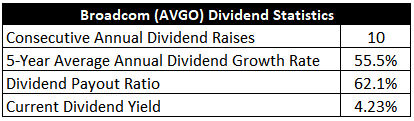

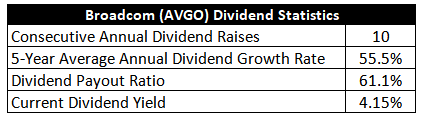

Unlike many stocks in the tech sector, this one offers up a much better mix of growth and value. That is, in contrast to other tech plays, this one trades at a more-than-reasonable valuation, with a relatively high dividend (2.92% forward yield) to boot.

With more strong revenue and earnings results likely, and room for it to see its price-to-earnings (P/E) multiple expand, I am bullish on it at today’s prices (around $492 per share).

Why AVGO Stock has Room to Hit New Highs

Investors may think that Broadcom’s strong results as of late are entirely due to the global chip shortage. However, there are other drivers at play that are enabling it to meet and slightly beat expectations.

Demand from its key end users (cloud computing, mobile communications) is also playing a big role in its performance. For instance, the buildout of 5G infrastructure, and the rollout of 5G devices, particularly the rollout of Apple’s (AAPL) iPhone 13, are boosting Broadcom's results.

With demand for the latest incarnation of the iPhone coming in higher than expected, it makes sense that the lion’s share of sell-side analysts have upped their earnings-per-share (EPS) estimates for AVGO stock this fiscal quarter (ending October 31, 2021).

Between now, and when it announces results again in December? Shares could see a gradual climb to prices above its past highs. That could be both on earnings growth, and possible expansion of its forward valuation.

Current Valuation Based on Incorrect Perceptions from Investors

The main appeal with AVGO stock isn’t that many trends are on its side. Rather, the main appeal is the fact that it’s projected to see double-digit percentage growth in its sales and earnings. All while trading at a valuation not only below tech names of its side, but of the market overall as well.

Why, with a forward P/E ratio of 17.6x, is Broadcom a lot cheaper than chip names like Advanced Micro Devices (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA), which trade at P/E ratios of 41.9x and 51.01x, respectively? Two reasons. First, both of these chip stocks are projected to see much higher rates of growth. Second, mobile chip makers, like this company, as well as direct peers such as Qualcomm (NASDAQ:QCOM), are viewed as more cyclical, and thus deserving a lower forward multiple.

However, in my view, both are incorrect perceptions from investors. Analyst consensus calls for Broadcom to grow its earnings by about 11.2% between this fiscal year (ending October 2021) and the next (fiscal year ending October 2022). Yet, based on the tailwinds discussed above, it has high chances of hitting numbers that come in at the top end of estimates. That would be $35.05 per share, or 25.5% earnings growth.

With its diversification into infrastructure software, which will continue as it makes more acquisitions, over time it makes less sense to give it a valuation on par with Qualcomm rather than on par with more premium-priced chip names. A move to a multiple on par with AMD and Nvidia may be wishful thinking. But a move from a 15x-20x P/E to one between 20x and 25x could be attainable.

What Analysts are Saying About AVGO Stock

According to TipRanks, AVGO stock has a consensus rating of Strong Buy. Out of 20 analyst ratings, 18 rate it a Buy, 2 analysts rate it a Hold, and 0 analysts rate it a Sell.

As for price targets, the average analyst price target on AVGO stock today is $570.94 per share, implying around 15.84% in upside from today’s prices. Analyst price targets range from a low of $540 per share to a high of $600 per share.

Bottom Line: In a Space That’s Seemingly ‘Too Hot to Touch,’ Broadcom Seems a Good Choice

It’s too early to tell how tech stocks will fare in the next year. The Federal Reserve’s monetary tightening plans could play gradually enough to prevent a correction. Or, taper/interest rate increases could happen faster than Wall Street today expects, resulting in further market turmoil.

With this, investors looking for a tech growth play that’s not richly-priced may want to take a look at AVGO stock.

Disclosure: At the time of publication, Thomas Niel did not have a position in any of the securities mentioned in this article.

Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom (AVGO) gapped up to a gain of nearly 10% after the chip company's quarterly results topped expectations. Broadcom forecast current-quarter sales of around $7.6 billion, above analysts' estimates. The stock is on track for its highest percentage increase since March 26, 2020, when it soared 11.8%, according to Dow Jones Market Data.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Latest Release

Dec 09, 2021

EPS / Forecast

7.81 / 7.74

Revenue / Forecast

7.41B / 7.36B

Broadcom up on EPS, buyback

The chip and software giant reported a 23% EPS gain, beating expectations, while revenue climbed

15%, missing. Broadcom (AVGO) offered bullish guidance, hiked its

dividend by 14% and set a $10 billion buyback. AVGO stock rose to a

new high Friday

Dec 09, 2021

EPS / Forecast

7.81 / 7.74

Revenue / Forecast

7.41B / 7.36B

Broadcom up on EPS, buyback

The chip and software giant reported a 23% EPS gain, beating expectations, while revenue climbed

15%, missing. Broadcom (AVGO) offered bullish guidance, hiked its

dividend by 14% and set a $10 billion buyback. AVGO stock rose to a

new high Friday

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Latest Release

Mar 03, 2022

EPS / Forecast

8.39 / 8.13

Revenue / Forecast

7.71B / 7.61B

Broadcom (NASDAQ:AVGO) reported fiscal first-quarter results that topped Wall Street expectations on both the top and bottom lines, sending its shares more than 3% higher.

The chipmaker also guided fiscal second-quarter growth well above expectations on “broad-based demand, lean channel inventory and growing backlog despite stable albeit extended lead times [of about] 50 weeks,” Credit Suisse said in a note as it reiterated its $700 price target on the stock.

Mar 03, 2022

EPS / Forecast

8.39 / 8.13

Revenue / Forecast

7.71B / 7.61B

Broadcom (NASDAQ:AVGO) reported fiscal first-quarter results that topped Wall Street expectations on both the top and bottom lines, sending its shares more than 3% higher.

The chipmaker also guided fiscal second-quarter growth well above expectations on “broad-based demand, lean channel inventory and growing backlog despite stable albeit extended lead times [of about] 50 weeks,” Credit Suisse said in a note as it reiterated its $700 price target on the stock.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom Earnings, Revenue Beat in Q2

Investing.com - Broadcom (NASDAQ:AVGO) reported on Thursday second quarter earnings that beat analysts' forecasts and revenue that topped expectations.

Broadcom announced earnings per share of $9.07 on revenue of $8.1B. Analysts polled by Investing.com anticipated EPS of $8.71 on revenue of $7.91B.

Broadcom shares are down 16.92% from the beginning of the year, still down 18.44% from its 52 week high of $677.76 set on December 28, 2021. They are under-performing the S&P 500 which is down 14.67% from the start of the year.

Broadcom shares gained 3.98% in intra-day trade following the report.

Broadcom follows other major Information Technology sector earnings this month

Broadcom's report follows an earnings beat by Apple on April 28, who reported EPS of $1.52 on revenue of $97.28B, compared to forecasts EPS of $1.42 on revenue of $94.03B.

NVIDIA had beat expectations on Wednesday with first quarter EPS of $1.36 on revenue of $8.29B, compared to forecast for EPS of $1.3 on revenue of $8.12B.

Investing.com - Broadcom (NASDAQ:AVGO) reported on Thursday second quarter earnings that beat analysts' forecasts and revenue that topped expectations.

Broadcom announced earnings per share of $9.07 on revenue of $8.1B. Analysts polled by Investing.com anticipated EPS of $8.71 on revenue of $7.91B.

Broadcom shares are down 16.92% from the beginning of the year, still down 18.44% from its 52 week high of $677.76 set on December 28, 2021. They are under-performing the S&P 500 which is down 14.67% from the start of the year.

Broadcom shares gained 3.98% in intra-day trade following the report.

Broadcom follows other major Information Technology sector earnings this month

Broadcom's report follows an earnings beat by Apple on April 28, who reported EPS of $1.52 on revenue of $97.28B, compared to forecasts EPS of $1.42 on revenue of $94.03B.

NVIDIA had beat expectations on Wednesday with first quarter EPS of $1.36 on revenue of $8.29B, compared to forecast for EPS of $1.3 on revenue of $8.12B.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Shares of Broadcom Inc. (NASDAQ:AVGO) gained 2% after-hours Thursday after posting a solid third quarter beat and raising guidance in the face of macro headwinds.

The semiconductor company reported that consolidated revenue grew 25% year-over-year to $8.5 billion, beating the consensus of $8.4 billion. Meanwhile, operating profit increased 32%. Non-GAAP diluted EPS was $9.73, versus the consensus of $9.56.

"Broadcom's record third quarter results were driven by robust demand across cloud, service providers, and enterprise," said Hock Tan, President and CEO of Broadcom Inc. "We expect solid demand across our end markets to continue in the fourth quarter, reflecting continued investment by our customers of next generation technologies in data centers, broadband, and wireless."

The company returned $3.2 billion to shareholders in the quarter, including $1.7 billion of cash dividends and $1.5 billion of share repurchases.

Looking ahead, Broadcom sees fourth quarter revenue of $8.9 billion, versus the consensus of $8.7 billion. Fourth quarter Adjusted EBITDA guidance is approximately 63 percent of projected revenue.

The semiconductor company reported that consolidated revenue grew 25% year-over-year to $8.5 billion, beating the consensus of $8.4 billion. Meanwhile, operating profit increased 32%. Non-GAAP diluted EPS was $9.73, versus the consensus of $9.56.

"Broadcom's record third quarter results were driven by robust demand across cloud, service providers, and enterprise," said Hock Tan, President and CEO of Broadcom Inc. "We expect solid demand across our end markets to continue in the fourth quarter, reflecting continued investment by our customers of next generation technologies in data centers, broadband, and wireless."

The company returned $3.2 billion to shareholders in the quarter, including $1.7 billion of cash dividends and $1.5 billion of share repurchases.

Looking ahead, Broadcom sees fourth quarter revenue of $8.9 billion, versus the consensus of $8.7 billion. Fourth quarter Adjusted EBITDA guidance is approximately 63 percent of projected revenue.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Undervalued Dividend Growth Stock of the Week: Broadcom (AVGO)Undervalued Dividend Growth Stock of the Week: Broadcom Inc. (AVGO)Undervalued Dividend Growth Stock of the Week: Broadcom Inc. (AVGO)

https://dailytradealert.com/2020/01/26/ ... -week-244/

https://dailytradealert.com/2020/06/28/ ... -inc-avgo/

by Jason Fieber, Mr. Free at 33 • November 20, 2022

https://dailytradealert.com/2022/11/20/ ... dcom-avgo/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Semiconductor maker Broadcom (AVGO) on Thursday reported earnings and revenue that topped Wall Street's targets for its fiscal fourth quarter, despite slowing smartphone sales. Management's revenue outlook for AVGO stock edged by analyst estimates.

Broadcom earnings for the October-ending quarter came in at $10.45 a share on an adjusted basis, up 34% from a year earlier. Revenue rose 21% to $8.93 billion in the quarter.

Analysts polled by FactSet expected Broadcom earnings of $10.29 a share on sales of $8.9 billion. A year earlier, the San Jose, Calif.-based company earned $7.81 per share on sales of $7.41 billion.

For the current quarter ending on Jan. 30, Broadcom predicted sales of $8.9 billion. Analysts expected revenue of $8.78 billion in the fiscal first quarter.

https://www.investors.com/news/technolo ... ws-q32022/

Broadcom earnings for the October-ending quarter came in at $10.45 a share on an adjusted basis, up 34% from a year earlier. Revenue rose 21% to $8.93 billion in the quarter.

Analysts polled by FactSet expected Broadcom earnings of $10.29 a share on sales of $8.9 billion. A year earlier, the San Jose, Calif.-based company earned $7.81 per share on sales of $7.41 billion.

For the current quarter ending on Jan. 30, Broadcom predicted sales of $8.9 billion. Analysts expected revenue of $8.78 billion in the fiscal first quarter.

https://www.investors.com/news/technolo ... ws-q32022/

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom Inc (NASDAQ:AVGO) stock rose 3.4% after the chip maker gave an optimistic forecast for revenue and boosted its dividend. After beating expectations for the most recent quarter, it said it would resume stock buybacks.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

(Reuters) -Broadcom Inc forecast second-quarter revenue above estimates on Thursday, as increased investments in artificial intelligence spurs demand for its chips used in data centers.

In a deteriorating economy, where both consumer and enterprise spending is on a decline, AI has emerged as a bright spot for chip firms like Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO), thanks to the strong potential applications of the technology as illustrated by OpenAI's chatbot ChatGPT.

While analysts spotted green shoots in the AI space, they also saw weakness emerge in areas such as broadband and cloud spending.

"We are also seeing its end-market demand becoming more mixed," Summit Insights Group analyst Kinngai Chan said.

Still the company saw strong infrastructure demand across all its end markets in the first quarter, Chief Executive Hock Tan said. Revenue in the quarter rose 16% to $8.92 billion.

Broadcom, which supplies chips used in data centers for networking as well as specialized chips that speed up AI work, announced a quarterly dividend of $4.60 per share. The San Jose, California-based company's shares pared gains and were up 0.3% in extended trading.

The chip designer expects current-quarter revenue to be about $8.7 billion, while analysts on average expect $8.59 billion, according to Refinitiv data.

Excluding items, the company earned $10.33 per share for the first quarter, beating estimates of $10.10.

In a deteriorating economy, where both consumer and enterprise spending is on a decline, AI has emerged as a bright spot for chip firms like Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO), thanks to the strong potential applications of the technology as illustrated by OpenAI's chatbot ChatGPT.

While analysts spotted green shoots in the AI space, they also saw weakness emerge in areas such as broadband and cloud spending.

"We are also seeing its end-market demand becoming more mixed," Summit Insights Group analyst Kinngai Chan said.

Still the company saw strong infrastructure demand across all its end markets in the first quarter, Chief Executive Hock Tan said. Revenue in the quarter rose 16% to $8.92 billion.

Broadcom, which supplies chips used in data centers for networking as well as specialized chips that speed up AI work, announced a quarterly dividend of $4.60 per share. The San Jose, California-based company's shares pared gains and were up 0.3% in extended trading.

The chip designer expects current-quarter revenue to be about $8.7 billion, while analysts on average expect $8.59 billion, according to Refinitiv data.

Excluding items, the company earned $10.33 per share for the first quarter, beating estimates of $10.10.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom (NASDAQ:AVGO) reported its Q1 results, with EPS of $10.33 coming in better than the consensus estimate of $10.18. Revenue grew 16% year-over-year to $8.92 billion, compared to the consensus estimate of $8.9B.

"Broadcom's first quarter performance reflects continued strength in infrastructure demand across all our end markets," said Hock Tan, President and CEO of Broadcom. "Looking ahead, we are confident our growth will be driven by sustained leadership in next generation technologies across all of our core markets, and strong partnerships with our customers."

For Q2/2023, the company expects revenue of $8.7B, better than the consensus estimate of $8.58B.

Furthermore, the company declared a quarterly dividend of $4.60 per share, or $18.4 annualized, for an annual yield of 3.1%.

"Broadcom's first quarter performance reflects continued strength in infrastructure demand across all our end markets," said Hock Tan, President and CEO of Broadcom. "Looking ahead, we are confident our growth will be driven by sustained leadership in next generation technologies across all of our core markets, and strong partnerships with our customers."

For Q2/2023, the company expects revenue of $8.7B, better than the consensus estimate of $8.58B.

Furthermore, the company declared a quarterly dividend of $4.60 per share, or $18.4 annualized, for an annual yield of 3.1%.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom Inc (NASDAQ:AVGO) shares rose 2% after the chip maker reported a multi-year agreement to make 5G radio frequency components for Apple (NASDAQ:AAPL). Shares of Apple dipped 0.8%.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Wall Street analysts are weighing in positively on yesterday’s announcement from Apple (NASDAQ:AAPL) and in connection with the new partnership with Broadcom (NASDAQ:AVGO).

Two companies announced a “multi-billion-dollar” deal that will see the tech behemoth purchase 5G radio frequency components from Broadcom, including the FBAR filters.

“We’re thrilled to make commitments that harness the ingenuity, creativity, and innovative spirit of American manufacturing,” said Tim Cook, Apple’s CEO.

CFRA analysts boosted the AVGO price target to $750 per share after hiking P/E to reflect the Apple deal.

“We positively view the extension given AAPL's recent endeavors to internally source more chips and rumors earlier this year that certain AVGO chips could be displaced (in 2025). We also note that AAPL is AVGO's largest customer, about 20% of sales over the last year,” they said in a client note.

“We like AVGO's story, largely given opportunities that are evolving in the cloud, specifically as it relates to its AI initiatives - both on the network connectivity side and as a co-developer of application specific chips (e.g.,Alphabet's TPUs). Despite the uncertainty surrounding the pending VMware deal, we think shares have upside whether a deal is done or not.”

Similarly, BofA analysts also raised the price target on Buy-rated AVGO shares as he went to $800 per share. The analysts argue that the Apple contract removes “key overhang re trends at largest customer.”

“We reiterate Buy on AVGO on this improved certainty, and separately on its highly underappreciated/overlooked position as a leading provider of custom AI computing and switching silicon,” they said in a note.

The analysts also added that Broadcom is the “most underappreciated AI beneficiary.”

close 812.73$ +11.52%

Two companies announced a “multi-billion-dollar” deal that will see the tech behemoth purchase 5G radio frequency components from Broadcom, including the FBAR filters.

“We’re thrilled to make commitments that harness the ingenuity, creativity, and innovative spirit of American manufacturing,” said Tim Cook, Apple’s CEO.

CFRA analysts boosted the AVGO price target to $750 per share after hiking P/E to reflect the Apple deal.

“We positively view the extension given AAPL's recent endeavors to internally source more chips and rumors earlier this year that certain AVGO chips could be displaced (in 2025). We also note that AAPL is AVGO's largest customer, about 20% of sales over the last year,” they said in a client note.

“We like AVGO's story, largely given opportunities that are evolving in the cloud, specifically as it relates to its AI initiatives - both on the network connectivity side and as a co-developer of application specific chips (e.g.,Alphabet's TPUs). Despite the uncertainty surrounding the pending VMware deal, we think shares have upside whether a deal is done or not.”

Similarly, BofA analysts also raised the price target on Buy-rated AVGO shares as he went to $800 per share. The analysts argue that the Apple contract removes “key overhang re trends at largest customer.”

“We reiterate Buy on AVGO on this improved certainty, and separately on its highly underappreciated/overlooked position as a leading provider of custom AI computing and switching silicon,” they said in a note.

The analysts also added that Broadcom is the “most underappreciated AI beneficiary.”

close 812.73$ +11.52%

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Latest Release

Jun 01, 2023

EPS / Forecast

10.32 / 10.12

Revenue / Forecast

8.73B / 8.7B

Broadcom forecasts third-quarter revenue above estimates on AI boost

Broadcom forecasts third-quarter revenue above estimates on AI boost© Reuters. FILE PHOTO: A smartphone with a displayed Broadcom logo is placed on a computer motherboard in this illustration taken March 6, 2023. REUTERS/Dado Ruvic/Illustration

(Reuters) - Broadcom (NASDAQ:AVGO) Inc forecast third-quarter revenue above market estimates on Thursday, as it benefits from massive corporate investments in AI-related technologies.

The viral success of ChatGPT has sparked a surge in orders for chips that underpin the technology at big data centers, driving a rally in shares of semiconductor companies that cater to the hottest slice of the market.

Broadcom Chief Executive Hock Tan said generative AI could account for more than 25% of the company's semiconductor revenue in 2024.

"Our revenue today, from this opportunity, represents about 15% of our semiconductor business," Tan said, adding that it was only 10% in fiscal 2022.

Broadcom supplies chips used in data centers for networking and specialized chips that speed up AI work. It released a new chip for wiring together supercomputers for AI work using networking technology in April.

Shares of the San Jose, California-based company were last down nearly 2% in choppy trading after the bell.

"We believe investors are disappointed with the company's outlook as expectations were ratcheted up after the strong outlook provided by Nvidia (NASDAQ:NVDA)," Summit Insights Group analyst Kinngai Chan said.

Nvidia Corp in May forecast second-quarter revenue more than 50% above Wall Street estimates, and said it was boosting supplies to meet surging demand for its AI chips.

Broadcom forecast current-quarter revenue of about $8.85 billion, while analysts polled by Refinitiv are expecting revenue of $8.72 billion.

Revenue in the second quarter rose 8% to $8.73 billion, compared with the estimates of $8.71 billion.

On an adjusted basis, the company earned $10.32 per share, compared with the estimates of $10.08 per share.

Jun 01, 2023

EPS / Forecast

10.32 / 10.12

Revenue / Forecast

8.73B / 8.7B

Broadcom forecasts third-quarter revenue above estimates on AI boost

Broadcom forecasts third-quarter revenue above estimates on AI boost© Reuters. FILE PHOTO: A smartphone with a displayed Broadcom logo is placed on a computer motherboard in this illustration taken March 6, 2023. REUTERS/Dado Ruvic/Illustration

(Reuters) - Broadcom (NASDAQ:AVGO) Inc forecast third-quarter revenue above market estimates on Thursday, as it benefits from massive corporate investments in AI-related technologies.

The viral success of ChatGPT has sparked a surge in orders for chips that underpin the technology at big data centers, driving a rally in shares of semiconductor companies that cater to the hottest slice of the market.

Broadcom Chief Executive Hock Tan said generative AI could account for more than 25% of the company's semiconductor revenue in 2024.

"Our revenue today, from this opportunity, represents about 15% of our semiconductor business," Tan said, adding that it was only 10% in fiscal 2022.

Broadcom supplies chips used in data centers for networking and specialized chips that speed up AI work. It released a new chip for wiring together supercomputers for AI work using networking technology in April.

Shares of the San Jose, California-based company were last down nearly 2% in choppy trading after the bell.

"We believe investors are disappointed with the company's outlook as expectations were ratcheted up after the strong outlook provided by Nvidia (NASDAQ:NVDA)," Summit Insights Group analyst Kinngai Chan said.

Nvidia Corp in May forecast second-quarter revenue more than 50% above Wall Street estimates, and said it was boosting supplies to meet surging demand for its AI chips.

Broadcom forecast current-quarter revenue of about $8.85 billion, while analysts polled by Refinitiv are expecting revenue of $8.72 billion.

Revenue in the second quarter rose 8% to $8.73 billion, compared with the estimates of $8.71 billion.

On an adjusted basis, the company earned $10.32 per share, compared with the estimates of $10.08 per share.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

Re: Broadcom NASDAQ: AVGO półprzewodniki, technologia 5G

Broadcom to invest in a $1 billion EU-funded chip programme in Spain

MADRID (Reuters) - U.S. chipmaker Broadcom (NASDAQ:AVGO) will invest in a European Union-funded programme to develop a semiconductor industry in Spain, Chief Executive Charlie Kawwas said late on Thursday.

"Excited to announce our decision to invest in Spain's semiconductor ecosystem under their semiconductor support program," Kawwas said on his Twitter account.

The project in which Broadcom would be involved could be worth $1 billion, the Spanish economy ministry said in an emailed statement. Broadcom did not say how much it would invest.

The project would include the construction of "large-scale back-end semiconductors facilities unique in Europe", the ministry said, adding no location had been picked yet.

The Spanish government has said it would allocate as much as 12 billion euros ($13 billion) from the European Union's pandemic relief funds it is set to receive to subsidise the development of the semiconductor industry.

Prior to Broadcom, the Spanish government had said U.S. tech giant Cisco Systems Inc (NASDAQ:CSCO). was planning to open a new chip design centre in the northeastern Spanish city of Barcelona.

The EU is seeking to reinforce its own chip industry and reduce its dependence on U.S. and Asian supply, triggered by a global shortage of semiconductors and supply chain bottlenecks.

Pieniądz robi pieniądz a bieda robi jeszcze wiekszą biedę !!!

REKLAMA

Kto jest online

Użytkownicy przeglądający to forum: Obecnie na forum nie ma żadnego zarejestrowanego użytkownika i 66 gości